Tab to navigate within form. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or press Enter.

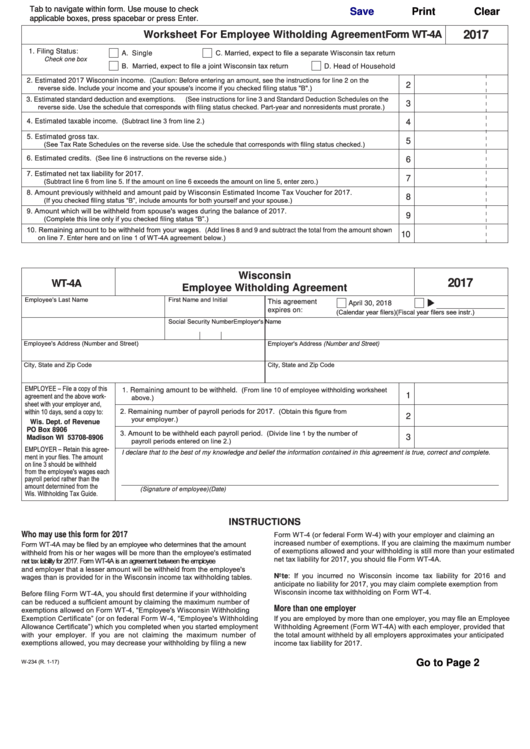

2017

Form WT-4A

Worksheet For Employee Witholding Agreement

1. Filing Status:

C. Married, expect to file a separate Wisconsin tax return

A. Single

Check one box

B. Married, expect to file a joint Wisconsin tax return

D. Head of Household

2. Estimated 2017 Wisconsin income.

(Caution: Before entering an amount, see the instructions for line 2 on the

2

reverse side. Include your income and your spouse's income if you checked filing status "B".)

3. Estimated standard deduction and exemptions.

(See instructions for line 3 and Standard Deduction Schedules on the

3

reverse side. Use the schedule that corresponds with filing status checked. Part-year and nonresidents must prorate.)

(Subtract line 3 from line 2.)

4. Estimated taxable income.

4

5. Estimated gross tax.

5

(See Tax Rate Schedules on the reverse side. Use the schedule that corresponds with filing status checked.)

6. Estimated credits.

(See line 6 instructions on the reverse side.)

6

7. Estimated net tax liability for 2017.

7

(Subtract line 6 from line 5. If the amount on line 6 exceeds the amount on line 5, enter zero.)

8. Amount previously withheld and amount paid by Wisconsin Estimated Income Tax Voucher for 2017.

8

(If you checked filing status “B”, include amounts for both yourself and your spouse.)

9. Amount which will be withheld from spouse's wages during the balance of 2017.

9

(Complete this line only if you checked filing status “B”.)

10. Remaining amount to be withheld from your wages.

(Add lines 8 and 9 and subtract the total from the amount shown

10

on line 7. Enter here and on line 1 of WT-4A agreement below.)

Wisconsin

2017

WT-4A

Employee Witholding Agreement

Employee's Last Name

First Name and Initial

This agreement

April 30, 2018

expires on:

(Calendar year filers)

(Fiscal year filers see instr.)

Social Security Number

Employer's Name

Employee's Address (Number and Street)

Employer's Address (Number and Street)

City, State and Zip Code

City, State and Zip Code

EMPLOYEE – File a copy of this

(From line 10 of employee withholding worksheet

1. Remaining amount to be withheld.

agreement and the above work-

1

above.)

sheet with your employer and,

within 10 days, send a copy to:

2. Remaining number of payroll periods for 2017.

(Obtain this figure from

2

your employer.)

Wis. Dept. of Revenue

PO Box 8906

3. Amount to be withheld each payroll period.

(Divide line 1 by the number of

3

Madison WI 53708-8906

payroll periods entered on line 2.)

EMPLOYER – Retain this agree-

I declare that to the best of my knowledge and belief the information contained in this agreement is true, correct and complete.

ment in your files. The amount

on line 3 should be withheld

from the employee's wages each

payroll period rather than the

amount determined from the

(Signature of employee)

(Date)

Wis. Withholding Tax Guide.

INSTRUCTIONS

Form WT-4 (or federal Form W-4) with your employer and claiming an

Who may use this form for 2017

increased number of exemptions. If you are claiming the maximum number

Form WT-4A may be filed by an employee who determines that the amount

of exemptions allowed and your withholding is still more than your estimated

withheld from his or her wages will be more than the employee's estimated

net tax liability for 2017, you should file Form WT-4A.

net tax liability for 2017. Form WT-4A is an agreement between the employee

and employer that a lesser amount will be withheld from the employee's

Note: If you incurred no Wisconsin income tax liability for 2016 and

wages than is provided for in the Wisconsin income tax withholding tables.

anticipate no liability for 2017, you may claim complete exemption from

Wisconsin income tax withholding on Form WT-4.

Before filing Form WT-4A, you should first determine if your withholding

can be reduced a sufficient amount by claiming the maximum number of

More than one employer

exemptions allowed on Form WT-4, “Employee's Wisconsin Withholding

Exemption Certificate” (or on federal Form W-4, “Employee's Withholding

If you are employed by more than one employer, you may file an Employee

Allowance Certificate”) which you completed when you started employment

Withholding Agreement (Form WT-4A) with each employer, provided that

with your employer. If you are not claiming the maximum number of

the total amount withheld by all employers approximates your anticipated

exemptions allowed, you may decrease your withholding by filing a new

income tax liability for 2017.

W-234 (R. 1-17)

Go to Page 2

1

1 2

2