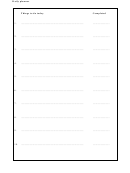

Christmas Planner Template With Survival Guide

ADVERTISEMENT

Guide to Surviving Christmas

It’s that time of year again, when the

8. If you have been able to put aside a few euro

over the year to meet the cost of Christmas, well

evenings draw early, there’s frost in

done. Will it be enough to cover the costs you

the air and glittery ads are on the

planned for?

telly. Yes, Christmas is coming… If

9. If you have not been able to put aside any

the thought of Christmas makes you

money, or if what you have saved is not enough,

shiver when you think of how much

then you have a choice; either you cut the

amount you intend to spend again, until your

it’s going to cost, then take a breath

savings can cover it, or you may decide to

and a moment to think. It is easy to

borrow.

get caught up in the moment, which

10. Try not to build your plans on the basis of a

is why it’s so important that you

bonus or overtime payment, or any other payment

take control of your finances when

that you are not absolutely certain you will get –

you can. Remember, if you are the

only count the money you can rely on getting.

person who keeps track of the

11. Smart Shopping

money in your household, you de-

• Try to get the best value you can when shopping

serve a Christmas too – don’t turn it

for gifts – look for offers in the shops, three-for-

two deals and so on, but remember the value is

into a nightmare.

only there if you actually need the three items.

• Stick to cash – you will spend less than using

The 12 steps of Christmas

debit and credit cards.

1. Make a list of what you need to buy for

• Keep the receipts in case something needs to

Christmas. Divide it into gifts, food, clothes and

be exchanged.

socialising. Use our Christmas planner to help.

• Work from a list to avoid unplanned, impulse

2. Prioritise – if you had a limited amount of money,

shopping.

what could you cut from that list? Work your

way through, numbering items in order of

• Leave the children at home.

importance.

• Remember the shops only close for one or two

3. Try to estimate how much money you expect to

days, so there is no need to stock up on food.

spend on each of these items. What does it

add up to ?

12. Borrowing

If you really believe borrowing is your only option,

4. Is it a very large figure? If the number makes

then remember these points:

your eyes bulge, look at each individual item

• Only borrow what you truly need and not once

again. How can you reduce the cost?

cent more

5. What does it add up to now? Is that a better

• Try to make sure you can pay back this loan

figure?

before the middle of next year, if at all possible,

otherwise it makes it difficult for save for next

6. Keep going with this until you get to a number

Christmas.

you can live with – it is important to be honest

with yourself.

• Find out what the weekly or monthly repayments

are going to be and see how this will affect your

7. This is the amount of money you have decided

budget next year – can you afford that amount,

you NEED for Christmas.

and still pay your regular bills and expenses?

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Life

1

1 2

2