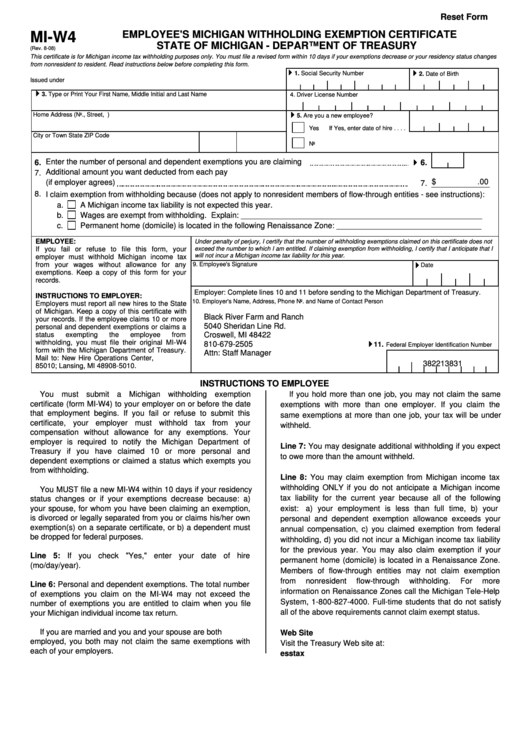

Reset Form

EMPLOYEE'S MICHIGAN WITHHOLDING EXEMPTION CERTIFICATE

MI-W4

STATE OF MICHIGAN - DEPARTMENT OF TREASURY

(Rev. 8-08)

This certificate is for Michigan income tax withholding purposes only. You must file a revised form within 10 days if your exemptions decrease or your residency status changes

from nonresident to resident. Read instructions below before completing this form.

1. Social Security Number

2. Date of Birth

Issued under P.A. 281 of 1967.

3. Type or Print Your First Name, Middle Initial and Last Name

4. Driver License Number

Home Address (No., Street, P.O. Box or Rural Route)

5. Are you a new employee?

Yes

If Yes, enter date of hire . . . .

City or Town

State

ZIP Code

No

Enter the number of personal and dependent exemptions you are claiming

6.

6.

Additional amount you want deducted from each pay

7.

$

.00

(if employer agrees)

7.

8.

I claim exemption from withholding because (does not apply to nonresident members of flow-through entities - see instructions):

a.

A Michigan income tax liability is not expected this year.

b.

Wages are exempt from withholding. Explain: _______________________________________________________

c.

Permanent home (domicile) is located in the following Renaissance Zone: _________________________________

EMPLOYEE:

Under penalty of perjury, I certify that the number of withholding exemptions claimed on this certificate does not

If you fail or refuse to file this form, your

exceed the number to which I am entitled. If claiming exemption from withholding, I certify that I anticipate that I

will not incur a Michigan income tax liability for this year.

employer must withhold Michigan income tax

9. Employee's Signature

from your wages without allowance for any

Date

exemptions. Keep a copy of this form for your

records.

Employer: Complete lines 10 and 11 before sending to the Michigan Department of Treasury.

INSTRUCTIONS TO EMPLOYER:

10. Employer's Name, Address, Phone No. and Name of Contact Person

Employers must report all new hires to the State

of Michigan. Keep a copy of this certificate with

Black River Farm and Ranch

your records. If the employee claims 10 or more

5040 Sheridan Line Rd.

personal and dependent exemptions or claims a

status

exempting

the

employee

from

Croswell, MI 48422

withholding, you must file their original MI-W4

810-679-2505

11.

Federal Employer Identification Number

form with the Michigan Department of Treasury.

Attn: Staff Manager

Mail to: New Hire Operations Center, P.O. Box

382213831

85010; Lansing, MI 48908-5010.

INSTRUCTIONS TO EMPLOYEE

You must submit a Michigan withholding exemption

If you hold more than one job, you may not claim the same

certificate (form MI-W4) to your employer on or before the date

exemptions with more than one employer. If you claim the

that employment begins. If you fail or refuse to submit this

same exemptions at more than one job, your tax will be under

certificate, your employer must withhold tax from your

withheld.

compensation without allowance for any exemptions. Your

employer is required to notify the Michigan Department of

Line 7: You may designate additional withholding if you expect

Treasury if you have claimed 10 or more personal and

to owe more than the amount withheld.

dependent exemptions or claimed a status which exempts you

from withholding.

Line 8: You may claim exemption from Michigan income tax

withholding ONLY if you do not anticipate a Michigan income

You MUST file a new MI-W4 within 10 days if your residency

tax liability for the current year because all of the following

status changes or if your exemptions decrease because: a)

your spouse, for whom you have been claiming an exemption,

exist:

a) your employment is less than full time, b) your

is divorced or legally separated from you or claims his/her own

personal and dependent exemption allowance exceeds your

exemption(s) on a separate certificate, or b) a dependent must

annual compensation, c) you claimed exemption from federal

be dropped for federal purposes.

withholding, d) you did not incur a Michigan income tax liability

for the previous year. You may also claim exemption if your

Line 5: If you check "Yes," enter your date of hire

permanent home (domicile) is located in a Renaissance Zone.

(mo/day/year).

Members of flow-through entities may not claim exemption

from

nonresident

flow-through

withholding.

For

more

Line 6: Personal and dependent exemptions. The total number

information on Renaissance Zones call the Michigan Tele-Help

of exemptions you claim on the MI-W4 may not exceed the

System, 1-800-827-4000. Full-time students that do not satisfy

number of exemptions you are entitled to claim when you file

all of the above requirements cannot claim exempt status.

your Michigan individual income tax return.

If you are married and you and your spouse are both

Web Site

employed, you both may not claim the same exemptions with

Visit the Treasury Web site at:

each of your employers.

1

1