Instructions For Schedule W-2 - Alabama Department Of Revenue - 2016

ADVERTISEMENT

I

F

T

P

NSTRUCTIONS

OR

HE

REPARATION OF

A

D

R

LABAMA

EPARTMENT OF

EVENUE

SCHEDULE

Wages, Salaries, Tips, etc.

2016

W 2

INSTRUCTIONS

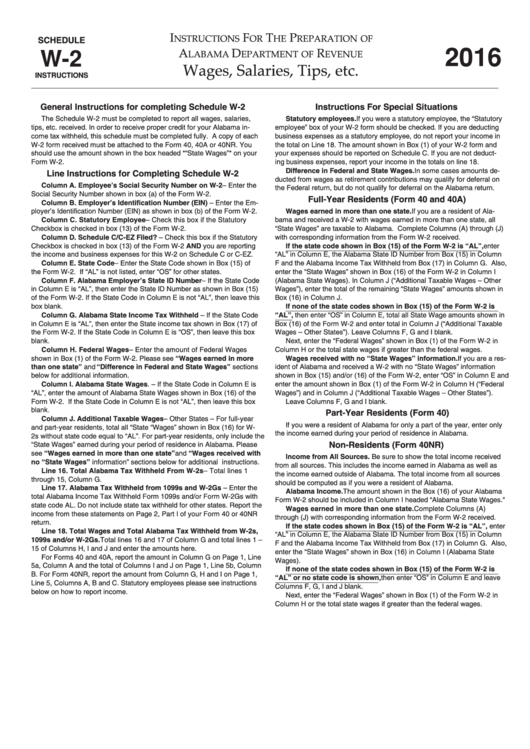

General Instructions for completing Schedule W-2

Instructions For Special Situations

The Schedule W-2 must be completed to report all wages, salaries,

Statutory employees. If you were a statutory employee, the “Statutory

tips, etc. received. In order to receive proper credit for your Alabama in-

employee” box of your W-2 form should be checked. If you are deducting

come tax withheld, this schedule must be completed fully. A copy of each

business expenses as a statutory employee, do not report your income in

W-2 form received must be attached to the Form 40, 40A or 40NR. You

the total on Line 18. The amount shown in Box (1) of your W-2 form and

should use the amount shown in the box headed *“State Wages”* on your

your expenses should be reported on Schedule C. If you are not deduct-

Form W-2.

ing business expenses, report your income in the totals on line 18.

Difference in Federal and State Wages. In some cases amounts de-

Line Instructions for Completing Schedule W-2

ducted from wages as retirement contributions may qualify for deferral on

Column A. Employee’s Social Security Number on W-2 – Enter the

the Federal return, but do not qualify for deferral on the Alabama return.

Social Security Number shown in box (a) of the Form W-2.

Full-Year Residents (Form 40 and 40A)

Column B. Employer’s Identification Number (EIN) – Enter the Em-

ployer’s Identification Number (EIN) as shown in box (b) of the Form W-2.

Wages earned in more than one state. If you are a resident of Ala-

Column C. Statutory Employee – Check this box if the Statutory

bama and received a W-2 with wages earned in more than one state, all

Checkbox is checked in box (13) of the Form W-2.

“State Wages” are taxable to Alabama. Complete Columns (A) through (J)

Column D. Schedule C/C-EZ Filed? – Check this box if the Statutory

with corresponding information from the Form W-2 received.

Checkbox is checked in box (13) of the Form W-2 AND you are reporting

If the state code shown in Box (15) of the Form W-2 is “AL”, enter

the income and business expenses for this W-2 on Schedule C or C-EZ.

“AL” in Column E, the Alabama State ID Number from Box (15) in Column

Column E. State Code – Enter the State Code shown in Box (15) of

F and the Alabama Income Tax Withheld from Box (17) in Column G. Also,

the Form W-2. If “AL” is not listed, enter “OS” for other states.

enter the “State Wages” shown in Box (16) of the Form W-2 in Column I

Column F. Alabama Employer’s State ID Number – If the State Code

(Alabama State Wages). In Column J (“Additional Taxable Wages – Other

in Column E is “AL”, then enter the State ID Number as shown in Box (15)

Wages”), enter the total of the remaining “State Wages” amounts shown in

of the Form W-2. If the State Code in Column E is not “AL”, then leave this

Box (16) in Column J.

box blank.

If none of the state codes shown in Box (15) of the Form W-2 is

Column G. Alabama State Income Tax Withheld – If the State Code

“AL”, then enter “OS” in Column E, total all State Wage amounts shown in

in Column E is “AL”, then enter the State income tax shown in Box (17) of

Box (16) of the Form W-2 and enter total in Column J (“Additional Taxable

the Form W-2. If the State Code in Column E is “OS”, then leave this box

Wages – Other States”). Leave Columns F, G and I blank.

blank.

Next, enter the “Federal Wages” shown in Box (1) of the Form W-2 in

Column H. Federal Wages – Enter the amount of Federal Wages

Column H or the total state wages if greater than the federal wages.

shown in Box (1) of the Form W-2. Please see “Wages earned in more

Wages received with no “State Wages” information. If you are a res-

than one state” and “Difference in Federal and State Wages” sections

ident of Alabama and received a W-2 with no “State Wages” information

below for additional information.

shown in Box (15) and/or (16) of the Form W-2, enter “OS” in Column E and

Column I. Alabama State Wages. – If the State Code in Column E is

enter the amount shown in Box (1) of the Form W-2 in Column H (“Federal

“AL”, enter the amount of Alabama State Wages shown in Box (16) of the

Wages”) and in Column J (“Additional Taxable Wages – Other States”).

Form W-2. If the State Code in Column E is not “AL”, then leave this box

Leave Columns F, G and I blank.

blank.

Part-Year Residents (Form 40)

Column J. Additional Taxable Wages – Other States – For full-year

If you were a resident of Alabama for only a part of the year, enter only

and part-year residents, total all “State “Wages” shown in Box (16) for W-

the income earned during your period of residence in Alabama.

2s without state code equal to “AL”. For part-year residents, only include the

Non-Residents (Form 40NR)

“State Wages” earned during your period of residence in Alabama. Please

see “Wages earned in more than one state” and “Wages received with

Income from All Sources. Be sure to show the total income received

no “State Wages” information” sections below for additional instructions.

from all sources. This includes the income earned in Alabama as well as

Line 16. Total Alabama Tax Withheld From W-2s – Total lines 1

the income earned outside of Alabama. The total income from all sources

through 15, Column G.

should be computed as if you were a resident of Alabama.

Line 17. Alabama Tax Withheld from 1099s and W-2Gs – Enter the

Alabama Income. The amount shown in the Box (16) of your Alabama

total Alabama Income Tax Withheld Form 1099s and/or Form W-2Gs with

Form W-2 should be included in Column I headed “Alabama State Wages."

state code AL. Do not include state tax withheld for other states. Report the

Wages earned in more than one state. Complete Columns (A)

income from these statements on Page 2, Part I of your Form 40 or 40NR

through (J) with corresponding information from the Form W-2 received.

return.

If the state codes shown in Box (15) of the Form W-2 is “AL”, enter

Line 18. Total Wages and Total Alabama Tax Withheld from W-2s,

“AL” in Column E, the Alabama State ID Number from Box (15) in Column

1099s and/or W-2Gs. Total lines 16 and 17 of Column G and total lines 1 –

F and the Alabama Income Tax Withheld from Box (17) in Column G. Also,

15 of Columns H, I and J and enter the amounts here.

enter the “State Wages” shown in Box (16) in Column I (Alabama State

For Forms 40 and 40A, report the amount in Column G on Page 1, Line

Wages).

5a, Column A and the total of Columns I and J on Page 1, Line 5b, Column

If none of the state codes shown in Box (15) of the Form W-2 is

B. For Form 40NR, report the amount from Column G, H and I on Page 1,

“AL” or no state code is shown, then enter “OS” in Column E and leave

Line 5, Columns A, B and C. Statutory employees please see instructions

Columns F, G, I and J blank.

below on how to report income.

Next, enter the “Federal Wages” shown in Box (1) of the Form W-2 in

Column H or the total state wages if greater than the federal wages.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1