Important Filing Reminders For Forms Nys-45 And Nys -45-Att

ADVERTISEMENT

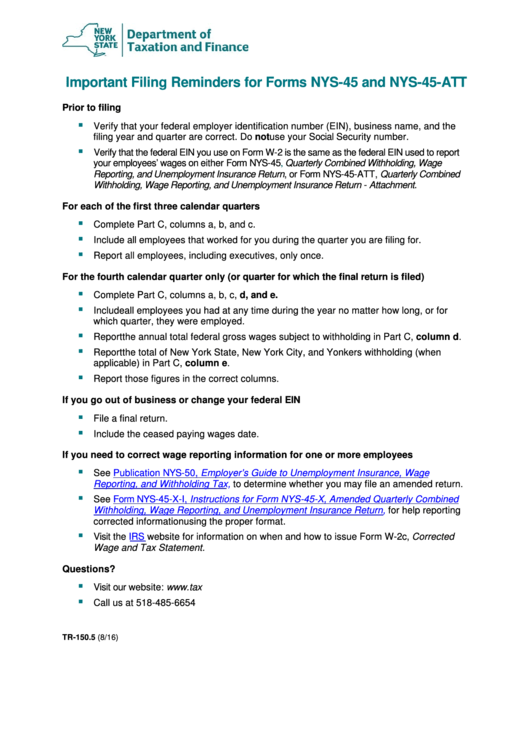

Important Filing Reminders for Forms NYS-45 and NYS-45-ATT

Prior to filing

Verify that your federal employer identification number (EIN), business name, and the

filing year and quarter are correct. Do not use your Social Security number.

Verify that the federal EIN you use on Form W-2 is the same as the federal EIN used to report

your employees’ wages on either Form

NYS-45,

Quarterly Combined Withholding, Wage

Reporting, and Unemployment Insurance Return, or Form NYS-45-ATT, Quarterly Combined

Withholding, Wage Reporting, and Unemployment Insurance Return - Attachment.

For each of the first three calendar quarters

Complete Part C, columns a, b, and c.

Include all employees that worked for you during the quarter you are filing for.

Report all employees, including executives, only once.

For the fourth calendar quarter only (or quarter for which the final return is filed)

Complete Part C, columns a, b, c, d, and e.

Include all employees you had at any time during the year no matter how long, or for

which quarter, they were employed.

Report the annual total federal gross wages subject to withholding in Part C, column d.

Report the total of New York State, New York City, and Yonkers withholding (when

applicable) in Part C, column e.

Report those figures in the correct columns.

If you go out of business or change your federal EIN

File a final return.

Include the ceased paying wages date.

If you need to correct wage reporting information for one or more employees

See

Publication NYS-50, Employer’s Guide to Unemployment Insurance, Wage

Reporting, and Withholding Tax,

to determine whether you may file an amended return.

See

Form NYS-45-X-I, Instructions for Form NYS-45-X, Amended Quarterly Combined

Withholding, Wage Reporting, and Unemployment Insurance Return,

for help reporting

corrected information using the proper format.

Visit the

IRS

website for information on when and how to issue Form W-2c, Corrected

Wage and Tax Statement.

Questions?

Visit our website:

Call us at 518-485-6654

TR-150.5 (8/16)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1