Post-Separation Vacation Payout Deferral Election Form - State Of Hawaii

ADVERTISEMENT

209

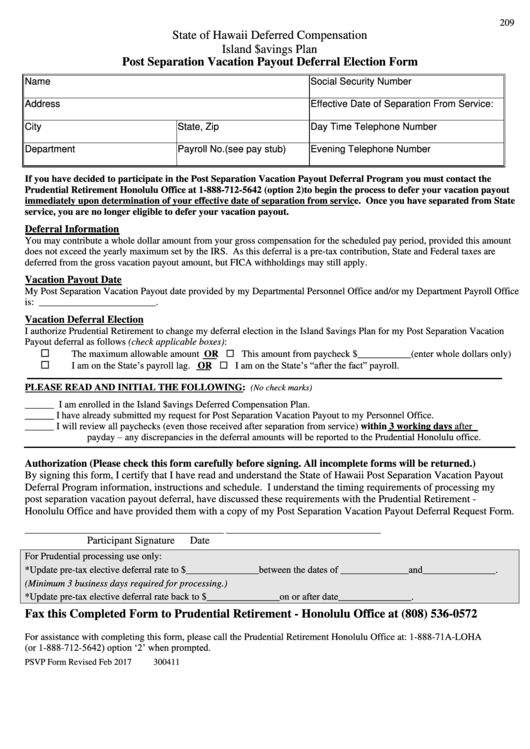

State of Hawaii Deferred Compensation

Island $avings Plan

Post Separation Vacation Payout Deferral Election Form

Name

Social Security Number

Address

Effective Date of Separation From Service:

City

State, Zip

Day Time Telephone Number

Department

Payroll No.(see pay stub)

Evening Telephone Number

If you have decided to participate in the Post Separation Vacation Payout Deferral Program you must contact the

Prudential Retirement Honolulu Office at 1-888-712-5642 (option 2)to begin the process to defer your vacation payout

immediately upon determination of your effective date of separation from service. Once you have separated from State

service, you are no longer eligible to defer your vacation payout.

Deferral Information

You may contribute a whole dollar amount from your gross compensation for the scheduled pay period, provided this amount

does not exceed the yearly maximum set by the IRS. As this deferral is a pre-tax contribution, State and Federal taxes are

deferred from the gross vacation payout amount, but FICA withholdings may still apply.

Vacation Payout Date

My Post Separation Vacation Payout date provided by my Departmental Personnel Office and/or my Department Payroll Office

is: ________________________.

Vacation Deferral Election

I authorize Prudential Retirement to change my deferral election in the Island $avings Plan for my Post Separation Vacation

Payout deferral as follows (check applicable boxes):

The maximum allowable amount OR This amount from paycheck $___________(enter whole dollars only)

I am on the State’s payroll lag. OR I am on the State’s “after the fact” payroll.

PLEASE READ AND INITIAL THE FOLLOWING:

(No check marks)

______

I am enrolled in the Island $avings Deferred Compensation Plan.

______

I have already submitted my request for Post Separation Vacation Payout to my Personnel Office.

______

I will review all paychecks (even those received after separation from service) within 3 working days after

payday – any discrepancies in the deferral amounts will be reported to the Prudential Honolulu office.

Authorization (Please check this form carefully before signing. All incomplete forms will be returned.)

By signing this form, I certify that I have read and understand the State of Hawaii Post Separation Vacation Payout

Deferral Program information, instructions and schedule. I understand the timing requirements of processing my

post separation vacation payout deferral, have discussed these requirements with the Prudential Retirement -

Honolulu Office and have provided them with a copy of my Post Separation Vacation Payout Deferral Request Form.

_____________________________________________

___________________________________

Participant Signature

Date

For Prudential processing use only:

*Update pre-tax elective deferral rate to $_______________between the dates of ______________and_______________.

(Minimum 3 business days required for processing.)

*Update pre-tax elective deferral rate back to $_______________on or after date_______________.

Fax this Completed Form to Prudential Retirement - Honolulu Office at (808) 536-0572

For assistance with completing this form, please call the Prudential Retirement Honolulu Office at: 1-888-71A-LOHA

(or 1-888-712-5642) option ‘2’ when prompted.

PSVP Form Revised Feb 2017

300411

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1