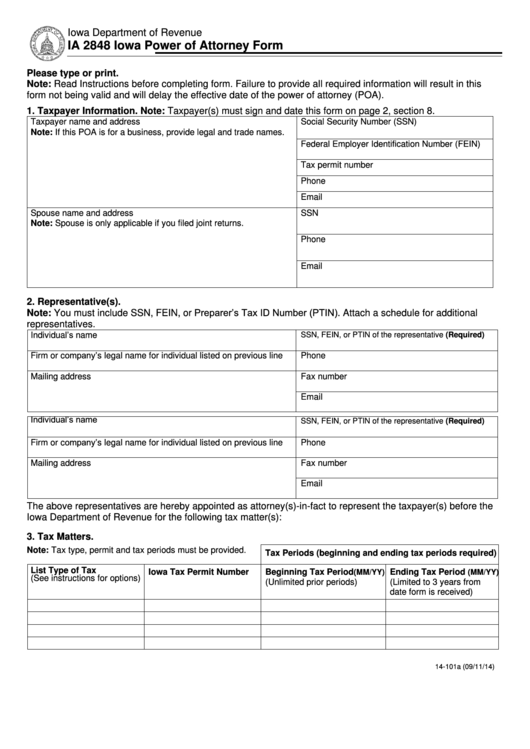

Iowa Department of Revenue

IA 2848 Iowa Power of Attorney Form

Please type or print.

Note: Read Instructions before completing form. Failure to provide all required information will result in this

form not being valid and will delay the effective date of the power of attorney (POA).

1. Taxpayer Information. Note: Taxpayer(s) must sign and date this form on page 2, section 8.

Taxpayer name and address

Social Security Number (SSN)

Note: If this POA is for a business, provide legal and trade names.

Federal Employer Identification Number (FEIN)

Tax permit number

Phone

Email

Spouse name and address

SSN

Note: Spouse is only applicable if you filed joint returns.

Phone

Email

2. Representative(s).

Note: You must include SSN, FEIN, or Preparer’s Tax ID Number (PTIN). Attach a schedule for additional

representatives.

SSN, FEIN, or PTIN of the representative (Required)

Individual’s name

Firm or company’s legal name for individual listed on previous line Phone

Mailing address

Fax number

Email

Individual’s name

SSN, FEIN, or PTIN of the representative (Required)

Firm or company’s legal name for individual listed on previous line Phone

Mailing address

Fax number

Email

The above representatives are hereby appointed as attorney(s)-in-fact to represent the taxpayer(s) before the

Iowa Department of Revenue for the following tax matter(s):

3. Tax Matters.

Note: Tax type, permit and tax periods must be provided.

Tax Periods (beginning and ending tax periods required)

List Type of Tax

Iowa Tax Permit Number

Beginning Tax Period

Ending Tax Period

(MM/YY)

(MM/YY)

(See instructions for options)

(Unlimited prior periods)

(Limited to 3 years from

date form is received)

14-101a (09/11/14)

1

1 2

2 3

3