Submit this information online at

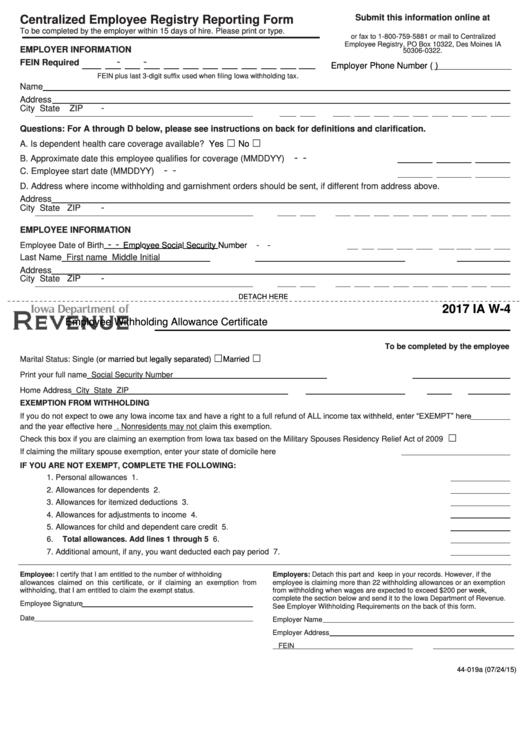

Centralized Employee Registry Reporting Form

To be completed by the employer within 15 days of hire. Please print or type.

or fax to 1-800-759-5881 or mail to Centralized

Employee Registry, PO Box 10322, Des Moines IA

EMPLOYER INFORMATION

50306-0322.

-

-

FEIN Required

Employer Phone Number (

)

.

FEIN plus last 3-digit suffix used when filing Iowa withholding tax

Name

Address

-

City

State

ZIP

Questions: For A through D below, please see instructions on back for definitions and clarification.

☐

☐

A. Is dependent health care coverage available? ................................................................................

Yes

No

-

-

B. Approximate date this employee qualifies for coverage (MMDDYY)

..............................................

-

-

C. Employee start date (MMDDYY)

.....................................................................................................

D. Address where income withholding and garnishment orders should be sent, if different from address above.

Address

-

City

State

ZIP

EMPLOYEE INFORMATION

-

-

-

-

Employee Date of Birth

Employee Social Security Number

Last Name

First name

Middle Initial

Address

-

City

State

ZIP

DETACH HERE

2017 IA W-4

Employee Withholding Allowance Certificate

https://tax.iowa.gov

To be completed by the employee

☐

☐

Marital Status:

Single

(or married but legally separated)

Married

Print your full name

Social Security Number

Home Address

City

State

ZIP

EXEMPTION FROM WITHHOLDING

If you do not expect to owe any Iowa income tax and have a right to a full refund of ALL income tax withheld, enter “EXEMPT” here

and the year effective here

. Nonresidents may not claim this exemption.

☐

Check this box if you are claiming an exemption from Iowa tax based on the Military Spouses Residency Relief Act of 2009 ...........................

If claiming the military spouse exemption, enter your state of domicile here ........................................................

IF YOU ARE NOT EXEMPT, COMPLETE THE FOLLOWING:

1.

Personal allowances ............................................................................................................................................. 1.

2.

Allowances for dependents ................................................................................................................................... 2.

3.

Allowances for itemized deductions ...................................................................................................................... 3.

4.

Allowances for adjustments to income .................................................................................................................. 4.

5.

Allowances for child and dependent care credit .................................................................................................... 5.

6.

Total allowances. Add lines 1 through 5 ........................................................................................................... 6.

7.

Additional amount, if any, you want deducted each pay period ............................................................................ 7.

Employee: I certify that I am entitled to the number of withholding

Employers: Detach this part and keep in your records. However, if the

allowances claimed on this certificate, or if claiming an exemption from

employee is claiming more than 22 withholding allowances or an exemption

withholding, that I am entitled to claim the exempt status.

from withholding when wages are expected to exceed $200 per week,

complete the section below and send it to the Iowa Department of Revenue.

Employee Signature

See Employer Withholding Requirements on the back of this form.

Date

Employer Name

Employer Address

FEIN

44-019a (07/24/15)

1

1