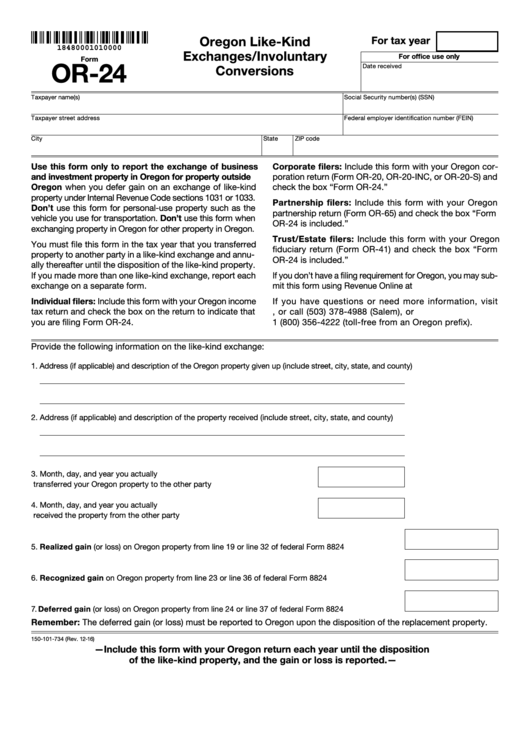

Clear Form

Oregon Like-Kind

For tax year

18480001010000

Exchanges/Involuntary

For office use only

Form

OR-24

Date received

Conversions

Taxpayer name(s)

Social Security number(s) (SSN)

Taxpayer street address

Federal employer identification number (FEIN)

City

State

ZIP code

Use this form only to report the exchange of business

Corporate filers: Include this form with your Oregon cor-

and investment property in Oregon for property outside

poration return (Form OR-20, OR-20-INC, or OR-20-S) and

Oregon when you defer gain on an exchange of like-kind

check the box “Form OR-24.”

property under Internal Revenue Code sections 1031 or 1033.

Partnership filers: Include this form with your Oregon

Don’t use this form for personal-use property such as the

partnership return (Form OR-65) and check the box “Form

vehicle you use for transportation. Don’t use this form when

OR-24 is included.”

exchanging property in Oregon for other property in Oregon.

Trust/Estate filers: Include this form with your Oregon

You must file this form in the tax year that you transferred

fiduciary return (Form OR-41) and check the box “Form

property to another party in a like-kind exchange and annu-

OR-24 is included.”

ally thereafter until the disposition of the like-kind property.

If you made more than one like-kind exchange, report each

If you don’t have a filing requirement for Oregon, you may sub-

exchange on a separate form.

mit this form using Revenue Online at

Individual filers: Include this form with your Oregon income

If you have questions or need more information, visit

tax return and check the box on the return to indicate that

, or call (503) 378-4988 (Salem), or

you are filing Form OR-24.

1 (800) 356-4222 (toll-free from an Oregon prefix).

Provide the following information on the like-kind exchange:

1. Address (if applicable) and description of the Oregon property given up (include street, city, state, and county)

2. Address (if applicable) and description of the property received (include street, city, state, and county)

3. Month, day, and year you actually

transferred your Oregon property to the other party ...........................................

4. Month, day, and year you actually

received the property from the other party ..........................................................

5. Realized gain (or loss) on Oregon property from line 19 or line 32 of federal Form 8824 ........................

6. Recognized gain on Oregon property from line 23 or line 36 of federal Form 8824 ...............................

7. Deferred gain (or loss) on Oregon property from line 24 or line 37 of federal Form 8824 .......................

Remember: The deferred gain (or loss) must be reported to Oregon upon the disposition of the replacement property.

150-101-734 (Rev. 12-16)

—Include this form with your Oregon return each year until the disposition

of the like-kind property, and the gain or loss is reported.—

1

1