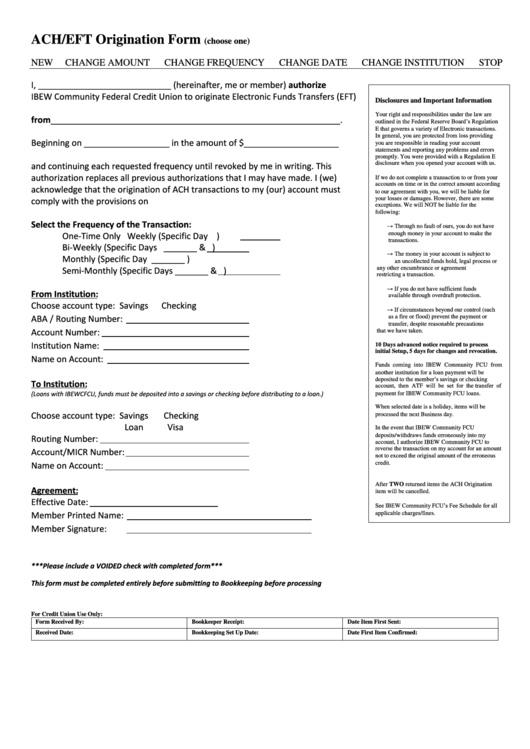

Ach/eft Origination Form

ADVERTISEMENT

ACH/EFT Origination Form

(choose one)

NEW

CHANGE AMOUNT

CHANGE FREQUENCY

CHANGE DATE

CHANGE INSTITUTION

STOP

I, ____________________________ (hereinafter, me or member) authorize

IBEW Community Federal Credit Union to originate Electronic Funds Transfers (EFT)

Disclosures and Important Information

Your right and responsibilities under the law are

from_____________________________________________________________.

outlined in the Federal Reserve Board’s Regulation

E that governs a variety of Electronic transactions.

In general, you are protected from loss providing

Beginning on __________________ in the amount of $____________________

you are responsible in reading your account

statements and reporting any problems and errors

promptly. You were provided with a Regulation E

disclosure when you opened your account with us.

and continuing each requested frequency until revoked by me in writing. This

authorization replaces all previous authorizations that I may have made. I (we)

If we do not complete a transaction to or from your

accounts on time or in the correct amount according

acknowledge that the origination of ACH transactions to my (our) account must

to our agreement with you, we will be liable for

your losses or damages. However, there are some

comply with the provisions on U.S. law.

exceptions. We will NOT be liable for the

following:

Select the Frequency of the Transaction:

→ Through no fault of ours, you do not have

enough money in your account to make the

One-Time Only

Weekly (Specific Day

)

transactions.

Bi-Weekly (Specific Days _______ &

)

→ The money in your account is subject to

Monthly (Specific Day _______ )

an uncollected funds hold, legal process or

any other encumbrance or agreement

Semi-Monthly (Specific Days _______ &

)

restricting a transaction.

→ If you do not have sufficient funds

From Institution:

available through overdraft protection.

Choose account type: Savings

Checking

→ If circumstances beyond our control (such

as a fire or flood) prevent the payment or

ABA / Routing Number:

transfer, despite reasonable precautions

Account Number:

that we have taken.

Institution Name:

10 Days advanced notice required to process

initial Setup, 5 days for changes and revocation.

Name on Account:

Funds coming into IBEW Community FCU from

another institution for a loan payment will be

deposited to the member’s savings or checking

To Institution:

account, then ATF will be set for the transfer of

(Loans with IBEWCFCU, funds must be deposited into a savings or checking before distributing to a loan.)

payment for IBEW Community FCU loans.

When selected date is a holiday, items will be

Choose account type: Savings

Checking

processed the next Business day.

Loan

Visa

In the event that IBEW Community FCU

deposits/withdraws funds erroneously into my

Routing Number:

account, I authorize IBEW Community FCU to

reverse the transaction on my account for an amount

Account/MICR Number:

not to exceed the original amount of the erroneous

credit.

Name on Account:

After TWO returned items the ACH Origination

Agreement:

item will be cancelled.

Effective Date:

See IBEW Community FCU’s Fee Schedule for all

Member Printed Name:

applicable charges/fines.

Member Signature:

***Please include a VOIDED check with completed form***

This form must be completed entirely before submitting to Bookkeeping before processing

For Credit Union Use Only:

Form Received By:

Bookkeeper Receipt:

Date Item First Sent:

Received Date:

Bookkeeping Set Up Date:

Date First Item Confirmed:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1