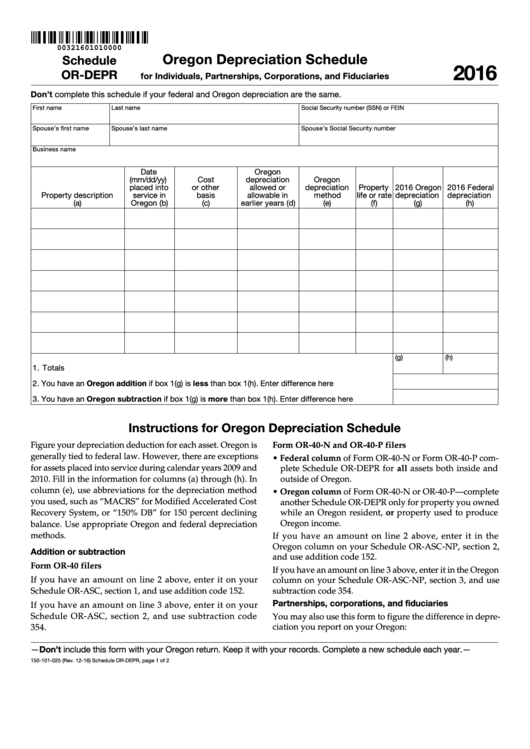

Clear Form

00321601010000

Oregon Depreciation Schedule

Schedule

2016

OR-DEPR

for Individuals, Partnerships, Corporations, and Fiduciaries

Don’t complete this schedule if your federal and Oregon depreciation are the same.

First name

Last name

Social Security number (SSN) or FEIN

Spouse’s first name

Spouse’s last name

Spouse’s Social Security number

Business name

Date

Oregon

(mm/dd/yy)

Cost

depreciation

Oregon

placed into

or other

allowed or

depreciation

Property

2016 Oregon

2016 Federal

Property description

service in

basis

allowable in

method

life or rate

depreciation

depreciation

(a)

Oregon (b)

(c)

earlier years (d)

(e)

(f)

(g)

(h)

(g)

(h)

1. Totals ..................................................................................................................................................... 1

2. You have an Oregon addition if box 1(g) is less than box 1(h). Enter difference here ....................... 2

3. You have an Oregon subtraction if box 1(g) is more than box 1(h). Enter difference here ............... 3

Instructions for Oregon Depreciation Schedule

Figure your depreciation deduction for each asset. Oregon is

Form OR-40-N and OR-40-P filers

generally tied to federal law. However, there are exceptions

• Federal column of Form OR-40-N or Form OR-40-P com-

for assets placed into service during calendar years 2009 and

plete Schedule OR-DEPR for all assets both inside and

2010. Fill in the information for columns (a) through (h). In

outside of Oregon.

column (e), use abbreviations for the depreciation method

• Oregon column of Form OR-40-N or OR-40-P—complete

you used, such as “MACRS” for Modified Accelerated Cost

another Schedule OR-DEPR only for property you owned

while an Oregon resident, or property used to produce

Recovery System, or “150% DB” for 150 percent declining

Oregon income.

balance. Use appropriate Oregon and federal depreciation

methods.

If you have an amount on line 2 above, enter it in the

Oregon column on your Schedule OR-ASC-NP, section 2,

Addition or subtraction

and use addition code 152.

Form OR-40 filers

If you have an amount on line 3 above, enter it in the Oregon

If you have an amount on line 2 above, enter it on your

column on your Schedule OR-ASC-NP, section 3, and use

subtraction code 354.

Schedule OR-ASC, section 1, and use addition code 152.

Partnerships, corporations, and fiduciaries

If you have an amount on line 3 above, enter it on your

Schedule OR-ASC, section 2, and use subtraction code

You may also use this form to figure the difference in depre-

354.

ciation you report on your Oregon:

—Don’t include this form with your Oregon return. Keep it with your records. Complete a new schedule each year.—

150-101-025 (Rev. 12-16)

Schedule OR-DEPR, page 1 of 2

1

1 2

2