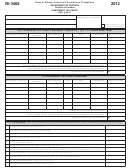

S

A: C

T

- D

D

R

I

CHEDULE

OMPUTATION OF

AX

ECEDENT

OMICILED IN

HODE

SLAND

$

1.

Federal Credit for State Death Taxes from Federal Form 706:

$

2.

Death taxes paid to a state other than Rhode Island:

(If none, skip lines 2 through 7. Enter amount from line 1 on line 8).

$

3.

Federal Gross Estate from Federal Form 706:

$

4.

Non-Rhode Island Gross Estate*:

%

5.

Percentage of non-Rhode Island Gross Estate to Federal Gross Estate:

(Divide line 4 by line 3).

6.

Adjusted State Death Tax Credit. Multiply line 1 by line 5:

$

$

7.

Enter the lesser of line 2 or line 6:

$

8.

Tax Payable to Rhode Island. Subtract line 7 from line 1:

S

B: C

T

- D

D

O

R

I

CHEDULE

OMPUTATION OF

AX

ECEDENT

OMICILED

UTSIDE OF

HODE

SLAND

$

1.

Federal Credit for State Death Taxes from Federal Form 706:

$

2.

Federal Gross Estate from Federal Form 706:

3.

Rhode Island Gross Estate**:

$

%

4.

Percentage of Rhode Island Gross Estate to Federal Gross Estate:

(Divide line 3 by line 2).

$

5.

Tax Payable to Rhode Island. Multiply line 1 by line 4:

*

Non-Rhode Island Gross Estate for a decedent domiciled in Rhode Island means the total value of real

estate and tangible personal property (cars, boats, clothes, jewelry, furniture, etc.) which is located outside

of Rhode Island at the date of death. The property must actually be taxed by another state and the tax

must qualify for the federal credit for state death taxes.

Rhode Island Gross Estate for a decedent domiciled outside of Rhode Island means the value of real

**

estate and tangible personal property (cars, boats, clothes, jewelry, furniture, etc.) which is located in

Rhode Island at the date of death.

PLEASE NOTE: Bank accounts, stocks, bonds and mortgages are intangible assets and are taxable by

the state in which the decedent was domiciled at the time of death regardless of where the asset was then

located.

Make checks payable to the RI Division of Taxation.

Mail forms and checks to the Rhode Island Division of Taxation

Estate Tax Section

One Capitol Hill

Providence, RI 02908-5800

Revised 01/10/2014

1

1 2

2