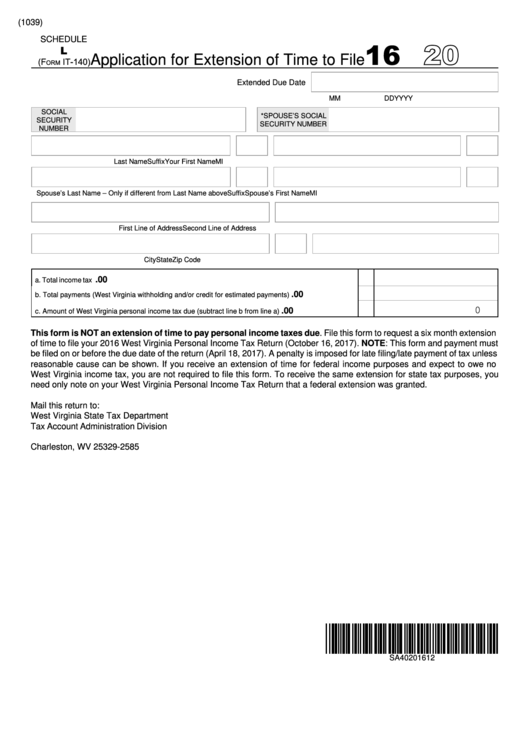

Schedule L Form It-140 - Application For Extension Of Time To File - 2016

ADVERTISEMENT

(1039)

16

SCHEDULE

L

Application for Extension of Time to File

IT-140)

(F

ORM

Extended Due Date

MM

DD

YYYY

SOCIAL

*SPOUSE’S SOCIAL

SECURITY

SECURITY NUMBER

NUMBER

Last Name

Suffix

Your First Name

MI

Spouse’s Last Name – Only if different from Last Name above

Suffix

Spouse’s First Name

MI

First Line of Address

Second Line of Address

City

State

Zip Code

.00

a. Total income tax liability..............................................................................................................................

a.

.00

b. Total payments (West Virginia withholding and/or credit for estimated payments)...................................

b.

0

.00

c. Amount of West Virginia personal income tax due (subtract line b from line a)........................................

c.

This form is NOT an extension of time to pay personal income taxes due. File this form to request a six month extension

of time to file your 2016 West Virginia Personal Income Tax Return (October 16, 2017). NOTE: This form and payment must

be filed on or before the due date of the return (April 18, 2017). A penalty is imposed for late filing/late payment of tax unless

reasonable cause can be shown. If you receive an extension of time for federal income purposes and expect to owe no

West Virginia income tax, you are not required to file this form. To receive the same extension for state tax purposes, you

need only note on your West Virginia Personal Income Tax Return that a federal extension was granted.

Mail this return to:

West Virginia State Tax Department

Tax Account Administration Division

P.O. Box 2585

Charleston, WV 25329-2585

SA40201612

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1