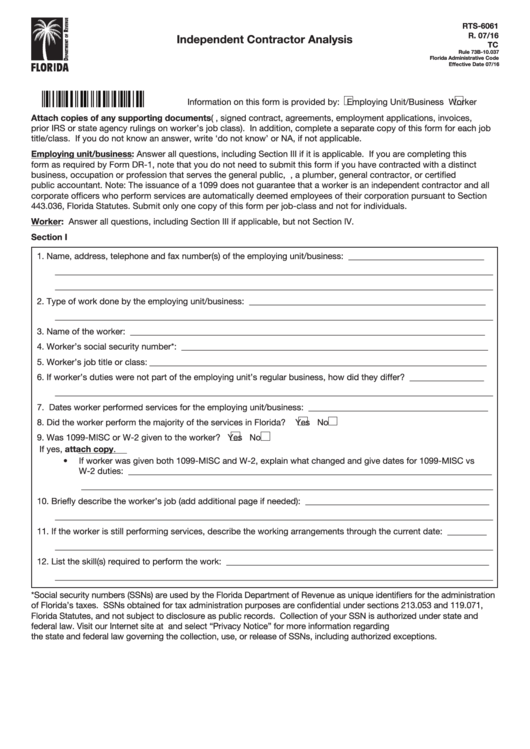

Independent Contractor Analysis - Florida Department Of Revenue

ADVERTISEMENT

RTS-6061

R. 07/16

Independent Contractor Analysis

TC

Rule 73B-10.037

Florida Administrative Code

Effective Date 07/16

Information on this form is provided by:

Employing Unit/Business

Worker

Attach copies of any supporting documents (e.g., signed contract, agreements, employment applications, invoices,

prior IRS or state agency rulings on worker’s job class). In addition, complete a separate copy of this form for each job

title/class. If you do not know an answer, write ‘do not know’ or NA, if not applicable.

Employing unit/business: Answer all questions, including Section III if it is applicable. If you are completing this

form as required by Form DR-1, note that you do not need to submit this form if you have contracted with a distinct

business, occupation or profession that serves the general public, e.g., a plumber, general contractor, or certified

public accountant. Note: The issuance of a 1099 does not guarantee that a worker is an independent contractor and all

corporate officers who perform services are automatically deemed employees of their corporation pursuant to Section

443.036, Florida Statutes. Submit only one copy of this form per job-class and not for individuals.

Worker: Answer all questions, including Section III if applicable, but not Section IV.

Section I

1. Name, address, telephone and fax number(s) of the employing unit/business: _______________________________

____________________________________________________________________________________________________

____________________________________________________________________________________________________

2. Type of work done by the employing unit/business: ______________________________________________________

____________________________________________________________________________________________________

3. Name of the worker: _________________________________________________________________________________

4. Worker’s social security number*: ______________________________________________________________________

5. Worker’s job title or class: _____________________________________________________________________________

6. If worker’s duties were not part of the employing unit’s regular business, how did they differ? _________________

____________________________________________________________________________________________________

7. Dates worker performed services for the employing unit/business: _________________________________________

8. Did the worker perform the majority of the services in Florida?

Yes

No

9. Was 1099-MISC or W-2 given to the worker?

Yes

No

If yes, attach copy.

• If worker was given both 1099-MISC and W-2, explain what changed and give dates for 1099-MISC vs

W-2 duties: ___________________________________________________________________________________

______________________________________________________________________________________________

10. Briefly describe the worker’s job (add additional page if needed): __________________________________________

____________________________________________________________________________________________________

11. If the worker is still performing services, describe the working arrangements through the current date: _________

____________________________________________________________________________________________________

12. List the skill(s) required to perform the work: ____________________________________________________________

____________________________________________________________________________________________________

*Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identifiers for the administration

of Florida’s taxes. SSNs obtained for tax administration purposes are confidential under sections 213.053 and 119.071,

Florida Statutes, and not subject to disclosure as public records. Collection of your SSN is authorized under state and

federal law. Visit our Internet site at and select “Privacy Notice” for more information regarding

the state and federal law governing the collection, use, or release of SSNs, including authorized exceptions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3