Pa Schedule A (Pa-1000 A) - 2016

Download a blank fillable Pa Schedule A (Pa-1000 A) - 2016 in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Pa Schedule A (Pa-1000 A) - 2016 with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

16 541

57

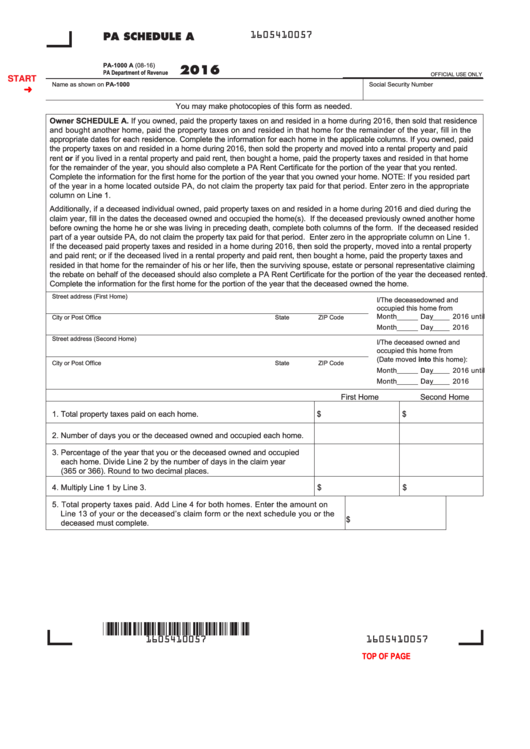

PA SCHEDULE A

PA-1000 A (08-16)

PA Department of Revenue

2016

OFFICIAL USE ONLY

Name as shown on PA-1000

Social Security Number

START

You may make photocopies of this form as needed.

Owner SCHEDULE A. If you owned, paid the property taxes on and resided in a home during 2016, then sold that residence

and bought another home, paid the property taxes on and resided in that home for the remainder of the year, fill in the

appropriate dates for each residence. Complete the information for each home in the applicable columns. If you owned, paid

the property taxes on and resided in a home during 2016, then sold the property and moved into a rental property and paid

rent or if you lived in a rental property and paid rent, then bought a home, paid the property taxes and resided in that home

for the remainder of the year, you should also complete a PA Rent Certificate for the portion of the year that you rented.

Complete the information for the first home for the portion of the year that you owned your home. NOTE: If you resided part

of the year in a home located outside PA, do not claim the property tax paid for that period. Enter zero in the appropriate

column on Line 1.

Additionally, if a deceased individual owned, paid property taxes on and resided in a home during 2016 and died during the

claim year, fill in the dates the deceased owned and occupied the home(s). If the deceased previously owned another home

before owning the home he or she was living in preceding death, complete both columns of the form. If the deceased resided

part of a year outside PA, do not claim the property tax paid for that period. Enter zero in the appropriate column on Line 1.

If the deceased paid property taxes and resided in a home during 2016, then sold the property, moved into a rental property

and paid rent; or if the deceased lived in a rental property and paid rent, then bought a home, paid the property taxes and

resided in that home for the remainder of his or her life, then the surviving spouse, estate or personal representative claiming

the rebate on behalf of the deceased should also complete a PA Rent Certificate for the portion of the year the deceased rented.

Complete the information for the first home for the portion of the year that the deceased owned the home.

Street address (First Home)

I/The deceased owned and

occupied this home from

Month

Day

2016 until

City or Post Office

State

ZIP Code

Month

Day

2016

Street address (Second Home)

I/The deceased owned and

occupied this home from

(Date moved into this home):

City or Post Office

State

ZIP Code

Month

Day

2016 until

Month

Day

2016

First Home

Second Home

1. Total property taxes paid on each home.

$

$

2. Number of days you or the deceased owned and occupied each home.

3. Percentage of the year that you or the deceased owned and occupied

each home. Divide Line 2 by the number of days in the claim year

(365 or 366). Round to two decimal places.

4. Multiply Line 1 by Line 3.

$

$

5. Total property taxes paid. Add Line 4 for both homes. Enter the amount on

Line 13 of your or the deceased’s claim form or the next schedule you or the

$

deceased must complete.

1605410057

16 541

57

TOP OF PAGE

PRINT

Reset Entire Form

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1