Canada Customs

Agence des douanes

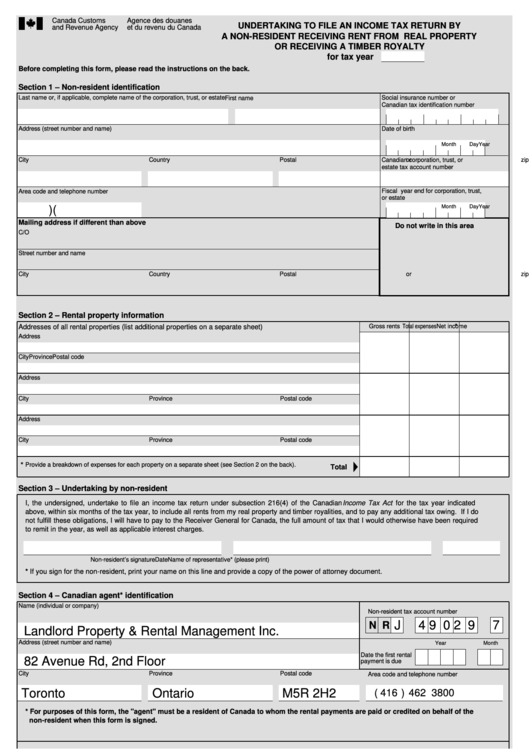

UNDERTAKING TO FILE AN INCOME TAX RETURN BY

and Revenue Agency

et du revenu du Canada

A NON-RESIDENT RECEIVING RENT FROM REAL PROPERTY

OR RECEIVING A TIMBER ROYALTY

for tax year

Before completing this form, please read the instructions on the back.

Section 1 – Non-resident identification

Last name or, if applicable, complete name of the corporation, trust, or estate

Social insurance number or

First name

Canadian tax identification number

Address (street number and name)

Date of birth

Year

Month

Day

City

Country

Postal or zip code

Canadian corporation, trust, or

estate tax account number

Fiscal year end for corporation, trust,

Area code and telephone number

or estate

Year

Month

Day

(

)

Mailing address if different than above

Do not write in this area

C/O

Street number and name

City

Country

Postal or zip code

Section 2 – Rental property information

*

Addresses of all rental properties (list additional properties on a separate sheet)

Gross rents

Total expenses

Net income

Address

City

Province

Postal code

Address

City

Province

Postal code

Address

City

Province

Postal code

*

Provide a breakdown of expenses for each property on a separate sheet (see Section 2 on the back).

Total

Section 3 – Undertaking by non-resident

I, the undersigned, undertake to file an income tax return under subsection 216(4) of the Canadian Income Tax Act for the tax year indicated

above, within six months of the tax year, to include all rents from my real property and timber royalities, and to pay any additional tax owing. If I do

not fulfill these obligations, I will have to pay to the Receiver General for Canada, the full amount of tax that I would otherwise have been required

to remit in the year, as well as applicable interest charges.

Non-resident’s signature

Name of representative* (please print)

Date

* If you sign for the non-resident, print your name on this line and provide a copy of the power of attorney document.

Section 4 – Canadian agent* identification

Name (individual or company)

Non-resident tax account number

J

4 9 0 2 9

7

N R

Landlord Property & Rental Management Inc.

Address (street number and name)

Year

Month

Date the first rental

82 Avenue Rd, 2nd Floor

payment is due

City

Province

Postal code

Area code and telephone number

Toronto

Ontario

M5R 2H2

(

416

)

462 3800

* For purposes of this form, the "agent" must be a resident of Canada to whom the rental payments are paid or credited on behalf of the

non-resident when this form is signed.

I, the undersigned, declare that I am the Canadian agent of the non-resident indicated in Section 1. If the non-resident does not file an income tax

return or pay tax according to the undertaking, I understand that I will have to pay to the Receiver General for Canada the full amount of tax that

would otherwise have been required to be remitted for the year, as well as applicable penalty and interest charges.

Agent’s signature

Name of individual signing on the agent’s* behalf (please print)

Date

* If the agent is a company, print the name of the person signing on the agent’s behalf.

NR6 E (00)

(Ce formulaire existe en français.)

1

1 2

2