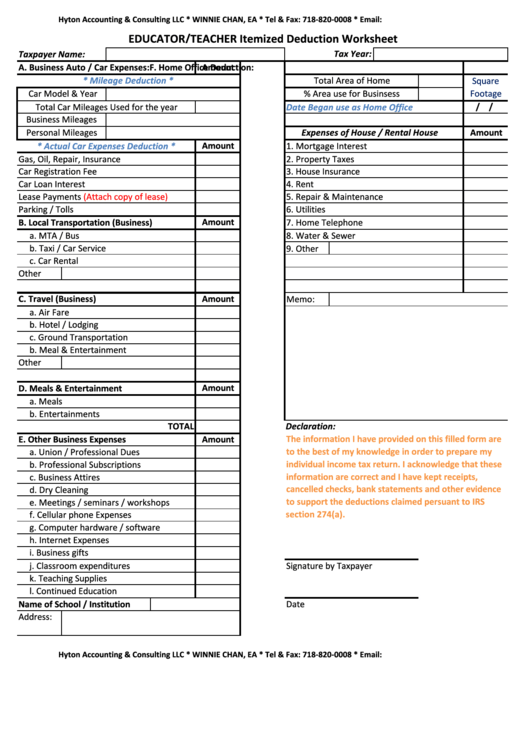

Hyton Accounting & Consulting LLC * WINNIE CHAN, EA * Tel & Fax: 718-820-0008 * Email:

EDUCATOR/TEACHER Itemized Deduction Worksheet

Taxpayer Name:

Tax Year:

Amount

A. Business Auto / Car Expenses:

F. Home Office Deduction:

* Mileage Deduction *

Total Area of Home

Square

Footage

Car Model & Year

% Area use for Businsess

Total Car Mileages Used for the year

Date Began use as Home Office

/ /

Business Mileages

Personal Mileages

Expenses of House / Rental House

Amount

Amount

* Actual Car Expenses Deduction *

1. Mortgage Interest

Gas, Oil, Repair, Insurance

2. Property Taxes

Car Registration Fee

3. House Insurance

Car Loan Interest

4. Rent

Lease Payments

(Attach copy of lease)

5. Repair & Maintenance

Parking / Tolls

6. Utilities

Amount

B. Local Transportation (Business)

7. Home Telephone

a. MTA / Bus

8. Water & Sewer

b. Taxi / Car Service

9. Other

c. Car Rental

Other

Amount

C. Travel (Business)

Memo:

a. Air Fare

b. Hotel / Lodging

c. Ground Transportation

b. Meal & Entertainment

Other

D. Meals & Entertainment

Amount

a. Meals

b. Entertainments

TOTAL

Declaration:

The information I have provided on this filled form are

E. Other Business Expenses

Amount

to the best of my knowledge in order to prepare my

a. Union / Professional Dues

individual income tax return. I acknowledge that these

b. Professional Subscriptions

information are correct and I have kept receipts,

c. Business Attires

cancelled checks, bank statements and other evidence

d. Dry Cleaning

to support the deductions claimed persuant to IRS

e. Meetings / seminars / workshops

section 274(a).

f. Cellular phone Expenses

g. Computer hardware / software

h. Internet Expenses

i. Business gifts

j. Classroom expenditures

Signature by Taxpayer

k. Teaching Supplies

l. Continued Education

Name of School / Institution

Date

Address:

Hyton Accounting & Consulting LLC * WINNIE CHAN, EA * Tel & Fax: 718-820-0008 * Email:

1

1