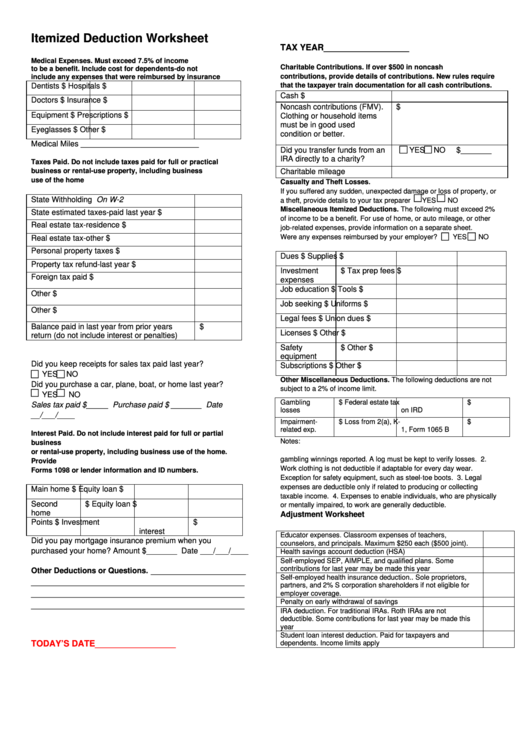

Itemized Deduction Worksheet

ADVERTISEMENT

Itemized Deduction Worksheet

TAX YEAR__________________

Medical Expenses. Must exceed 7.5% of income

Charitable Contributions. If over $500 in noncash

to be a benefit. Include cost for dependents-do not

include any expenses that were reimbursed by insurance

contributions, provide details of contributions. New rules require

Dentists

$

Hospitals

$

that the taxpayer train documentation for all cash contributions.

Cash

$

Doctors

$

Insurance

$

Noncash contributions (FMV).

$

Equipment

$

Prescriptions

$

Clothing or household items

must be in good used

Eyeglasses

$

Other

$

condition or better.

Medical Miles ___________________________

Did you transfer funds from an

YES

NO

$_______

IRA directly to a charity?

Taxes Paid. Do not include taxes paid for full or practical

business or rental-use property, including business

Charitable mileage

use of the home

Casualty and Theft Losses.

If you suffered any sudden, unexpected damage or loss of property, or

On W-2

State Withholding

a theft, provide details to your tax preparer

YES

NO

Miscellaneous Itemized Deductions. The following must exceed 2%

State estimated taxes-paid last year

$

of income to be a benefit. For use of home, or auto mileage, or other

Real estate tax-residence

$

job-related expenses, provide information on a separate sheet.

Were any expenses reimbursed by your employer?

YES

NO

Real estate tax-other

$

Personal property taxes

$

Dues

$

Supplies

$

Property tax refund-last year

$

Investment

$

Tax prep fees

$

Foreign tax paid

$

expenses

Job education

$

Tools

$

Other

$

Job seeking

$

Uniforms

$

Other

$

Legal fees

$

Union dues

$

Balance paid in last year from prior years

$

Licenses

$

Other

$

return (do not include interest or penalties)

Safety

$

Other

$

equipment

Did you keep receipts for sales tax paid last year?

Subscriptions

$

Other

$

YES

NO

Other Miscellaneous Deductions. The following deductions are not

Did you purchase a car, plane, boat, or home last year?

subject to a 2% of income limit.

YES

NO

Gambling

$

Federal estate tax

$

Sales tax paid $_____ Purchase paid $ _______ Date

losses

on IRD

__/___/____

Impairment-

$

Loss from 2(a), K-

$

related exp.

1, Form 1065 B

Interest Paid. Do not include interest paid for full or partial

Notes:

business

1.Gambling losses are deductible only up to the amount of the

or rental-use property, including business use of the home.

gambling winnings reported. A log must be kept to verify losses. 2.

Provide

Work clothing is not deductible if adaptable for every day wear.

Forms 1098 or lender information and ID numbers.

Exception for safety equipment, such as steel-toe boots. 3. Legal

expenses are deductible only if related to producing or collecting

Main home

$

Equity loan

$

taxable income. 4. Expenses to enable individuals, who are physically

Second

$

Equity loan

$

or mentally impaired, to work are generally deductible.

home

Adjustment Worksheet

Points

$

Investment

$

interest

Educator expenses. Classroom expenses of teachers,

Did you pay mortgage insurance premium when you

counselors, and principals. Maximum $250 each ($500 joint).

purchased your home? Amount $_______ Date ___/___/____

Health savings account deduction (HSA)

Self-employed SEP, AIMPLE, and qualified plans. Some

contributions for last year may be made this year

____________________

Other Deductions or Questions.

Self-employed health insurance deduction.. Sole proprietors,

_____________________________________________

partners, and 2% S corporation shareholders if not eligible for

_____________________________________________

employer coverage.

Penalty on early withdrawal of savings

_____________________________________________

IRA deduction. For traditional IRAs. Roth IRAs are not

deductible. Some contributions for last year may be made this

year

Student loan interest deduction. Paid for taxpayers and

TODAY’S DATE_________________

dependents. Income limits apply

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1