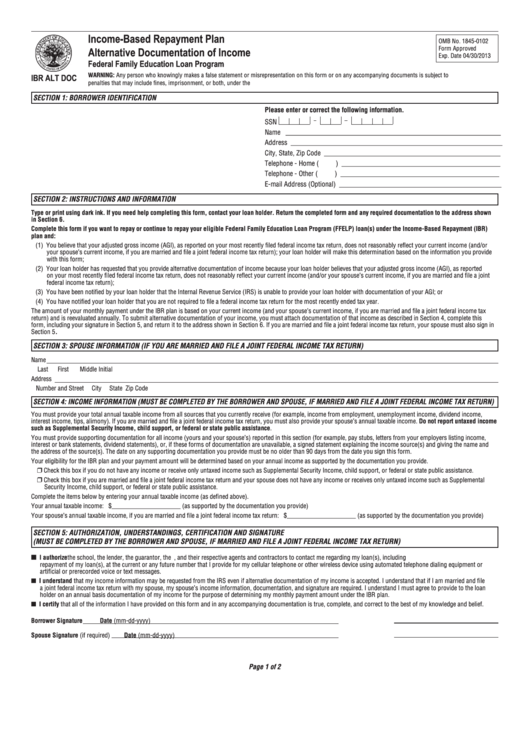

Income-Based Repayment Plan Alternative Documentation Of Income

ADVERTISEMENT

Income-Based Repayment Plan

OMB No. 1845-0102

Alternative Documentation of Income

Form Approved

Exp. Date 04/30/2013

Federal Family Education Loan Program

IBR ALT DOC

WARNING: Any person who knowingly makes a false statement or misrepresentation on this form or on any accompanying documents is subject to

penalties that may include fines, imprisonment, or both, under the U.S. Criminal Code and 20 U.S.C. 1097.

SECTION 1: BORROWER IDENTIFICATION

Please enter or correct the following information.

SSN

Name _____________________________________________________________

Address ____________________________________________________________

City, State, Zip Code __________________________________________________

Telephone - Home (

) _____________________________________________

Telephone - Other (

) _____________________________________________

E-mail Address (Optional) ______________________________________________

SECTION 2: INSTRUCTIONS AND INFORMATION

Type or print using dark ink. If you need help completing this form, contact your loan holder. Return the completed form and any required documentation to the address shown

in Section 6.

Complete this form if you want to repay or continue to repay your eligible Federal Family Education Loan Program (FFELP) loan(s) under the Income-Based Repayment (IBR)

plan and:

(1) You believe that your adjusted gross income (AGI), as reported on your most recently filed federal income tax return, does not reasonably reflect your current income (and/or

your spouse’s current income, if you are married and file a joint federal income tax return); your loan holder will make this determination based on the information you provide

with this form;

(2) Your loan holder has requested that you provide alternative documentation of income because your loan holder believes that your adjusted gross income (AGI), as reported

on your most recently filed federal income tax return, does not reasonably reflect your current income (and/or your spouse’s current income, if you are married and file a joint

federal income tax return);

(3) You have been notified by your loan holder that the Internal Revenue Service (IRS) is unable to provide your loan holder with documentation of your AGI; or

(4) You have notified your loan holder that you are not required to file a federal income tax return for the most recently ended tax year.

The amount of your monthly payment under the IBR plan is based on your current income (and your spouse’s current income, if you are married and file a joint federal income tax

return) and is reevaluated annually. To submit alternative documentation of your income, you must attach documentation of that income as described in Section 4, complete this

form, including your signature in Section 5, and return it to the address shown in Section 6. If you are married and file a joint federal income tax return, your spouse must also sign in

Section 5.

SECTION 3: SPOUSE INFORMATION (IF YOU ARE MARRIED AND FILE A JOINT FEDERAL INCOME TAX RETURN)

Name

Last

First

Middle Initial

Address

Number and Street

City

State

Zip Code

SECTION 4: INCOME INFORMATION (MUST BE COMPLETED BY THE BORROWER AND SPOUSE, IF MARRIED AND FILE A JOINT FEDERAL INCOME TAX RETURN)

You must provide your total annual taxable income from all sources that you currently receive (for example, income from employment, unemployment income, dividend income,

interest income, tips, alimony). If you are married and file a joint federal income tax return, you must also provide your spouse’s annual taxable income. Do not report untaxed income

such as Supplemental Security Income, child support, or federal or state public assistance.

You must provide supporting documentation for all income (yours and your spouse’s) reported in this section (for example, pay stubs, letters from your employers listing income,

interest or bank statements, dividend statements), or, if these forms of documentation are unavailable, a signed statement explaining the income source(s) and giving the name and

the address of the source(s). The date on any supporting documentation you provide must be no older than 90 days from the date you sign this form.

Your eligibility for the IBR plan and your payment amount will be determined based on your annual income as supported by the documentation you provide.

Check this box if you do not have any income or receive only untaxed income such as Supplemental Security Income, child support, or federal or state public assistance.

r

Check this box if you are married and file a joint federal income tax return and your spouse does not have any income or receives only untaxed income such as Supplemental

r

Security Income, child support, or federal or state public assistance.

Complete the items below by entering your annual taxable income (as defined above).

Your annual taxable income: $_____________________ (as supported by the documentation you provide)

Your spouse’s annual taxable income, if you are married and file a joint federal income tax return: $_____________________ (as supported by the documentation you provide)

SECTION 5: AUTHORIZATION, UNDERSTANDINGS, CERTIFICATION AND SIGNATURE

(MUST BE COMPLETED BY THE BORROWER AND SPOUSE, IF MARRIED AND FILE A JOINT FEDERAL INCOME TAX RETURN)

I authorize the school, the lender, the guarantor, the U.S. Department of Education, and their respective agents and contractors to contact me regarding my loan(s), including

n

repayment of my loan(s), at the current or any future number that I provide for my cellular telephone or other wireless device using automated telephone dialing equipment or

artificial or prerecorded voice or text messages.

n I understand that my income information may be requested from the IRS even if alternative documentation of my income is accepted. I understand that if I am married and file

a joint federal income tax return with my spouse, my spouse’s income information, documentation, and signature are required. I understand I must agree to provide to the loan

holder on an annual basis documentation of my income for the purpose of determining my monthly payment amount under the IBR plan.

n I certify that all of the information I have provided on this form and in any accompanying documentation is true, complete, and correct to the best of my knowledge and belief.

Borrower Signature

Date (mm-dd-yyyy)

Spouse Signature (if required)

Date (mm-dd-yyyy)

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2