Form 3698, 2010, Resident Fund Surety Bond

ADVERTISEMENT

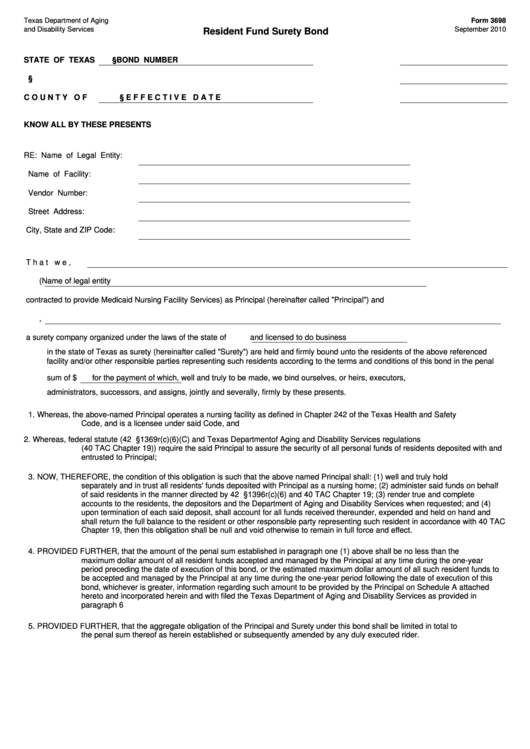

Texas Department of Aging

Form 3698

and Disability Services

September 2010

Resident Fund Surety Bond

STATE OF TEXAS

§ BOND NUMBER

§

COUNTY OF

§ EFFECTIVE DATE

KNOW ALL BY THESE PRESENTS

RE:

Name of Legal Entity:

Name of Facility:

Vendor Number:

Street Address:

City, State and ZIP Code:

That we,

(Name of legal entity

contracted to provide Medicaid Nursing Facility Services) as Principal (hereinafter called "Principal") and

,

a surety company organized under the laws of the state of

and licensed to do business

in the state of Texas as surety (hereinafter called "Surety") are held and firmly bound unto the residents of the above referenced

facility and/or other responsible parties representing such residents according to the terms and conditions of this bond in the penal

sum of $

for the payment of which, well and truly to be made, we bind ourselves, or heirs, executors,

administrators, successors, and assigns, jointly and severally, firmly by these presents.

1.

Whereas, the above-named Principal operates a nursing facility as defined in Chapter 242 of the Texas Health and Safety

Code, and is a licensee under said Code, and

2.

Whereas, federal statute (42 U.S.C.A. §1369r(c)(6)(C) and Texas Department of Aging and Disability Services regulations

(40 TAC Chapter 19)) require the said Principal to assure the security of all personal funds of residents deposited with and

entrusted to Principal;

3.

NOW, THEREFORE, the condition of this obligation is such that the above named Principal shall: (1) well and truly hold

separately and in trust all residents' funds deposited with Principal as a nursing home; (2) administer said funds on behalf

of said residents in the manner directed by 42 U.S.C.A. §1396r(c)(6) and 40 TAC Chapter 19; (3) render true and complete

accounts to the residents, the depositors and the Department of Aging and Disability Services when requested; and (4)

upon termination of each said deposit, shall account for all funds received thereunder, expended and held on hand and

shall return the full balance to the resident or other responsible party representing such resident in accordance with 40 TAC

Chapter 19, then this obligation shall be null and void otherwise to remain in full force and effect.

4.

PROVIDED FURTHER, that the amount of the penal sum established in paragraph one (1) above shall be no less than the

maximum dollar amount of all resident funds accepted and managed by the Principal at any time during the one-year

period preceding the date of execution of this bond, or the estimated maximum dollar amount of all such resident funds to

be accepted and managed by the Principal at any time during the one-year period following the date of execution of this

bond, whichever is greater, information regarding such amount to be provided by the Principal on Schedule A attached

hereto and incorporated herein and with filed the Texas Department of Aging and Disability Services as provided in

paragraph 6

5.

PROVIDED FURTHER, that the aggregate obligation of the Principal and Surety under this bond shall be limited in total to

the penal sum thereof as herein established or subsequently amended by any duly executed rider.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3