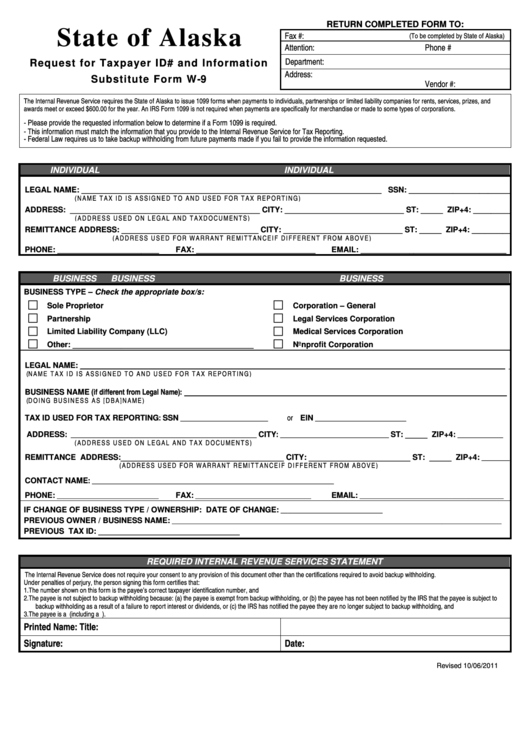

RETURN COMPLETED FORM TO:

State of Alaska

Fax #:

(To be completed by State of Alaska)

Attention:

Phone #

Department:

Request for Taxpayer ID# and Information

Address:

Substitute Form W-9

Vendor #:

The Internal Revenue Service requires the State of Alaska to issue 1099 forms when payments to individuals, partnerships or limited liability companies for rents, services, prizes, and

awards meet or exceed $600.00 for the year. An IRS Form 1099 is not required when payments are specifically for merchandise or made to some types of corporations.

- Please provide the requested information below to determine if a Form 1099 is required.

- This information must match the information that you provide to the Internal Revenue Service for Tax Reporting.

- Federal Law requires us to take backup withholding from future payments made if you fail to provide the information requested.

INDIVIDUAL

INDIVIDUAL

INDIVIDUAL

LEGAL NAME: ____________________________________________________________________ SSN: ________________________

( N A M E T A X I D I S A S S I G N E D T O A N D U S E D F O R T A X R E P O R T I N G )

ADDRESS: ___________________________________________ CITY: ___________________________ ST: _____ ZIP+4: _________

( A D D R E S S U S E D O N L E G A L A N D T A X D O C U M E N T S )

REMITTANCE ADDRESS: _______________________________ CITY: ___________________________ ST: _____ ZIP+4: _________

( A D D R E S S U S E D F O R W A R R A N T R E M I T T A N C E I F D I F F E R E N T F R O M A B O V E )

PHONE: _______________________

FAX: ___________________________

EMAIL: _________________________________

BUSINESS

BUSINESS

BUSINESS

BUSINESS TYPE – Check the appropriate box/s:

Sole Proprietor

Corporation – General

Partnership

Legal Services Corporation

Limited Liability Company (LLC)

Medical Services Corporation

Other: _________________________________________

Nonprofit Corporation

LEGAL NAME: ___________________________________________________________

_

( N A M E T A X I D I S A S S I G N E D T O A N D U S E D F O R T A X R E P O R T I N G )

BUSINESS NAME (if different from Legal Name):

( D O I N G B U S I N E S S A S [ D B A ] N A M E )

SSN _________________________

or

EIN __________________________

TAX ID USED FOR TAX REPORTING:

ADDRESS: _____________________________________________________ CITY: _______________________________ ST: _____ ZIP+4: _____________

( A D D R E S S U S E D O N L E G A L A N D T A X D O C U M E N T S )

REMITTANCE ADDRESS: _____________________________________ CITY: _______________________ ST: _____ ZIP+4: ________

( A D D R E S S U S E D F O R W A R R A N T R E M I T T A N C E I F D I F F E R E N T F R O M A B O V E )

CONTACT NAME: _____________________________________________________________________

PHONE: _____________________________

FAX: _________________________________

EMAIL: _________________________________________

DATE OF CHANGE: _____________________________

IF CHANGE OF BUSINESS TYPE / OWNERSHIP:

PREVIOUS OWNER / BUSINESS NAME: ______________________________________________________________________________________________

PREVIOUS TAX ID: ________________________________

REQUIRED INTERNAL REVENUE SERVICES STATEMENT

The Internal Revenue Service does not require your consent to any provision of this document other than the certifications required to avoid backup withholding.

Under penalties of perjury, the person signing this form certifies that:

1. The number shown on this form is the payee’s correct taxpayer identification number, and

2. The payee is not subject to backup withholding because: (a) the payee is exempt from backup withholding, or (b) the payee has not been notified by the IRS that the payee is subject to

backup withholding as a result of a failure to report interest or dividends, or (c) the IRS has notified the payee they are no longer subject to backup withholding, and

3. The payee is a U.S. person (including a U.S. resident alien).

Printed Name:

Title:

Signature:

Date:

Revised 10/06/2011

1

1