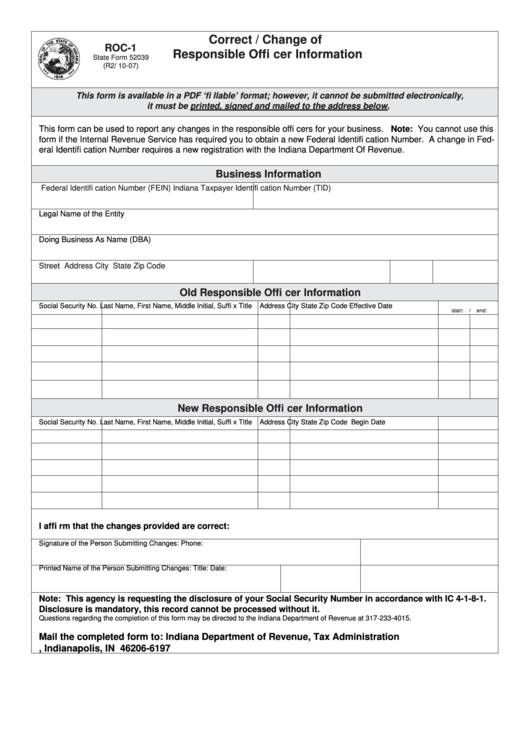

Correct / Change of

ROC-1

Responsible Offi cer Information

State Form 52039

(R2/ 10-07)

This form is available in a PDF ‘fi llable’ format; however, it cannot be submitted electronically,

it must be printed, signed and mailed to the address below.

This form can be used to report any changes in the responsible offi cers for your business. Note: You cannot use this

form if the Internal Revenue Service has required you to obtain a new Federal Identifi cation Number. A change in Fed-

eral Identifi cation Number requires a new registration with the Indiana Department Of Revenue.

Business Information

Federal Identifi cation Number (FEIN)

Indiana Taxpayer Identifi cation Number (TID)

Legal Name of the Entity

Doing Business As Name (DBA)

Street Address

City

State

Zip Code

Old Responsible Offi cer Information

Social Security No.

Last Name, First Name, Middle Initial, Suffi x

Title

Address

City

State

Zip Code

Effective Date

start:

/

end:

New Responsible Offi cer Information

Social Security No.

Last Name, First Name, Middle Initial, Suffi x

Title

Address

City

State

Zip Code

Begin Date

I affi rm that the changes provided are correct:

Signature of the Person Submitting Changes:

Phone:

Printed Name of the Person Submitting Changes:

Title:

Date:

Note: This agency is requesting the disclosure of your Social Security Number in accordance with IC 4-1-8-1.

Disclosure is mandatory, this record cannot be processed without it.

Questions regarding the completion of this form may be directed to the Indiana Department of Revenue at 317-233-4015.

Mail the completed form to: Indiana Department of Revenue, Tax Administration

P.O. Box 6197, Indianapolis, IN 46206-6197

1

1 2

2