Retirement Plan Loan Request Form

Download a blank fillable Retirement Plan Loan Request Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Retirement Plan Loan Request Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

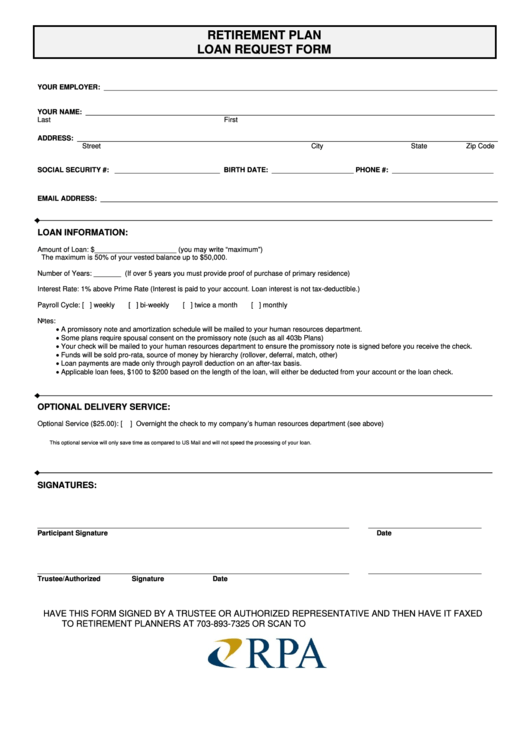

RETIREMENT PLAN

LOAN REQUEST FORM

YOUR EMPLOYER: _____________________________________________________________________________________________________

YOUR NAME: _________________________________________________________________________________________________________

Last

First

M.I.

ADDRESS: ____________________________________________________________________________________________________________

Street

City

State

Zip Code

SOCIAL SECURITY #: ___________________________ BIRTH DATE: _____________________ PHONE #: __________________________

EMAIL ADDRESS: ______________________________________________________________________________________________________

LOAN INFORMATION:

Amount of Loan:

$_____________________ (you may write “maximum”)

The maximum is 50% of your vested balance up to $50,000.

Number of Years:

_______ (If over 5 years you must provide proof of purchase of primary residence)

Interest Rate:

1% above Prime Rate (Interest is paid to your account. Loan interest is not tax-deductible.)

Payroll Cycle:

[ ] weekly

[ ] bi-weekly

[ ] twice a month

[ ] monthly

Notes:

A promissory note and amortization schedule will be mailed to your human resources department.

Some plans require spousal consent on the promissory note (such as all 403b Plans)

Your check will be mailed to your human resources department to ensure the promissory note is signed before you receive the check.

Funds will be sold pro-rata, source of money by hierarchy (rollover, deferral, match, other)

Loan payments are made only through payroll deduction on an after-tax basis.

Applicable loan fees, $100 to $200 based on the length of the loan, will either be deducted from your account or the loan check.

OPTIONAL DELIVERY SERVICE:

Optional Service ($25.00):

[

] Overnight the check to my company’s human resources department (see above)

This optional service will only save time as compared to US Mail and will not speed the processing of your loan.

SIGNATURES:

________________________________________________________________________________

_____________________________

Participant Signature

Date

________________________________________________________________________________

_____________________________

Trustee/Authorized Signature

Date

HAVE THIS FORM SIGNED BY A TRUSTEE OR AUTHORIZED REPRESENTATIVE AND THEN HAVE IT FAXED

TO RETIREMENT PLANNERS AT 703-893-7325 OR SCAN TO

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1