Form 54 Claims - Income Tax - Repayment Claim For The Year 2012

ADVERTISEMENT

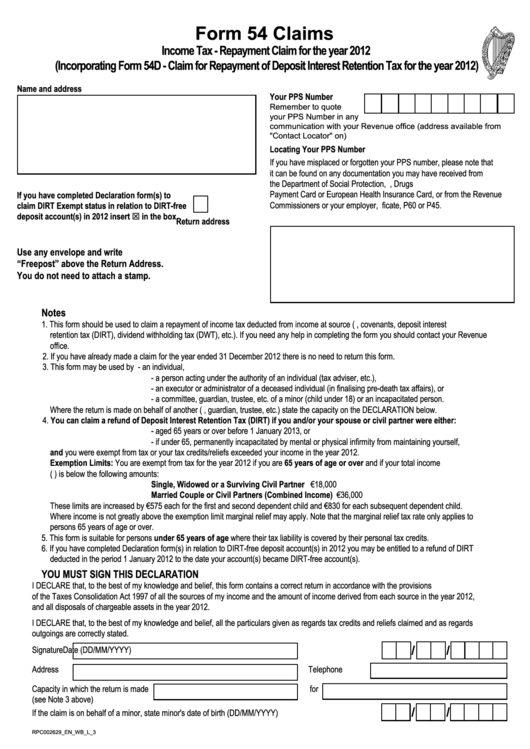

Form 54 Claims

Income Tax - Repayment Claim for the year 2012

(Incorporating Form 54D - Claim for Repayment of Deposit Interest Retention Tax for the year 2012)

Name and address

Your PPS Number

Remember to quote

your PPS Number in any

communication with your Revenue office (address available from

"Contact Locator" on )

Locating Your PPS Number

If you have misplaced or forgotten your PPS number, please note that

it can be found on any documentation you may have received from

the Department of Social Protection, e.g. Social Services Card, Drugs

Payment Card or European Health Insurance Card, or from the Revenue

If you have completed Declaration form(s) to

Commissioners or your employer, e.g. Tax Credit Certificate, P60 or P45.

claim DIRT Exempt status in relation to DIRT-free

deposit account(s) in 2012 insert T in the box

Return address

Use any envelope and write

“Freepost” above the Return Address.

You do not need to attach a stamp.

Notes

1. This form should be used to claim a repayment of income tax deducted from income at source (e.g. annuities, covenants, deposit interest

retention tax (DIRT), dividend withholding tax (DWT), etc.). If you need any help in completing the form you should contact your Revenue

office.

2. If you have already made a claim for the year ended 31 December 2012 there is no need to return this form.

3. This form may be used by

- an individual,

- a person acting under the authority of an individual (tax adviser, etc.),

- an executor or administrator of a deceased individual (in finalising pre-death tax affairs), or

- a committee, guardian, trustee, etc. of a minor (child under 18) or an incapacitated person.

Where the return is made on behalf of another (e.g. as agent, guardian, trustee, etc.) state the capacity on the DECLARATION below.

4. You can claim a refund of Deposit Interest Retention Tax (DIRT) if you and/or your spouse or civil partner were either:

- aged 65 years or over before 1 January 2013, or

- if under 65, permanently incapacitated by mental or physical infirmity from maintaining yourself,

and you were exempt from tax or your tax credits/reliefs exceeded your income in the year 2012.

Exemption Limits: You are exempt from tax for the year 2012 if you are 65 years of age or over and if your total income

(i.e. gross income less certain deductions) is below the following amounts:

Single, Widowed or a Surviving Civil Partner

€18,000

Married Couple or Civil Partners (Combined Income)

€36,000

These limits are increased by €575 each for the first and second dependent child and €830 for each subsequent dependent child.

Where income is not greatly above the exemption limit marginal relief may apply. Note that the marginal relief tax rate only applies to

persons 65 years of age or over.

5. This form is suitable for persons under 65 years of age where their tax liability is covered by their personal tax credits.

6. If you have completed Declaration form(s) in relation to DIRT-free deposit account(s) in 2012 you may be entitled to a refund of DIRT

deducted in the period 1 January 2012 to the date your account(s) became DIRT-free account(s).

YOU MUST SIGN THIS DECLARATION

I DECLARE that, to the best of my knowledge and belief, this form contains a correct return in accordance with the provisions

of the Taxes Consolidation Act 1997 of all the sources of my income and the amount of income derived from each source in the year 2012,

and all disposals of chargeable assets in the year 2012.

I DECLARE that, to the best of my knowledge and belief, all the particulars given as regards tax credits and reliefs claimed and as regards

outgoings are correctly stated.

/

/

Signature

Date (DD/MM/YYYY)

Address

Telephone

Capacity in which the return is made

for

(see Note 3 above)

/

/

If the claim is on behalf of a minor, state minor's date of birth (DD/MM/YYYY)

RPC002629_EN_WB_L_3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4