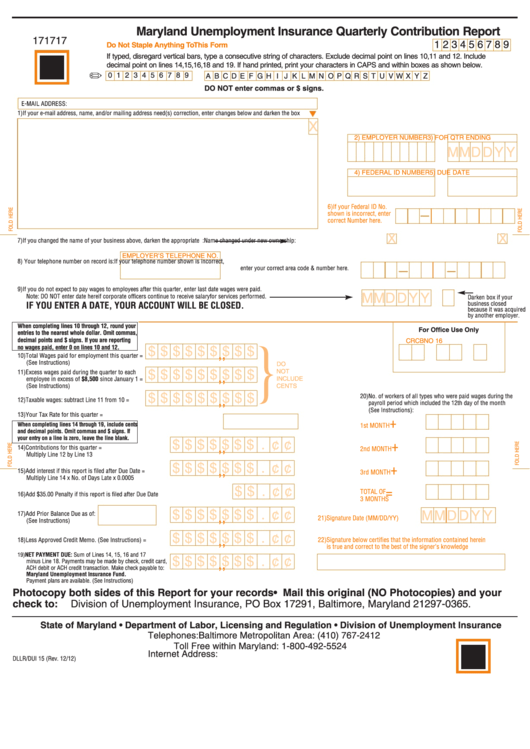

Form Dllr/oui 15 - Maryland Unemployment Insurance Quarterly Contribution Report

ADVERTISEMENT

Maryland Unemployment Insurance Quarterly Contribution Report

171717

1 2 3 4 5 6 7 8 9

Do Not Staple Anything To This Form

If typed, disregard vertical bars, type a consecutive string of characters. Exclude decimal point on lines 10,11 and 12. Include

decimal point on lines 14,15,16,18 and 19. If hand printed, print your characters in CAPS and within boxes as shown below.

0 1 2 3 4 5 6 7 8 9

A B C D E F G H I J K L M N O P Q R S T U V W X Y Z

DO NOT enter commas or $ signs.

E-MAIL ADDRESS:

1) If your e-mail address, name, and/or mailing address need(s) correction, enter changes below and darken the box

X

2) EMPLOYER NUMBER

3) FOR QTR ENDING

MMD D Y Y

4) FEDERAL ID NUMBER

5) DUE DATE

6) If your Federal ID No.

shown is incorrect, enter

correct Number here.

D.B.A. NAME

X

X

7) If you changed the name of your business above, darken the appropriate box.

Name changed under same ownership:

Name changed under new ownership:

EMPLOYER’S TELEPHONE NO.

8) Your telephone number on record is:

If your telephone number shown is incorrect,

enter your correct area code & number here.

9) If you do not expect to pay wages to employees after this quarter, enter last date wages were paid.

MMD D Y Y

Note: DO NOT enter date here if corporate officers continue to receive salary for services performed.

Darken box if your

IF YOU ENTER A DATE, YOUR ACCOUNT WILL BE CLOSED.

business closed

because it was acquired

by another employer.

When completing lines 10 through 12, round your

For Office Use Only

entries to the nearest whole dollar. Omit commas,

}

decimal points and $ signs. If you are reporting

CR

CB

NO 16

no wages paid, enter 0 on lines 10 and 12.

$ $ $ $ $ $ $ $ $

,

,

10)Total Wages paid for employment this quarter =

(See Instructions)

DO

$ $ $ $ $ $ $ $ $

NOT

11)Excess wages paid during the quarter to each

,

,

employee in excess of $8,500 since January 1 =

INCLUDE

(See Instructions)

CENTS

$ $ $ $ $ $ $ $ $

20)No. of workers of all types who were paid wages during the

,

,

12)Taxable wages: subtract Line 11 from 10 =

payroll period which included the 12th day of the month

(See Instructions):

13)Your Tax Rate for this quarter =

+

When completing lines 14 through 19, include cents

1st MONTH

and decimal points. Omit commas and $ signs. If

your entry on a line is zero, leave the line blank.

$ $ $ $ $ $ $ . ¢ ¢

+

,

,

14)Contributions for this quarter =

2nd MONTH

Multiply Line 12 by Line 13

$ $ $ $ $ $ $ . ¢ ¢

+

,

,

15)Add interest if this report is filed after Due Date =

3rd MONTH

Multiply Line 14 x No. of Days Late x 0.0005

$ $ . ¢ ¢

=

TOTAL OF

16)Add $35.00 Penalty if this report is filed after Due Date

3 MONTHS

$ $ $ $ $ $ $ . ¢ ¢

MMD D Y Y

,

,

17)Add Prior Balance Due as of:

21)Signature Date (MM/DD/YY)

(See Instructions)

$ $ $ $ $ $ $ . ¢ ¢

,

,

22)Signature below certifies that the information contained herein

18)Less Approved Credit Memo. (See Instructions) =

is true and correct to the best of the signer’s knowledge

19) NET PAYMENT DUE: Sum of Lines 14, 15, 16 and 17

$ $ $ $ $ $ $ . ¢ ¢

,

,

minus Line 18. Payments may be made by check, credit card,

ACH debit or ACH credit transaction. Make check payable to:

Maryland Unemployment Insurance Fund.

Payment plans are available. (See Instructions)

Photocopy both sides of this Report for your records • Mail this original (NO Photocopies) and your

check to:

Division of Unemployment Insurance, PO Box 17291, Baltimore, Maryland 21297-0365.

State of Maryland • Department of Labor, Licensing and Regulation • Division of Unemployment Insurance

Telephones: Baltimore Metropolitan Area: (410) 767-2412

Toll Free within Maryland: 1-800-492-5524

Internet Address:

DLLR/DUI 15 (Rev. 12/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3