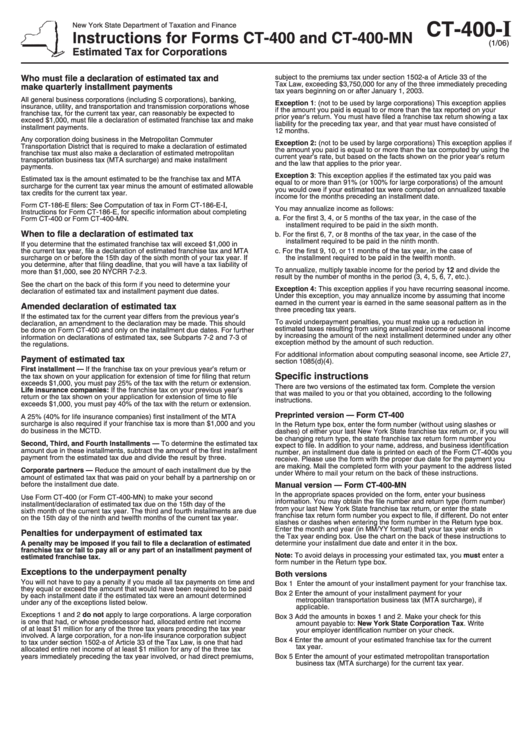

Instructions For Forms Ct-400 And Ct-400-Mn, Estimated Tax For Corporations

ADVERTISEMENT

I

CT-400-

New York State Department of Taxation and Finance

Instructions for Forms CT-400 and CT-400-MN

(1/06)

Estimated Tax for Corporations

Who must file a declaration of estimated tax and

subject to the premiums tax under section 1502-a of Article 33 of the

Tax Law, exceeding $3,750,000 for any of the three immediately preceding

make quarterly installment payments

tax years beginning on or after January 1, 2003.

All general business corporations (including S corporations), banking,

Exception 1: (not to be used by large corporations) This exception applies

insurance, utility, and transportation and transmission corporations whose

if the amount you paid is equal to or more than the tax reported on your

franchise tax, for the current tax year, can reasonably be expected to

prior year’s return. You must have filed a franchise tax return showing a tax

exceed $1,000, must file a declaration of estimated franchise tax and make

liability for the preceding tax year, and that year must have consisted of

installment payments.

12 months.

Any corporation doing business in the Metropolitan Commuter

Exception 2: (not to be used by large corporations) This exception applies if

Transportation District that is required to make a declaration of estimated

the amount you paid is equal to or more than the tax computed by using the

franchise tax must also make a declaration of estimated metropolitan

current year’s rate, but based on the facts shown on the prior year’s return

transportation business tax (MTA surcharge) and make installment

and the law that applies to the prior year.

payments.

Exception 3: This exception applies if the estimated tax you paid was

Estimated tax is the amount estimated to be the franchise tax and MTA

equal to or more than 91% (or 100% for large corporations) of the amount

surcharge for the current tax year minus the amount of estimated allowable

you would owe if your estimated tax were computed on annualized taxable

tax credits for the current tax year.

income for the months preceding an installment date.

I

Form CT-186-E filers: See Computation of tax in Form CT-186-E-

,

You may annualize income as follows:

Instructions for Form CT-186-E, for specific information about completing

a. For the first 3, 4, or 5 months of the tax year, in the case of the

Form CT-400 or Form CT-400-MN.

installment required to be paid in the sixth month.

When to file a declaration of estimated tax

b. For the first 6, 7, or 8 months of the tax year, in the case of the

installment required to be paid in the ninth month.

If you determine that the estimated franchise tax will exceed $1,000 in

the current tax year, file a declaration of estimated franchise tax and MTA

c. For the first 9, 10, or 11 months of the tax year, in the case of

surcharge on or before the 15th day of the sixth month of your tax year. If

the installment required to be paid in the twelfth month.

you determine, after that filing deadline, that you will have a tax liability of

To annualize, multiply taxable income for the period by 12 and divide the

more than $1,000, see 20 NYCRR 7-2.3.

result by the number of months in the period (3, 4, 5, 6, 7, etc.).

See the chart on the back of this form if you need to determine your

Exception 4: This exception applies if you have recurring seasonal income.

declaration of estimated tax and installment payment due dates.

Under this exception, you may annualize income by assuming that income

earned in the current year is earned in the same seasonal pattern as in the

Amended declaration of estimated tax

three preceding tax years.

If the estimated tax for the current year differs from the previous year’s

To avoid underpayment penalties, you must make up a reduction in

declaration, an amendment to the declaration may be made. This should

estimated taxes resulting from using annualized income or seasonal income

be done on Form CT-400 and only on the installment due dates. For further

by increasing the amount of the next installment determined under any other

information on declarations of estimated tax, see Subparts 7-2 and 7-3 of

exception method by the amount of such reduction.

the regulations.

For additional information about computing seasonal income, see Article 27,

Payment of estimated tax

section 1085(d)(4).

First installment — If the franchise tax on your previous year’s return or

Specific instructions

the tax shown on your application for extension of time for filing that return

exceeds $1,000, you must pay 25% of the tax with the return or extension.

There are two versions of the estimated tax form. Complete the version

Life insurance companies: If the franchise tax on your previous year’s

that was mailed to you or that you obtained, according to the following

return or the tax shown on your application for extension of time to file

instructions.

exceeds $1,000, you must pay 40% of the tax with the return or extension.

Preprinted version — Form CT-400

A 25% (40% for life insurance companies) first installment of the MTA

surcharge is also required if your franchise tax is more than $1,000 and you

In the Return type box, enter the form number (without using slashes or

do business in the MCTD.

dashes) of either your last New York State franchise tax return or, if you will

be changing return type, the state franchise tax return form number you

Second, Third, and Fourth Installments — To determine the estimated tax

expect to file. In addition to your name, address, and business identification

amount due in these installments, subtract the amount of the first installment

number, an installment due date is printed on each of the Form CT-400s you

payment from the estimated tax due and divide the result by three.

receive. Please use the form with the proper due date for the payment you

are making. Mail the completed form with your payment to the address listed

Corporate partners — Reduce the amount of each installment due by the

under Where to mail your return on the back of these instructions.

amount of estimated tax that was paid on your behalf by a partnership on or

before the installment due date.

Manual version — Form CT-400-MN

In the appropriate spaces provided on the form, enter your business

Use Form CT-400 (or Form CT-400-MN) to make your second

information. You may obtain the file number and return type (form number)

installment/declaration of estimated tax due on the 15th day of the

from your last New York State franchise tax return, or enter the state

sixth month of the current tax year. The third and fourth installments are due

franchise tax return form number you expect to file, if different. Do not enter

on the 15th day of the ninth and twelfth months of the current tax year.

slashes or dashes when entering the form number in the Return type box.

Enter the month and year (in MM/YY format) that your tax year ends in

Penalties for underpayment of estimated tax

the Tax year ending box. Use the chart on the back of these instructions to

A penalty may be imposed if you fail to file a declaration of estimated

determine your installment due date and enter it in the box.

franchise tax or fail to pay all or any part of an installment payment of

Note: To avoid delays in processing your estimated tax, you must enter a

estimated franchise tax.

form number in the Return type box.

Exceptions to the underpayment penalty

Both versions

You will not have to pay a penalty if you made all tax payments on time and

Box 1 Enter the amount of your installment payment for your franchise tax.

they equal or exceed the amount that would have been required to be paid

Box 2 Enter the amount of your installment payment for your

by each installment date if the estimated tax were an amount determined

metropolitan transportation business tax (MTA surcharge), if

under any of the exceptions listed below.

applicable.

Exceptions 1 and 2 do not apply to large corporations. A large corporation

Box 3 Add the amounts in boxes 1 and 2. Make your check for this

is one that had, or whose predecessor had, allocated entire net income

amount payable to: New York State Corporation Tax. Write

of at least $1 million for any of the three tax years preceding the tax year

your employer identification number on your check.

involved. A large corporation, for a non-life insurance corporation subject

Box 4 Enter the amount of your estimated franchise tax for the current

to tax under section 1502-a of Article 33 of the Tax Law, is one that had

tax year.

allocated entire net income of at least $1 million for any of the three tax

years immediately preceding the tax year involved, or had direct premiums,

Box 5 Enter the amount of your estimated metropolitan transportation

business tax (MTA surcharge) for the current tax year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2