Form 12 Bb - Form To Claim Income Tax Benefits / Rebate

ADVERTISEMENT

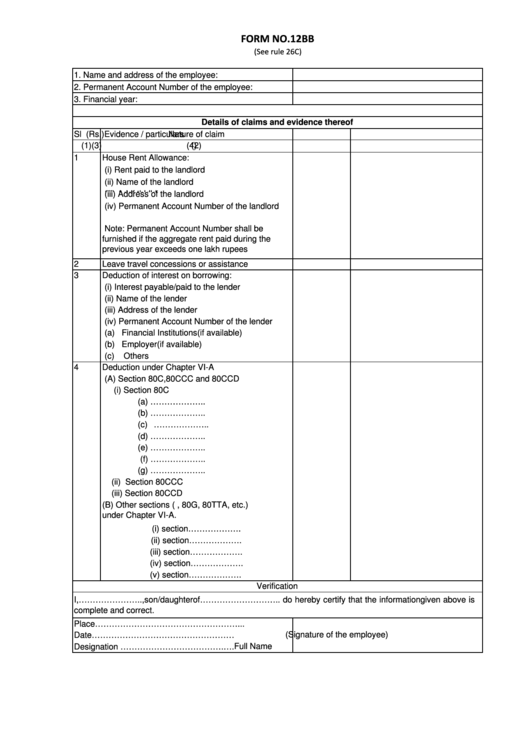

FORM NO.12BB

(See rule 26C)

1. Name and address of the employee:

2. Permanent Account Number of the employee:

3. Financial year:

Details of claims and evidence thereof

Sl No.

Nature of claim

Amount (Rs.)

Evidence / particulars

(1)

(2)

(3)

(4)

1

House Rent Allowance:

(i) Rent paid to the landlord

(ii) Name of the landlord

(iii) Add

(iii) Address of the landlord

f th l

dl d

(iv) Permanent Account Number of the landlord

Note: Permanent Account Number shall be

furnished if the aggregate rent paid during the

previous year exceeds one lakh rupees

2

Leave travel concessions or assistance

3

Deduction of interest on borrowing:

(i) Interest payable/paid to the lender

(ii) Name of the lender

(iii) Address of the lender

(iv) Permanent Account Number of the lender

(a) Financial Institutions(if available)

(b) Employer(if available)

(c)

Others

4

Deduction under Chapter VI-A

(A) Section 80C,80CCC and 80CCD

(i) Section 80C

(a) ………………..

(b) ………………..

(c) ………………..

(d) ………………..

(e) ………………..

(f) ………………..

(g) ………………..

(ii) Section 80CCC

(iii) Section 80CCD

(B) Other sections (e.g. 80E, 80G, 80TTA, etc.)

under Chapter VI-A.

(i) section……………….

(ii) section……………….

(iii) section……………….

(iv) section……………….

(v) section……………….

Verification

I,…………………..,son/daughter of……………………….. do hereby certify that the information given above is

complete and correct.

Place……………………………………………...

(Signature of the employee)

Date……………………………………………....

Full Name

Designation ……………………………….….

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1