Form M-2210 - Underpayment Of Massachusetts Estimated Income Tax

ADVERTISEMENT

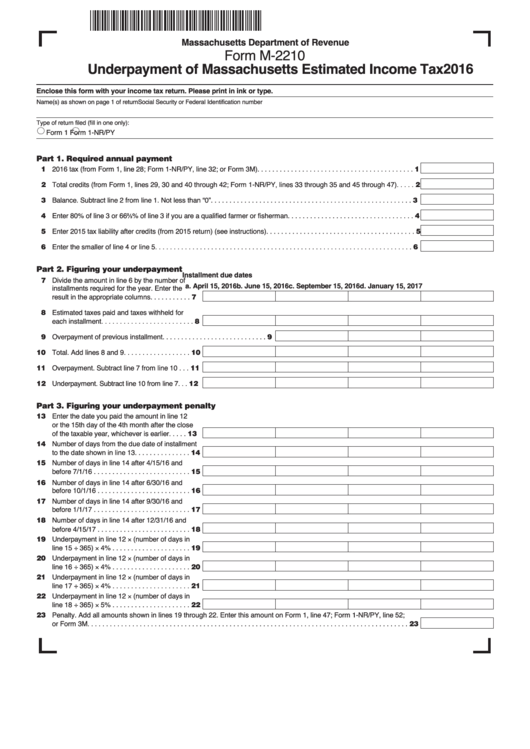

Massachusetts Department of Revenue

Form M-2210

Underpayment of Massachusetts Estimated Income Tax

2016

Enclose this form with your income tax return. Please print in ink or type.

Name(s) as shown on page 1 of return

Social Security or Federal Identification number

Type of return filed (fill in one only):

Form 1

Form 1-NR/PY

Part 1. Required annual payment

11 2016 tax (from Form 1, line 28; Form 1-NR/PY, line 32; or Form 3M) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

12 Total credits (from Form 1, lines 29, 30 and 40 through 42; Form 1-NR/PY, lines 33 through 35 and 45 through 47) . . . . . 2

13 Balance. Subtract line 2 from line 1. Not less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

14 Enter 80% of line 3 or 66

% of line 3 if you are a qualified farmer or fisherman. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

2

⁄

3

15 Enter 2015 tax liability after credits (from 2015 return) (see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

16 Enter the smaller of line 4 or line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Part 2. Figuring your underpayment

Installment due dates

17 Divide the amount in line 6 by the number of

a. April 15, 2016

b. June 15, 2016

c. September 15, 2016 d. January 15, 2017

installments required for the year. Enter the

result in the appropriate columns . . . . . . . . . . . 7

18 Estimated taxes paid and taxes withheld for

each installment . . . . . . . . . . . . . . . . . . . . . . . . . 8

19 Overpayment of previous installment . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Total. Add lines 8 and 9 . . . . . . . . . . . . . . . . . . 10

11 Overpayment. Subtract line 7 from line 10 . . . 11

12 Underpayment. Subtract line 10 from line 7 . . . 12

Part 3. Figuring your underpayment penalty

13 Enter the date you paid the amount in line 12

or the 15th day of the 4th month after the close

of the taxable year, whichever is earlier . . . . . 13

14 Number of days from the due date of installment

to the date shown in line 13. . . . . . . . . . . . . . . 14

15 Number of days in line 14 after 4/15/16 and

before 7/1/16 . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Number of days in line 14 after 6/30/16 and

before 10/1/16 . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Number of days in line 14 after 9/30/16 and

before 1/1/17 . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Number of days in line 14 after 12/31/16 and

before 4/15/17 . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Underpayment in line 12 × (number of days in

line 15 ÷ 365) × 4% . . . . . . . . . . . . . . . . . . . . . 19

20 Underpayment in line 12 × (number of days in

line 16 ÷ 365) × 4% . . . . . . . . . . . . . . . . . . . . . 20

21 Underpayment in line 12 × (number of days in

line 17 ÷ 365) × 4% . . . . . . . . . . . . . . . . . . . . . 21

22 Underpayment in line 12 × (number of days in

line 18 ÷ 365) × 5% . . . . . . . . . . . . . . . . . . . . . 22

23 Penalty. Add all amounts shown in lines 19 through 22. Enter this amount on Form 1, line 47; Form 1-NR/PY, line 52;

or Form 3M . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3