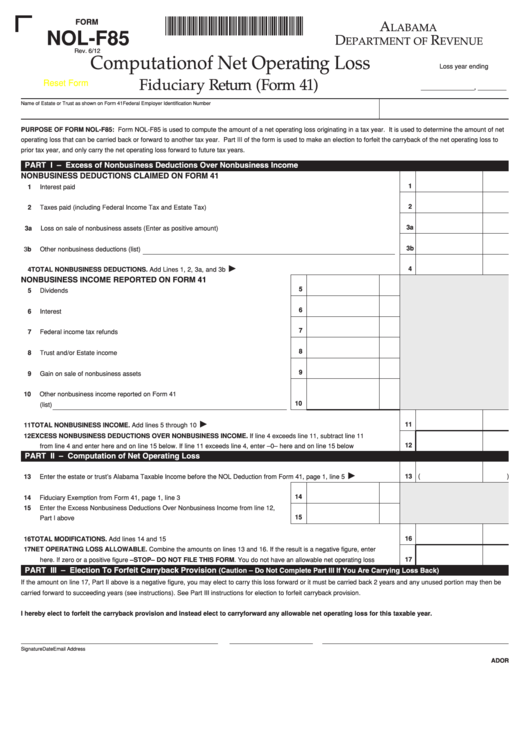

XX0006411283

FORM

A

LABAMA

NOL-F85

D

R

EPARTMENT OF

EVENUE

Rev. 6/12

Computation of Net Operating Loss

Loss year ending

Fiduciary Return (Form 41)

Reset Form

_______________, ________

Name of Estate or Trust as shown on Form 41

Federal Employer Identification Number

PURPOSE OF FORM NOL-F85: Form NOL-F85 is used to compute the amount of a net operating loss originating in a tax year. It is used to determine the amount of net

operating loss that can be carried back or forward to another tax year. Part III of the form is used to make an election to forfeit the carryback of the net operating loss to

prior tax year, and only carry the net operating loss forward to future tax years.

PART I – Excess of Nonbusiness Deductions Over Nonbusiness Income

NONBUSINESS DEDUCTIONS CLAIMED ON FORM 41

1

1

Interest paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2

Taxes paid (including Federal Income Tax and Estate Tax) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3a

3a

Loss on sale of nonbusiness assets (Enter as positive amount) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3b

3b

Other nonbusiness deductions (list)

4

4

TOTAL NONBUSINESS DEDUCTIONS. Add Lines 1, 2, 3a, and 3b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

NONBUSINESS INCOME REPORTED ON FORM 41

5

5

Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6

Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7

Federal income tax refunds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

8

Trust and/or Estate income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

9

Gain on sale of nonbusiness assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

Other nonbusiness income reported on Form 41

10

(list)

11

11

TOTAL NONBUSINESS INCOME. Add lines 5 through 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

EXCESS NONBUSINESS DEDUCTIONS OVER NONBUSINESS INCOME. If line 4 exceeds line 11, subtract line 11

12

from line 4 and enter here and on line 15 below. If line 11 exceeds line 4, enter –0– here and on line 15 below . . . . . . . . . .

PART II – Computation of Net Operating Loss

(

)

13

13

Enter the estate or trust’s Alabama Taxable Income before the NOL Deduction from Form 41, page 1, line 5 . . . . . . . . . . . .

14

14

Fiduciary Exemption from Form 41, page 1, line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

Enter the Excess Nonbusiness Deductions Over Nonbusiness Income from line 12,

15

Part I above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

16

TOTAL MODIFICATIONS. Add lines 14 and 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

NET OPERATING LOSS ALLOWABLE. Combine the amounts on lines 13 and 16. If the result is a negative figure, enter

17

here. If zero or a positive figure –STOP– DO NOT FILE THIS FORM. You do not have an allowable net operating loss. . . . .

PART III – Election To Forfeit Carryback Provision

(Caution – Do Not Complete Part III If You Are Carrying Loss Back)

If the amount on line 17, Part II above is a negative figure, you may elect to carry this loss forward or it must be carried back 2 years and any unused portion may then be

carried forward to succeeding years (see instructions). See Part III instructions for election to forfeit carryback provision.

I hereby elect to forfeit the carryback provision and instead elect to carryforward any allowable net operating loss for this taxable year.

Signature

Date

Email Address

ADOR

1

1 2

2