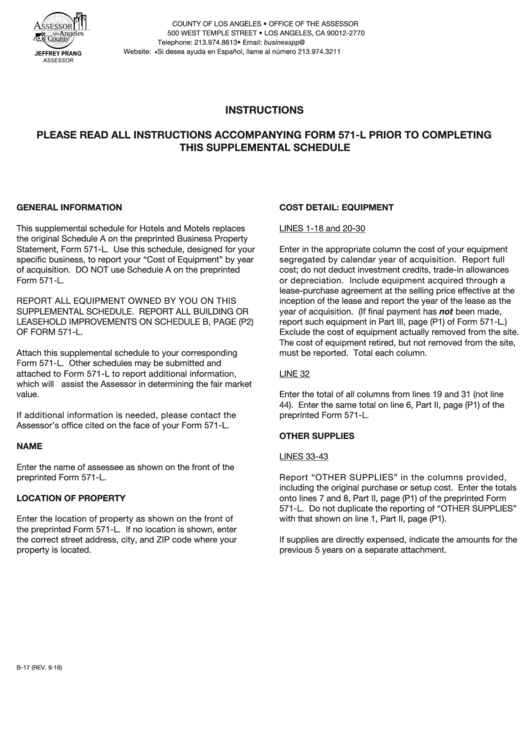

Form B-17 Instructions - Supplemental Schedule To Form 571-L For Hotels And Motels

ADVERTISEMENT

COUNTY OF LOS ANGELES • OFFICE OF THE ASSESSOR

500 WEST TEMPLE STREET • LOS ANGELES, CA 90012-2770

Telephone: 213.974.8613 • Email: businesspp@assessor.lacounty.gov

•

Website: assessor.lacounty.gov

Si desea ayuda en Español, llame al número 213.974.3211

INSTRUCTIONS

PLEASE READ ALL INSTRUCTIONS ACCOMPANYING FORM 571-L PRIOR TO COMPLETING

THIS SUPPLEMENTAL SCHEDULE

GENERAL INFORMATION

COST DETAIL: EQUIPMENT

This supplemental schedule for Hotels and Motels replaces

LINES 1-18 and 20-30

the original Schedule A on the preprinted Business Property

Statement, Form 571-L. Use this schedule, designed for your

Enter in the appropriate column the cost of your equipment

specific business, to report your “Cost of Equipment” by year

segregated by calendar year of acquisition. Report full

of acquisition. DO NOT use Schedule A on the preprinted

cost; do not deduct investment credits, trade-in allowances

Form 571-L.

or depreciation. Include equipment acquired through a

lease-purchase agreement at the selling price effective at the

REPORT ALL EQUIPMENT OWNED BY YOU ON THIS

inception of the lease and report the year of the lease as the

SUPPLEMENTAL SCHEDULE. REPORT ALL BUILDING OR

year of acquisition. (If final payment has not been made,

LEASEHOLD IMPROVEMENTS ON SCHEDULE B, PAGE (P2)

report such equipment in Part III, page (P1) of Form 571-L.)

OF FORM 571-L.

Exclude the cost of equipment actually removed from the site.

The cost of equipment retired, but not removed from the site,

Attach this supplemental schedule to your corresponding

must be reported. Total each column.

Form 571-L. Other schedules may be submitted and

attached to Form 571-L to report additional information,

LINE 32

which will assist the Assessor in determining the fair market

value.

Enter the total of all columns from lines 19 and 31 (not line

44). Enter the same total on line 6, Part II, page (P1) of the

If additional information is needed, please contact the

preprinted Form 571-L.

Assessor’s office cited on the face of your Form 571-L.

OTHER SUPPLIES

NAME

LINES 33-43

Enter the name of assessee as shown on the front of the

preprinted Form 571-L.

Report “OTHER SUPPLIES” in the columns provided,

including the original purchase or setup cost. Enter the totals

LOCATION OF PROPERTY

onto lines 7 and 8, Part II, page (P1) of the preprinted Form

571-L. Do not duplicate the reporting of “OTHER SUPPLIES”

Enter the location of property as shown on the front of

with that shown on line 1, Part II, page (P1).

the preprinted Form 571-L. If no location is shown, enter

the correct street address, city, and ZIP code where your

If supplies are directly expensed, indicate the amounts for the

property is located.

previous 5 years on a separate attachment.

B-17 (REV. 9-16)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1