Instructions For The Preparation Of The Tennessee Sales And Use Tax Return

ADVERTISEMENT

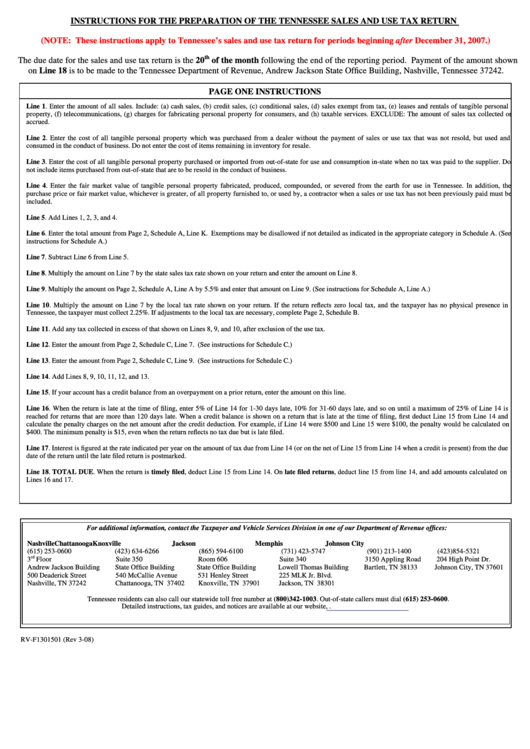

INSTRUCTIONS FOR THE PREPARATION OF THE TENNESSEE SALES AND USE TAX RETURN

(NOTE: These instructions apply to Tennessee’s sales and use tax return for periods beginning after December 31, 2007.)

th

The due date for the sales and use tax return is the 20

of the month following the end of the reporting period. Payment of the amount shown

on Line 18 is to be made to the Tennessee Department of Revenue, Andrew Jackson State Office Building, Nashville, Tennessee 37242.

PAGE ONE INSTRUCTIONS

Line 1. Enter the amount of all sales. Include: (a) cash sales, (b) credit sales, (c) conditional sales, (d) sales exempt from tax, (e) leases and rentals of tangible personal

property, (f) telecommunications, (g) charges for fabricating personal property for consumers, and (h) taxable services. EXCLUDE: The amount of sales tax collected or

accrued.

Line 2. Enter the cost of all tangible personal property which was purchased from a dealer without the payment of sales or use tax that was not resold, but used and

consumed in the conduct of business. Do not enter the cost of items remaining in inventory for resale.

Line 3. Enter the cost of all tangible personal property purchased or imported from out-of-state for use and consumption in-state when no tax was paid to the supplier. Do

not include items purchased from out-of-state that are to be resold in the conduct of business.

Line 4. Enter the fair market value of tangible personal property fabricated, produced, compounded, or severed from the earth for use in Tennessee. In addition, the

purchase price or fair market value, whichever is greater, of all property furnished to, or used by, a contractor when a sales or use tax has not been previously paid must be

included.

Line 5. Add Lines 1, 2, 3, and 4.

Line 6. Enter the total amount from Page 2, Schedule A, Line K. Exemptions may be disallowed if not detailed as indicated in the appropriate category in Schedule A. (See

instructions for Schedule A.)

Line 7. Subtract Line 6 from Line 5.

Line 8. Multiply the amount on Line 7 by the state sales tax rate shown on your return and enter the amount on Line 8.

Line 9. Multiply the amount on Page 2, Schedule A, Line A by 5.5% and enter that amount on Line 9. (See instructions for Schedule A, Line A.)

Line 10. Multiply the amount on Line 7 by the local tax rate shown on your return. If the return reflects zero local tax, and the taxpayer has no physical presence in

Tennessee, the taxpayer must collect 2.25%. If adjustments to the local tax are necessary, complete Page 2, Schedule B.

Line 11. Add any tax collected in excess of that shown on Lines 8, 9, and 10, after exclusion of the use tax.

Line 12. Enter the amount from Page 2, Schedule C, Line 7. (See instructions for Schedule C.)

Line 13. Enter the amount from Page 2, Schedule C, Line 9. (See instructions for Schedule C.)

Line 14. Add Lines 8, 9, 10, 11, 12, and 13.

Line 15. If your account has a credit balance from an overpayment on a prior return, enter the amount on this line.

Line 16. When the return is late at the time of filing, enter 5% of Line 14 for 1-30 days late, 10% for 31-60 days late, and so on until a maximum of 25% of Line 14 is

reached for returns that are more than 120 days late. When a credit balance is shown on a return that is late at the time of filing, first deduct Line 15 from Line 14 and

calculate the penalty charges on the net amount after the credit deduction. For example, if Line 14 were $500 and Line 15 were $100, the penalty would be calculated on

$400. The minimum penalty is $15, even when the return reflects no tax due but is late filed.

Line 17. Interest is figured at the rate indicated per year on the amount of tax due from Line 14 (or on the net of Line 15 from Line 14 when a credit is present) from the due

date of the return until the late filed return is postmarked.

Line 18. TOTAL DUE. When the return is timely filed, deduct Line 15 from Line 14. On late filed returns, deduct line 15 from line 14, and add amounts calculated on

Lines 16 and 17.

For additional information, contact the Taxpayer and Vehicle Services Division in one of our Department of Revenue offices:

Nashville

Chattanooga

Knoxville

Jackson

Memphis

Johnson City

(615) 253-0600

(423) 634-6266

(865) 594-6100

(731) 423-5747

(901) 213-1400

(423)854-5321

rd

3

Floor

Suite 350

Room 606

Suite 340

3150 Appling Road

204 High Point Dr.

Andrew Jackson Building

State Office Building

State Office Building

Lowell Thomas Building

Bartlett, TN 38133

Johnson City, TN 37601

500 Deaderick Street

540 McCallie Avenue

531 Henley Street

225 MLK Jr. Blvd.

Nashville, TN 37242

Chattanooga, TN 37402

Knoxville, TN 37901

Jackson, TN 38301

Tennessee residents can also call our statewide toll free number at (800)342-1003. Out-of-state callers must dial (615) 253-0600.

Detailed instructions, tax guides, and notices are available at our website,

RV-F1301501 (Rev 3-08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2