Point Document

ADVERTISEMENT

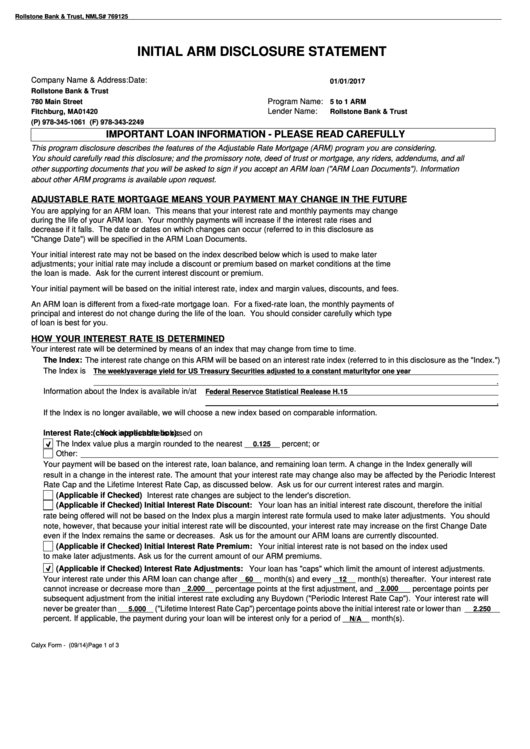

Rollstone Bank & Trust, NMLS# 769125

INITIAL ARM DISCLOSURE STATEMENT

Company Name & Address:

Date:

01/01/2017

Rollstone Bank & Trust

Program Name:

780 Main Street

5 to 1 ARM

Lender Name:

Fitchburg, MA 01420

Rollstone Bank & Trust

(P) 978-345-1061 (F) 978-343-2249

IMPORTANT LOAN INFORMATION - PLEASE READ CAREFULLY

This program disclosure describes the features of the Adjustable Rate Mortgage (ARM) program you are considering.

You should carefully read this disclosure; and the promissory note, deed of trust or mortgage, any riders, addendums, and all

other supporting documents that you will be asked to sign if you accept an ARM loan ("ARM Loan Documents"). Information

about other ARM programs is available upon request.

ADJUSTABLE RATE MORTGAGE MEANS YOUR PAYMENT MAY CHANGE IN THE FUTURE

You are applying for an ARM loan. This means that your interest rate and monthly payments may change

during the life of your ARM loan. Your monthly payments will increase if the interest rate rises and

decrease if it falls. The date or dates on which changes can occur (referred to in this disclosure as

"Change Date") will be specified in the ARM Loan Documents.

Your initial interest rate may not be based on the index described below which is used to make later

adjustments; your initial rate may include a discount or premium based on market conditions at the time

the loan is made. Ask for the current interest discount or premium.

Your initial payment will be based on the initial interest rate, index and margin values, discounts, and fees.

An ARM loan is different from a fixed-rate mortgage loan. For a fixed-rate loan, the monthly payments of

principal and interest do not change during the life of the loan. You should consider carefully which type

of loan is best for you.

HOW YOUR INTEREST RATE IS DETERMINED

Your interest rate will be determined by means of an index that may change from time to time.

The Index:

The interest rate change on this ARM will be based on an interest rate index (referred to in this disclosure as the "Index.")

The Index is

The weekly average yield for US Treasury Securities adjusted to a constant maturity for one year

.

Information about the Index is available in/at

Federal Reservce Statistical Realease H.15

.

If the Index is no longer available, we will choose a new index based on comparable information.

Interest Rate:

Your interest rate is based on

(check applicable box):

The Index value plus a margin rounded to the nearest ________ percent; or

0.125

Other:

Your payment will be based on the interest rate, loan balance, and remaining loan term. A change in the Index generally will

result in a change in the interest rate. The amount that your interest rate may change also may be affected by the Periodic Interest

Rate Cap and the Lifetime Interest Rate Cap, as discussed below. Ask us for our current interest rates and margin.

(Applicable if Checked)

Interest rate changes are subject to the lender's discretion.

(Applicable if Checked) Initial Interest Rate Discount:

Your loan has an initial interest rate discount, therefore the initial

rate being offered will not be based on the Index plus a margin interest rate formula used to make later adjustments. You should

note, however, that because your initial interest rate will be discounted, your interest rate may increase on the first Change Date

even if the Index remains the same or decreases. Ask us for the amount our ARM loans are currently discounted.

(Applicable if Checked) Initial Interest Rate Premium:

Your initial interest rate is not based on the index used

to make later adjustments. Ask us for the current amount of our ARM premiums.

(Applicable if Checked) Interest Rate Adjustments:

Your loan has "caps" which limit the amount of interest adjustments.

Your interest rate under this ARM loan can change after _____ month(s) and every _____ month(s) thereafter. Your interest rate

60

12

cannot increase or decrease more than _______ percentage points at the first adjustment, and ________ percentage points per

2.000

2.000

subsequent adjustment from the initial interest rate excluding any Buydown ("Periodic Interest Rate Cap"). Your interest rate will

never be greater than ________ ("Lifetime Interest Rate Cap") percentage points above the initial interest rate or lower than ________

5.000

2.250

percent. If applicable, the payment during your loan will be interest only for a period of ______ month(s).

N/A

Calyx Form - initarmdisc1.frm (09/14)

Page 1 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3