Agreement To Adopt An Accountable Plan

ADVERTISEMENT

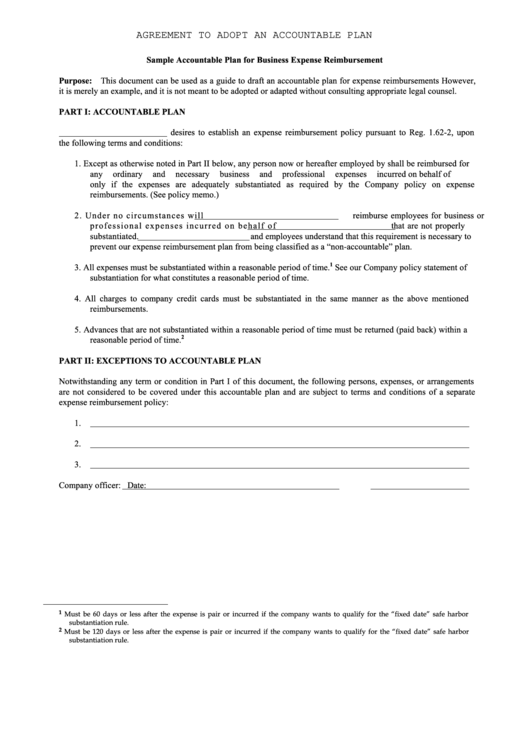

AGREEMENT TO ADOPT AN ACCOUNTABLE PLAN

Sample Accountable Plan for Business Expense Reimbursement

Purpose: This document can be used as a guide to draft an accountable plan for expense reimbursements However,

it is merely an example, and it is not meant to be adopted or adapted without consulting appropriate legal counsel.

PART I: ACCOUNTABLE PLAN

desires to establish an expense reimbursement policy pursuant to Reg. 1.62-2, upon

the following terms and conditions:

1. Except as otherwise noted in Part II below, any person now or hereafter employed by shall be reimbursed for

any

ordinary

and

necessary

business

and

professional

expenses

incurred

on

behalf

of

only if the expenses are adequately substantiated as required by the Company policy on expense

reimbursements. (See policy memo.)

2. Under no circumstances will

reimburse employees for business or

professional expenses incurred on behalf of

that are not properly

substantiated.

and employees understand that this requirement is necessary to

prevent our expense reimbursement plan from being classified as a “non-accountable” plan.

1

3. All expenses must be substantiated within a reasonable period of time.

See our Company policy statement of

substantiation for what constitutes a reasonable period of time.

4. All charges to company credit cards must be substantiated in the same manner as the above mentioned

reimbursements.

5. Advances that are not substantiated within a reasonable period of time must be returned (paid back) within a

2

reasonable period of time.

PART II: EXCEPTIONS TO ACCOUNTABLE PLAN

Notwithstanding any term or condition in Part I of this document, the following persons, expenses, or arrangements

are not considered to be covered under this accountable plan and are subject to terms and conditions of a separate

expense reimbursement policy:

1.

2.

3.

Company officer:

Date:

1

Must be 60 days or less after the expense is pair or incurred if the company wants to qualify for the “fixed date” safe harbor

substantiation rule.

2

Must be 120 days or less after the expense is pair or incurred if the company wants to qualify for the “fixed date” safe harbor

substantiation rule.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1