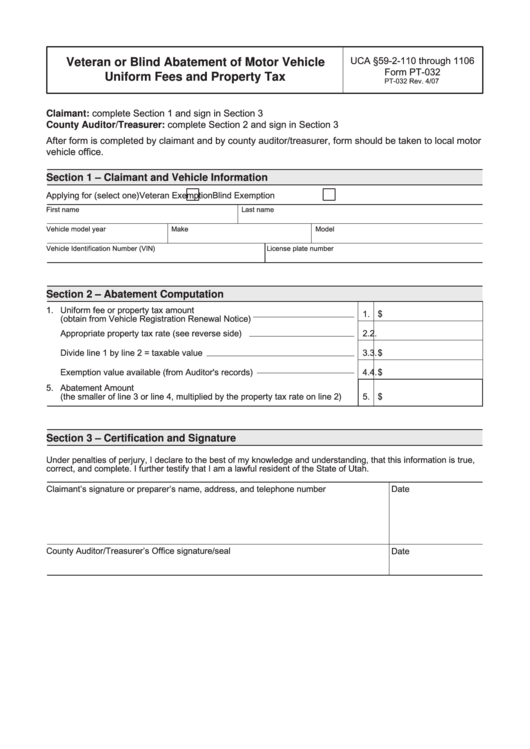

Pt-32, Veteran Or Blind Abatement Of Motor Vehicle Uniform Fees And Property Tax

ADVERTISEMENT

UCA §59-2-110 through 1106

Veteran or Blind Abatement of Motor Vehicle

Form PT-032

Uniform Fees and Property Tax

PT-032 Rev. 4/07

Claimant: complete Section 1 and sign in Section 3

County Auditor/Treasurer: complete Section 2 and sign in Section 3

After form is completed by claimant and by county auditor/treasurer, form should be taken to local motor

vehicle office.

Section 1 – Claimant and Vehicle Information

Applying for (select one)

Veteran Exemption

Blind Exemption

First name

Last name

Vehicle model year

Make

Model

Vehicle Identification Number (VIN)

License plate number

Section 2 – Abatement Computation

1.

Uniform fee or property tax amount

1.

$

(obtain from Vehicle Registration Renewal Notice)

2.

Appropriate property tax rate (see reverse side)

2.

3.

Divide line 1 by line 2 = taxable value

3.

$

4.

Exemption value available (from Auditor's records)

4.

$

5.

Abatement Amount

(the smaller of line 3 or line 4, multiplied by the property tax rate on line 2)

5.

$

Section 3 – Certification and Signature

Under penalties of perjury, I declare to the best of my knowledge and understanding, that this information is true,

correct, and complete. I further testify that I am a lawful resident of the State of Utah.

Claimant’s signature or preparer’s name, address, and telephone number

Date

County Auditor/Treasurer’s Office signature/seal

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2