Ⓣ (801) 224-1900

Ⓕ (801) 224-1930

Ⓦ

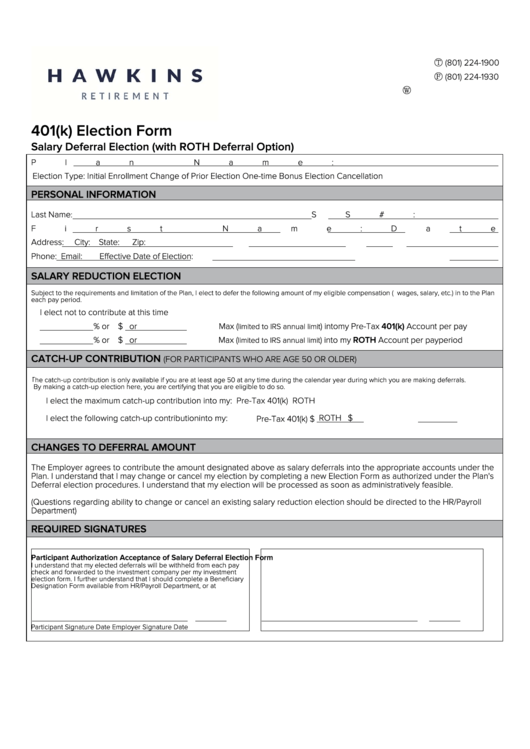

401(k) Election Form

Salary Deferral Election (with ROTH Deferral Option)

Plan Name:

Election Type:

Initial Enrollment

Change of Prior Election

One-time Bonus Election

Cancellation

PERSONAL INFORMATION

Last Name

SS#:

:

First Name:

Date of Birth:

Date of Hire:

Address:

City:

State:

Zip:

Phone:

Email:

Effective Date of Election:

SALARY REDUCTION ELECTION

Subject to the requirements and limitation of the Plan, I elect to defer the following amount of my eligible compensation (i.e. wages, salary, etc.) in to the Plan

each pay period.

I elect not to contribute at this time

% or

$

or

Max (

) into my Pre-Tax 401(k) Account per pay

limited to IRS annual limit

% or

$

or

Max (

) into my ROTH Account per pay period

limited to IRS annual limit

CATCH-UP CONTRIBUTION

(FOR PARTICIPANTS WHO ARE AGE 50 OR OLDER)

The catch-up contribution is only available if you are at least age 50 at any time during the calendar year during which you are making deferrals.

By making a catch-up election here, you are certifying that you are eligible to do so.

I elect the maximum catch-up contribution into my:

Pre-Tax 401(k)

ROTH

ROTH $

I elect the following catch-up contribution into my:

Pre-Tax 401(k) $

CHANGES TO DEFERRAL AMOUNT

The Employer agrees to contribute the amount designated above as salary deferrals into the appropriate accounts under the

Plan. I understand that I may change or cancel my election by completing a new Election Form as authorized under the Plan's

Deferral election procedures. I understand that my election will be processed as soon as administratively feasible.

(Questions regarding ability to change or cancel an existing salary reduction election should be directed to the HR/Payroll

Department)

REQUIRED SIGNATURES

Participant Authorization

Acceptance of Salary Deferral Election Form

I understand that my elected deferrals will be withheld from each pay

check and forwarded to the investment company per my investment

election form. I further understand that I should complete a Beneficiary

Designation Form available from HR/Payroll Department, or at

Participant Signature

Date

Employer Signature

Date

1

1