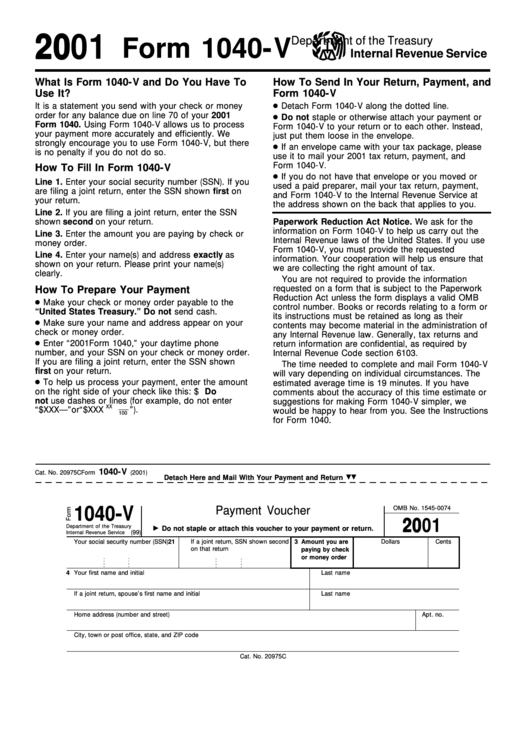

Form 1040-V - Payment Voucher - 2001

ADVERTISEMENT

2001

Department of the Treasury

Form 1040-V

Internal Revenue Service

What Is Form 1040-V and Do You Have To

How To Send In Your Return, Payment, and

Use It?

Form 1040-V

● Detach Form 1040-V along the dotted line.

It is a statement you send with your check or money

order for any balance due on line 70 of your 2001

● Do not staple or otherwise attach your payment or

Form 1040. Using Form 1040-V allows us to process

Form 1040-V to your return or to each other. Instead,

your payment more accurately and efficiently. We

just put them loose in the envelope.

strongly encourage you to use Form 1040-V, but there

● If an envelope came with your tax package, please

is no penalty if you do not do so.

use it to mail your 2001 tax return, payment, and

Form 1040-V.

How To Fill In Form 1040-V

● If you do not have that envelope or you moved or

Line 1. Enter your social security number (SSN). If you

used a paid preparer, mail your tax return, payment,

are filing a joint return, enter the SSN shown first on

and Form 1040-V to the Internal Revenue Service at

your return.

the address shown on the back that applies to you.

Line 2. If you are filing a joint return, enter the SSN

shown second on your return.

Paperwork Reduction Act Notice. We ask for the

information on Form 1040-V to help us carry out the

Line 3. Enter the amount you are paying by check or

Internal Revenue laws of the United States. If you use

money order.

Form 1040-V, you must provide the requested

Line 4. Enter your name(s) and address exactly as

information. Your cooperation will help us ensure that

shown on your return. Please print your name(s)

we are collecting the right amount of tax.

clearly.

You are not required to provide the information

requested on a form that is subject to the Paperwork

How To Prepare Your Payment

Reduction Act unless the form displays a valid OMB

● Make your check or money order payable to the

control number. Books or records relating to a form or

“United States Treasury.” Do not send cash.

its instructions must be retained as long as their

● Make sure your name and address appear on your

contents may become material in the administration of

check or money order.

any Internal Revenue law. Generally, tax returns and

● Enter “2001 Form 1040,” your daytime phone

return information are confidential, as required by

number, and your SSN on your check or money order.

Internal Revenue Code section 6103.

If you are filing a joint return, enter the SSN shown

The time needed to complete and mail Form 1040-V

first on your return.

will vary depending on individual circumstances. The

● To help us process your payment, enter the amount

estimated average time is 19 minutes. If you have

on the right side of your check like this: $ XXX.XX. Do

comments about the accuracy of this time estimate or

not use dashes or lines (for example, do not enter

suggestions for making Form 1040-V simpler, we

XX

“$ XXX—” or “$ XXX

”).

would be happy to hear from you. See the Instructions

100

for Form 1040.

1040-V

Cat. No. 20975C

Form

(2001)

Detach Here and Mail With Your Payment and Return

1040-V

OMB No. 1545-0074

Payment Voucher

2001

Department of the Treasury

Do not staple or attach this voucher to your payment or return.

(99)

Internal Revenue Service

1

Your social security number (SSN)

2

If a joint return, SSN shown second

3

Amount you are

Dollars

Cents

on that return

paying by check

or money order

4

Your first name and initial

Last name

If a joint return, spouse’s first name and initial

Last name

Home address (number and street)

Apt. no.

City, town or post office, state, and ZIP code

Cat. No. 20975C

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2