Instructions For Schedule K-1 (Form 1041) For A Beneficiary Filing Form 1040 - 2015

ADVERTISEMENT

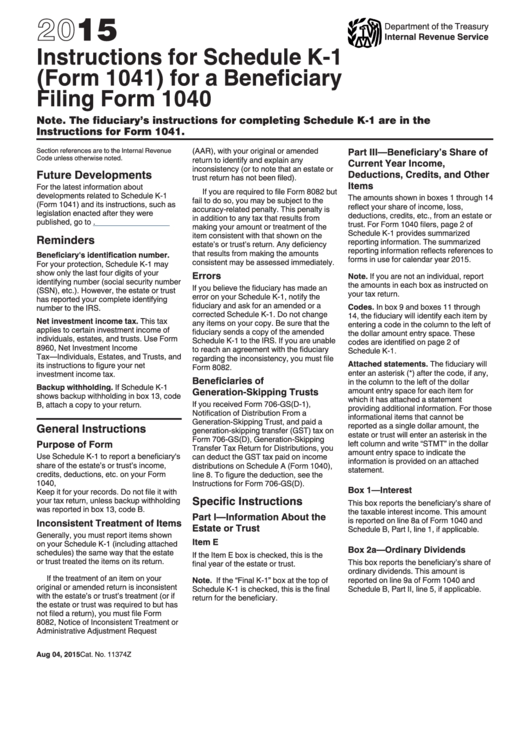

2015

Department of the Treasury

Internal Revenue Service

Instructions for Schedule K-1

(Form 1041) for a Beneficiary

Filing Form 1040

Note. The fiduciary’s instructions for completing Schedule K-1 are in the

Instructions for Form 1041.

Part III—Beneficiary’s Share of

(AAR), with your original or amended

Section references are to the Internal Revenue

Code unless otherwise noted.

return to identify and explain any

Current Year Income,

inconsistency (or to note that an estate or

Future Developments

Deductions, Credits, and Other

trust return has not been filed).

Items

For the latest information about

If you are required to file Form 8082 but

developments related to Schedule K-1

The amounts shown in boxes 1 through 14

fail to do so, you may be subject to the

(Form 1041) and its instructions, such as

reflect your share of income, loss,

accuracy-related penalty. This penalty is

legislation enacted after they were

deductions, credits, etc., from an estate or

in addition to any tax that results from

published, go to

trust. For Form 1040 filers, page 2 of

making your amount or treatment of the

Schedule K-1 provides summarized

item consistent with that shown on the

Reminders

reporting information. The summarized

estate’s or trust’s return. Any deficiency

reporting information reflects references to

that results from making the amounts

Beneficiary's identification number.

forms in use for calendar year 2015.

consistent may be assessed immediately.

For your protection, Schedule K-1 may

show only the last four digits of your

Errors

Note. If you are not an individual, report

identifying number (social security number

the amounts in each box as instructed on

If you believe the fiduciary has made an

(SSN), etc.). However, the estate or trust

your tax return.

error on your Schedule K-1, notify the

has reported your complete identifying

fiduciary and ask for an amended or a

Codes. In box 9 and boxes 11 through

number to the IRS.

corrected Schedule K-1. Do not change

14, the fiduciary will identify each item by

Net investment income tax. This tax

any items on your copy. Be sure that the

entering a code in the column to the left of

applies to certain investment income of

fiduciary sends a copy of the amended

the dollar amount entry space. These

individuals, estates, and trusts. Use Form

Schedule K-1 to the IRS. If you are unable

codes are identified on page 2 of

8960, Net Investment Income

to reach an agreement with the fiduciary

Schedule K-1.

Tax—Individuals, Estates, and Trusts, and

regarding the inconsistency, you must file

Attached statements. The fiduciary will

its instructions to figure your net

Form 8082.

enter an asterisk (*) after the code, if any,

investment income tax.

Beneficiaries of

in the column to the left of the dollar

Backup withholding. If Schedule K-1

amount entry space for each item for

Generation-Skipping Trusts

shows backup withholding in box 13, code

which it has attached a statement

If you received Form 706-GS(D-1),

B, attach a copy to your return.

providing additional information. For those

Notification of Distribution From a

informational items that cannot be

Generation-Skipping Trust, and paid a

General Instructions

reported as a single dollar amount, the

generation-skipping transfer (GST) tax on

estate or trust will enter an asterisk in the

Form 706-GS(D), Generation-Skipping

Purpose of Form

left column and write “STMT” in the dollar

Transfer Tax Return for Distributions, you

amount entry space to indicate the

Use Schedule K-1 to report a beneficiary's

can deduct the GST tax paid on income

information is provided on an attached

share of the estate’s or trust’s income,

distributions on Schedule A (Form 1040),

statement.

credits, deductions, etc. on your Form

line 8. To figure the deduction, see the

1040, U.S. Individual Income Tax Return.

Instructions for Form 706-GS(D).

Box 1—Interest

Keep it for your records. Do not file it with

Specific Instructions

your tax return, unless backup withholding

This box reports the beneficiary’s share of

was reported in box 13, code B.

the taxable interest income. This amount

Part I—Information About the

is reported on line 8a of Form 1040 and

Inconsistent Treatment of Items

Estate or Trust

Schedule B, Part I, line 1, if applicable.

Generally, you must report items shown

Item E

on your Schedule K-1 (including attached

Box 2a—Ordinary Dividends

schedules) the same way that the estate

If the Item E box is checked, this is the

or trust treated the items on its return.

This box reports the beneficiary’s share of

final year of the estate or trust.

ordinary dividends. This amount is

If the treatment of an item on your

reported on line 9a of Form 1040 and

Note. If the “Final K-1” box at the top of

original or amended return is inconsistent

Schedule B, Part II, line 5, if applicable.

Schedule K-1 is checked, this is the final

with the estate’s or trust’s treatment (or if

return for the beneficiary.

the estate or trust was required to but has

not filed a return), you must file Form

8082, Notice of Inconsistent Treatment or

Administrative Adjustment Request

Aug 04, 2015

Cat. No. 11374Z

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3