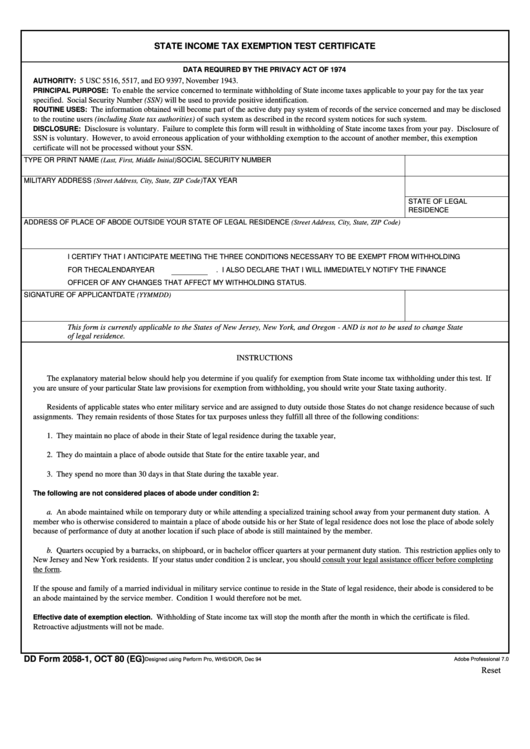

STATE INCOME TAX EXEMPTION TEST CERTIFICATE

DATA REQUIRED BY THE PRIVACY ACT OF 1974

5 USC 5516, 5517, and EO 9397, November 1943.

AUTHORITY:

To enable the service concerned to terminate withholding of State income taxes applicable to your pay for the tax year

PRINCIPAL PURPOSE:

specified. Social Security Number (SSN) will be used to provide positive identification.

ROUTINE USES:

The information obtained will become part of the active duty pay system of records of the service concerned and may be disclosed

to the routine users (including State tax authorities) of such system as described in the record system notices for such system.

DISCLOSURE:

Disclosure is voluntary. Failure to complete this form will result in withholding of State income taxes from your pay. Disclosure of

SSN is voluntary. However, to avoid erroneous application of your withholding exemption to the account of another member, this exemption

certificate will not be processed without your SSN.

TYPE OR PRINT NAME (Last, First, Middle Initial)

SOCIAL SECURITY NUMBER

MILITARY ADDRESS (Street Address, City, State, ZIP Code)

TAX YEAR

STATE OF LEGAL

RESIDENCE

ADDRESS OF PLACE OF ABODE OUTSIDE YOUR STATE OF LEGAL RESIDENCE (Street Address, City, State, ZIP Code)

I CERTIFY THAT I ANTICIPATE MEETING THE THREE CONDITIONS NECESSARY TO BE EXEMPT FROM WITHHOLDING

FOR THE CALENDAR YEAR

. I ALSO DECLARE THAT I WILL IMMEDIATELY NOTIFY THE FINANCE

OFFICER OF ANY CHANGES THAT AFFECT MY WITHHOLDING STATUS.

SIGNATURE OF APPLICANT

DATE (YYMMDD)

This form is currently applicable to the States of New Jersey, New York, and Oregon - AND is not to be used to change State

of legal residence.

INSTRUCTIONS

The explanatory material below should help you determine if you qualify for exemption from State income tax withholding under this test. If

you are unsure of your particular State law provisions for exemption from withholding, you should write your State taxing authority.

Residents of applicable states who enter military service and are assigned to duty outside those States do not change residence because of such

assignments. They remain residents of those States for tax purposes unless they fulfill all three of the following conditions:

1. They maintain no place of abode in their State of legal residence during the taxable year,

2. They do maintain a place of abode outside that State for the entire taxable year, and

3. They spend no more than 30 days in that State during the taxable year.

The following are not considered places of abode under condition 2:

a. An abode maintained while on temporary duty or while attending a specialized training school away from your permanent duty station. A

member who is otherwise considered to maintain a place of abode outside his or her State of legal residence does not lose the place of abode solely

because of performance of duty at another location if such place of abode is still maintained by the member.

b. Quarters occupied by a barracks, on shipboard, or in bachelor officer quarters at your permanent duty station. This restriction applies only to

New Jersey and New York residents. If your status under condition 2 is unclear, you should consult your legal assistance officer before completing

the form.

If the spouse and family of a married individual in military service continue to reside in the State of legal residence, their abode is considered to be

an abode maintained by the service member. Condition 1 would therefore not be met.

Withholding of State income tax will stop the month after the month in which the certificate is filed.

Effective date of exemption election.

Retroactive adjustments will not be made.

DD Form 2058-1, OCT 80 (EG)

Adobe Professional 7.0

Designed using Perform Pro, WHS/DIOR, Dec 94

Reset

1

1