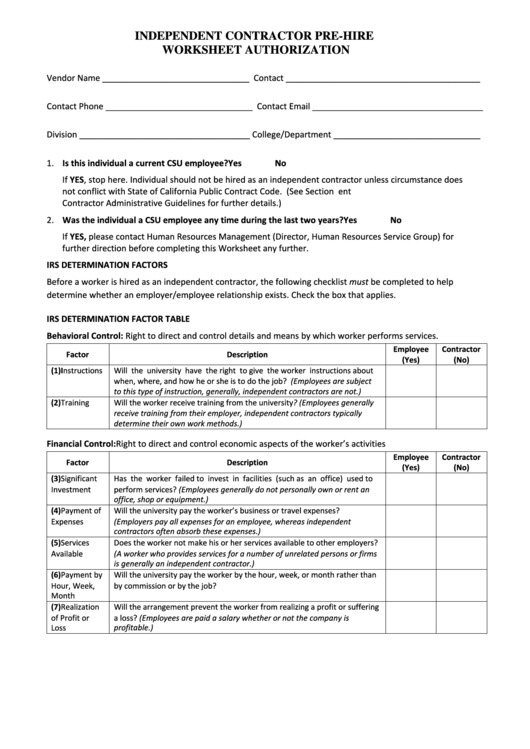

INDEPENDENT CONTRACTOR PRE-HIRE

WORKSHEET AUTHORIZATION

Vendor Name _______________________________ Contact _________________________________________

Contact Phone _______________________________ Contact Email ____________________________________

Division ____________________________________ College/Department _______________________________

1. Is this individual a current CSU employee?

Yes

No

If YES, stop here. Individual should not be hired as an independent contractor unless circumstance does

not conflict with State of California Public Contract Code. (See Section 4.C. of the Independent

Contractor Administrative Guidelines for further details.)

2. Was the individual a CSU employee any time during the last two years?

Yes

No

If YES, please contact Human Resources Management (Director, Human Resources Service Group) for

further direction before completing this Worksheet any further.

IRS DETERMINATION FACTORS

Before a worker is hired as an independent contractor, the following checklist must be completed to help

determine whether an employer/employee relationship exists. Check the box that applies.

IRS DETERMINATION FACTOR TABLE

Behavioral Control: Right to direct and control details and means by which worker performs services.

Employee

Contractor

Factor

Description

(Yes)

(No)

(1)Instructions

Will the university have the right to give the worker instructions about

when, where, and how he or she is to do the job? (Employees are subject

to this type of instruction, generally, independent contractors are not.)

(2)Training

Will the worker receive training from the university? (Employees generally

receive training from their employer, independent contractors typically

determine their own work methods.)

Financial Control: Right to direct and control economic aspects of the worker’s activities

Employee

Contractor

Factor

Description

(Yes)

(No)

(3)Significant

Has the worker failed to invest in facilities (such as an office) used to

Investment

perform services? (Employees generally do not personally own or rent an

office, shop or equipment.)

(4)Payment of

Will the university pay the worker’s business or travel expenses?

Expenses

(Employers pay all expenses for an employee, whereas independent

contractors often absorb these expenses.)

(5)Services

Does the worker not make his or her services available to other employers?

Available

(A worker who provides services for a number of unrelated persons or firms

is generally an independent contractor.)

(6)Payment by

Will the university pay the worker by the hour, week, or month rather than

Hour, Week,

by commission or by the job?

Month

(7)Realization

Will the arrangement prevent the worker from realizing a profit or suffering

of Profit or

a loss? (Employees are paid a salary whether or not the company is

Loss

profitable.)

1

1 2

2