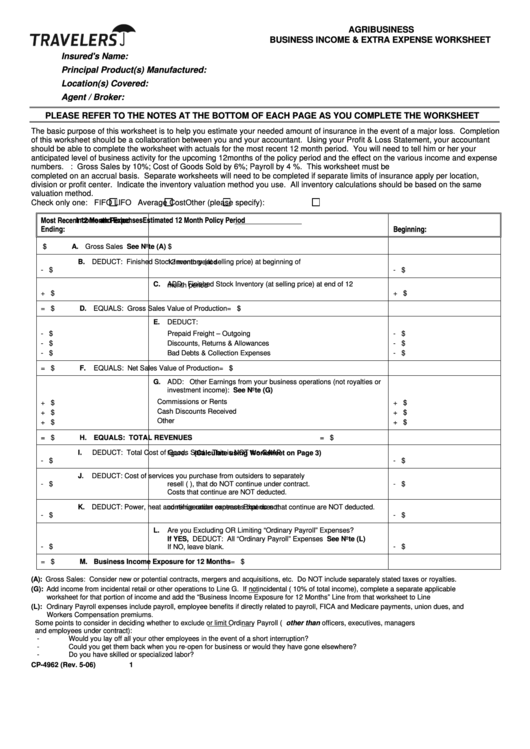

AGRIBUSINESS

BUSINESS INCOME & EXTRA EXPENSE WORKSHEET

Insured's Name:

Principal Product(s) Manufactured:

Location(s) Covered:

Agent / Broker:

PLEASE REFER TO THE NOTES AT THE BOTTOM OF EACH PAGE AS YOU COMPLETE THE WORKSHEET

The basic purpose of this worksheet is to help you estimate your needed amount of insurance in the event of a major loss. Completion

of this worksheet should be a collaboration between you and your accountant. Using your Profit & Loss Statement, your accountant

should be able to complete the worksheet with actuals for the most recent 12 month period. You will need to tell him or her your

anticipated level of business activity for the upcoming 12 months of the policy period and the effect on the various income and expense

numbers. e.g. Increases in the following: Gross Sales by 10%; Cost of Goods Sold by 6%; Payroll by 4 %. This worksheet must be

completed on an accrual basis. Separate worksheets will need to be completed if separate limits of insurance apply per location,

division or profit center. Indicate the inventory valuation method you use. All inventory calculations should be based on the same

valuation method.

Check only one:

FIFO

LIFO

Average Cost

Other (please specify):

Most Recent 12 Month Period

Income and Expenses

Estimated 12 Month Policy Period

Ending:

Beginning:

$

A.

Gross Sales See Note (A)

$

B. DEDUCT: Finished Stock Inventory (at selling price) at beginning of

-

$

12 month period

-

$

C. ADD: Finished Stock Inventory (at selling price) at end of 12

month period

+

$

+

$

D. EQUALS: Gross Sales Value of Production

=

$

=

$

E.

DEDUCT:

-

$

Prepaid Freight – Outgoing

-

$

-

$

Discounts, Returns & Allowances

-

$

-

$

Bad Debts & Collection Expenses

-

$

=

$

F.

EQUALS: Net Sales Value of Production

=

$

G. ADD: Other Earnings from your business operations (not royalties or

investment income): See Note (G)

Commissions or Rents

+

$

+

$

Cash Discounts Received

+

$

+

$

Other

+

$

+

$

=

$

H. EQUALS: TOTAL REVENUES

=

$

I.

DEDUCT: Total Cost of Goods Sold – This is NOT the GAAP

-

$

figure.

(Calculate using Worksheet on Page 3)

-

$

J.

DEDUCT: Cost of services you purchase from outsiders to separately

-

$

resell (e.g. service contracts), that do NOT continue under contract.

-

$

Costs that continue are NOT deducted.

K. DEDUCT: Power, heat and refrigeration expenses that do not

-

$

continue under contract. Expenses that continue are NOT deducted.

-

$

L.

Are you Excluding OR Limiting “Ordinary Payroll” Expenses?

If YES, DEDUCT: All “Ordinary Payroll” Expenses See Note (L)

-

$

-

$

If NO, leave blank.

=

$

M. Business Income Exposure for 12 Months

=

$

(A): Gross Sales: Consider new or potential contracts, mergers and acquisitions, etc. Do NOT include separately stated taxes or royalties.

(G): Add income from incidental retail or other operations to Line G. If not incidental (i.e. more than 10% of total income), complete a separate applicable

worksheet for that portion of income and add the “Business Income Exposure for 12 Months” Line from that worksheet to Line M. of this worksheet.

(L): Ordinary Payroll expenses include payroll, employee benefits if directly related to payroll, FICA and Medicare payments, union dues, and

Workers Compensation premiums.

Some points to consider in deciding whether to exclude or limit Ordinary Payroll ( i.e. other than officers, executives, managers

and employees under contract):

- Would you lay off all your other employees in the event of a short interruption?

- Could you get them back when you re-open for business or would they have gone elsewhere?

- Do you have skilled or specialized labor?

CP-4962 (Rev. 5-06)

1

1

1 2

2 3

3 4

4