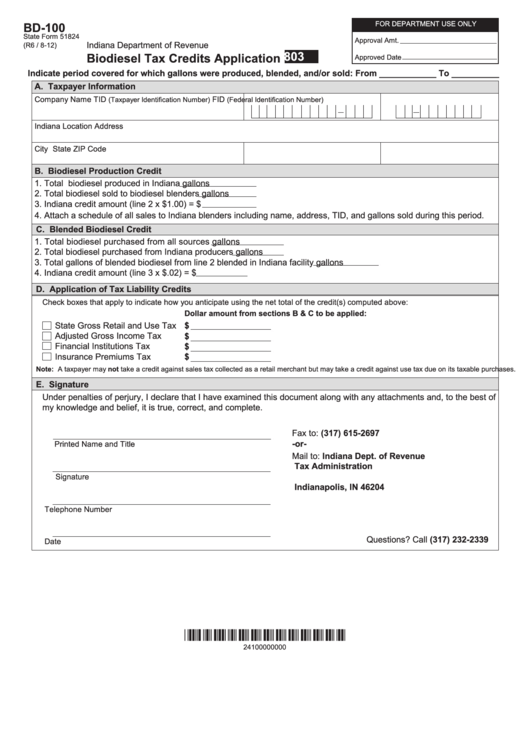

FOR DEPARTMENT USE ONLY

BD-100

State Form 51824

Approval Amt.

Indiana Department of Revenue

(R6 / 8-12)

803

Biodiesel Tax Credits Application

Approved Date

Indicate period covered for which gallons were produced, blended, and/or sold: From ____________ To __________

A. Taxpayer Information

Company Name

TID

FID

(Taxpayer Identification Number)

(Federal Identification Number)

Indiana Location Address

City

State

ZIP Code

B. Biodiesel Production Credit

1. Total biodiesel produced in Indiana

gallons

2. Total biodiesel sold to biodiesel blenders

gallons

3. Indiana credit amount (line 2 x $1.00) = $

4. Attach a schedule of all sales to Indiana blenders including name, address, TID, and gallons sold during this period.

C. Blended Biodiesel Credit

1. Total biodiesel purchased from all sources

gallons

2. Total biodiesel purchased from Indiana producers

gallons

3. Total gallons of blended biodiesel from line 2 blended in Indiana facility

gallons

4. Indiana credit amount (line 3 x $.02) = $

D. Application of Tax Liability Credits

Check boxes that apply to indicate how you anticipate using the net total of the credit(s) computed above:

Dollar amount from sections B & C to be applied:

State Gross Retail and Use Tax

$

Adjusted Gross Income Tax

$

Financial Institutions Tax

$

Insurance Premiums Tax

$

Note: A taxpayer may not take a credit against sales tax collected as a retail merchant but may take a credit against use tax due on its taxable purchases.

E. Signature

Under penalties of perjury, I declare that I have examined this document along with any attachments and, to the best of

my knowledge and belief, it is true, correct, and complete.

Fax to: (317) 615-2697

-or-

Printed Name and Title

Mail to: Indiana Dept. of Revenue

Tax Administration

P.O. Box 6197

Signature

Indianapolis, IN 46204

Telephone Number

Questions? Call (317) 232-2339

Date

*24100000000*

24100000000

1

1 2

2