Rollover Contribution Form

ADVERTISEMENT

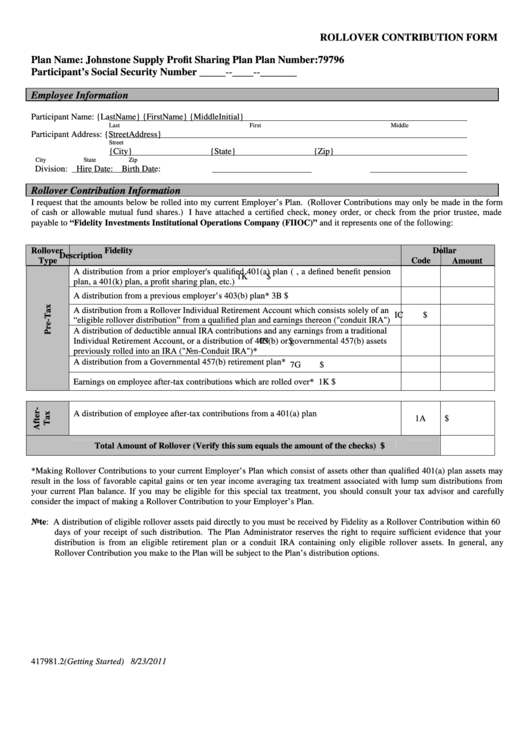

ROLLOVER CONTRIBUTION FORM

Plan Name: Johnstone Supply Profit Sharing Plan

Plan Number: 79796

Participant’s Social Security Number _____--____--_______

Employee Information

Participant Name:

{LastName}

{FirstName}

{MiddleInitial}

Last

First

Middle Initial

Participant Address: {StreetAddress}

Street

{City}

{State}

{Zip}

City

State

Zip

Division:

Hire Date:

Birth Date:

Rollover Contribution Information

I request that the amounts below be rolled into my current Employer’s Plan. (Rollover Contributions may only be made in the form

of cash or allowable mutual fund shares.) I have attached a certified check, money order, or check from the prior trustee, made

payable to “Fidelity Investments Institutional Operations Company (FIIOC)” and it represents one of the following:

Rollover

Fidelity

Dollar

Description

Type

Code

Amount

A distribution from a prior employer's qualified 401(a) plan (i.e., a defined benefit pension

1K

$

plan, a 401(k) plan, a profit sharing plan, etc.)

A distribution from a previous employer’s 403(b) plan*

3B

$

A distribution from a Rollover Individual Retirement Account which consists solely of an

IC

$

“eligible rollover distribution” from a qualified plan and earnings thereon ("conduit IRA")

A distribution of deductible annual IRA contributions and any earnings from a traditional

Individual Retirement Account, or a distribution of 403(b) or governmental 457(b) assets

IN

$

previously rolled into an IRA ("Non-Conduit IRA")*

A distribution from a Governmental 457(b) retirement plan*

7G

$

Earnings on employee after-tax contributions which are rolled over*

1K

$

A distribution of employee after-tax contributions from a 401(a) plan

1A

$

Total Amount of Rollover (Verify this sum equals the amount of the checks)

$

*Making Rollover Contributions to your current Employer’s Plan which consist of assets other than qualified 401(a) plan assets may

result in the loss of favorable capital gains or ten year income averaging tax treatment associated with lump sum distributions from

your current Plan balance. If you may be eligible for this special tax treatment, you should consult your tax advisor and carefully

consider the impact of making a Rollover Contribution to your Employer’s Plan.

Note: A distribution of eligible rollover assets paid directly to you must be received by Fidelity as a Rollover Contribution within 60

days of your receipt of such distribution. The Plan Administrator reserves the right to require sufficient evidence that your

distribution is from an eligible retirement plan or a conduit IRA containing only eligible rollover assets. In general, any

Rollover Contribution you make to the Plan will be subject to the Plan’s distribution options.

417981.2(Getting Started)

8/23/2011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3