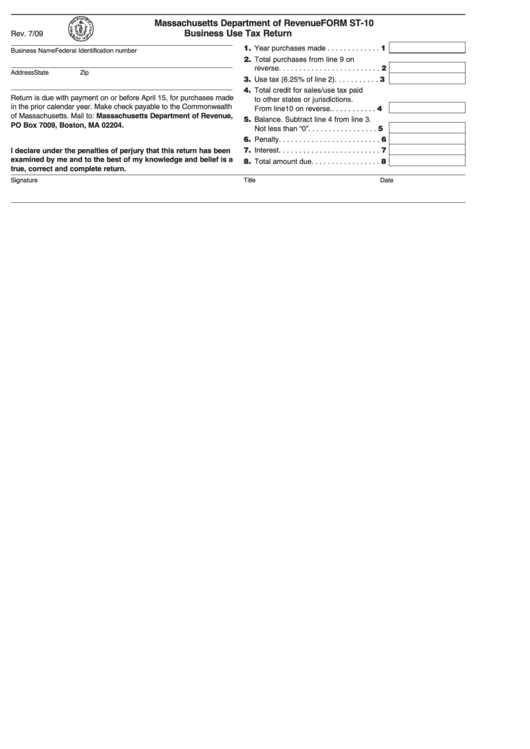

Massachusetts Department Of Revenue Form St-10 Rev. 7/09 Business Use Tax Return

ADVERTISEMENT

FORM ST-10

Massachusetts Department of Revenue

Business Use Tax Return

Rev. 7/09

1. Year purchases made . . . . . . . . . . . . . 1

Business Name

Federal Identification number

2. Total purchases from line 9 on

reverse. . . . . . . . . . . . . . . . . . . . . . . . . 2

Address

State

Zip

3. Use tax (6.25% of line 2). . . . . . . . . . . 3

4. Total credit for sales/use tax paid

Return is due with payment on or before April 15, for purchases made

to other states or jurisdictions.

in the prior calendar year. Make check payable to the Commonwealth

From line 10 on reverse. . . . . . . . . . . . 4

of Massachusetts. Mail to: Massachusetts Department of Revenue,

5. Balance. Subtract line 4 from line 3.

PO Box 7009, Boston, MA 02204.

Not less than “0” . . . . . . . . . . . . . . . . . 5

6. Penalty. . . . . . . . . . . . . . . . . . . . . . . . . 6

7. Interest. . . . . . . . . . . . . . . . . . . . . . . . . 7

I declare under the penalties of perjury that this return has been

examined by me and to the best of my knowledge and belief is a

8. Total amount due. . . . . . . . . . . . . . . . . 8

true, correct and complete return.

Signature

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2