P R O T E S T F O R M - Flathead County Treasurer

ADVERTISEMENT

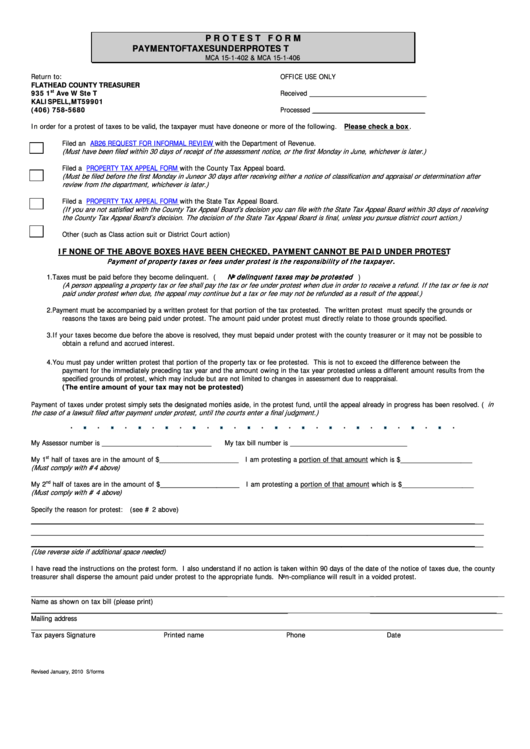

P R O T E S T F O R M

P A Y M E N T O F T A X E S U N D E R P R O T E S T

MCA 15-1-402 & MCA 15-1-406

Return to:

OFFICE USE ONLY

FLATHEAD COUNTY TREASURER

st

935 1

Ave W Ste T

Received _______________________________

KALISPELL, MT 59901

(406) 758-5680

Processed ______________________________

In order for a protest of taxes to be valid, the taxpayer must have done one or more of the following. Please check a box .

Filed an

AB26 REQUEST FOR INFORMAL REVIEW

with the Department of Revenue.

(Must have been filed within 30 days of receipt of the assessment notice, or the first Monday in June, whichever is later.)

Filed a

PROPERTY TAX APPEAL FORM

with the County Tax Appeal board.

(Must be filed before the first Monday in June or 30 days after receiving either a notice of classification and appraisal or determination after

review from the department, whichever is later.)

Filed a

PROPERTY TAX APPEAL FORM

with the State Tax Appeal Board.

(If you are not satisfied with the County Tax Appeal Board’s decision you can file with the State Tax Appeal Board within 30 days of receiving

the County Tax Appeal Board’s decision. The decision of the State Tax Appeal Board is final, unless you pursue district court action.)

Other (such as Class action suit or District Court action)

IF NONE OF THE ABOVE BOXES HAVE BEEN CHECKED, PAYMENT CANNOT BE PAID UNDER PROTEST

.

Paym ent of property tax es or fees under protest is the responsibility of the tax payer

N o delinquent tax es m ay be protested

1.

Taxes must be paid before they become delinquent. (

)

(A person appealing a property tax or fee shall pay the tax or fee under protest when due in order to receive a refund. If the tax or fee is not

paid under protest when due, the appeal may continue but a tax or fee may not be refunded as a result of the appeal.)

2.

Payment must be accompanied by a written protest for that portion of the tax protested. The written protest must specify the grounds or

reasons the taxes are being paid under protest. The amount paid under protest must directly relate to those grounds specified.

3.

If your taxes become due before the above is resolved, they must be paid under protest with the county treasurer or it may not be possible to

obtain a refund and accrued interest.

4.

You must pay under written protest that portion of the property tax or fee protested. This is not to exceed the difference between the

payment for the immediately preceding tax year and the amount owing in the tax year protested unless a different amount results from the

specified grounds of protest, which may include but are not limited to changes in assessment due to reappraisal.

(The entire amount of your tax may not be protested)

nie

in

Payment of taxes under protest simply sets the designated mo

s aside, in the protest fund, until the appeal already in progress has been resolved. (

the case of a lawsuit filed after payment under protest, until the courts enter a final judgment.)

My Assessor number is _____________________________

My tax bill number is _______________________________

My 1

st

half of taxes are in the amount of $_____________________ I am protesting a portion of that amount

which is $___________________

(Must comply with #4 above)

nd

My 2

half of taxes are in the amount of $_____________________ I am protesting a portion of that amount

which is $___________________

(Must comply with # 4 above)

Specify the reason for protest: (see # 2 above)

________________________________________________________________________________________

________________________________________________________________________________________

________________________________________________________________________________________

(Use reverse side if additional space needed)

I have read the instructions on the protest form. I also understand if no action is taken within 90 days of the date of the notice of taxes due, the county

treasurer shall disperse the amount paid under protest to the appropriate funds. Non-compliance will result in a voided protest.

____________________________________________________

_ __________________________________

Name as shown on tax bill (please print)

____________________________________________________________________

___________________________________

Mailing address

____________________________________________________________________________

__________________________________________

Tax payers Signature

Printed name

Phone

Date

Revised January, 2010 S/forms

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1