Business Income & Expense Worksheet

ADVERTISEMENT

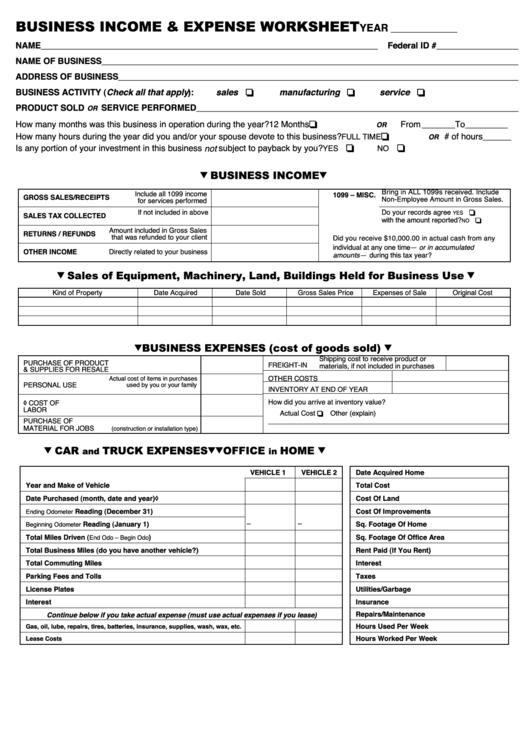

BUSINESS INCOME & EXPENSE WORKSHEET

YEAR

______________

NAME_______________________________________________________________________

Federal ID # ________________________

NAME OF BUSINESS ______________________________________________________________________________________________

ADDRESS OF BUSINESS___________________________________________________________________________________________

❏

❏

❏

BUSINESS ACTIVITY ( Check all that apply ):

sales

manufacturing

service

PRODUCT SOLD

SERVICE PERFORMED ________________________________________________________________________

OR

❏

How many months was this business in operation during the year?

12 Months

From _______

To_________

OR

❏

How many hours during the year did you and/or your spouse devote to this business?

# of hours ______

FULL TIME

OR

❏

❏

Is any portion of your investment in this business not subject to payback by you?

YES

NO

BUSINESS INCOME

1099 – MISC. Bring in ALL 1099s received. Include

Include all 1099 income

GROSS SALES/RECEIPTS

Non-Employee Amount in Gross Sales.

for services performed

If not included in above

Do your records agree

❏

YES

SALES TAX COLLECTED

with the amount reported?

❏

NO

Amount included in Gross Sales

RETURNS / REFUNDS

that was refunded to your client

Did you receive $10,000.00 in actual cash from any

individual at any one time— or in accumulated

OTHER INCOME

Directly related to your business

amounts— during this tax year?

Sales of Equipment, Machinery, Land, Buildings Held for Business Use

Kind of Property

Date Acquired

Date Sold

Gross Sales Price

Expenses of Sale

Original Cost

BUSINESS EXPENSES (cost of goods sold)

Shipping cost to receive product or

PURCHASE OF PRODUCT

FREIGHT-IN

materials, if not included in purchases

& SUPPLIES FOR RESALE

OTHER COSTS

Actual cost of items in purchases

PERSONAL USE

used by you or your family

INVENTORY AT END OF YEAR

How did you arrive at inventory value?

◊ COST OF

LABOR

❏

Actual Cost

Other (explain)

PURCHASE OF

__________________________________________________________________________________________

MATERIAL FOR JOBS

(construction or installation type)

CAR

TRUCK EXPENSES

OFFICE

HOME

and

in

VEHICLE 1

VEHICLE 2

Date Acquired Home

Year and Make of Vehicle

Total Cost

Date Purchased (month, date and year)◊

Cost Of Land

Reading (December 31)

Cost Of Improvements

Ending Odometer

–

–

Reading (January 1)

Sq. Footage Of Home

Beginning Odometer

Total Miles Driven (

)

Sq. Footage Of Office Area

End Odo – Begin Odo

Total Business Miles (do you have another vehicle?)

Rent Paid (If You Rent)

Total Commuting Miles

Interest

Parking Fees and Tolls

Taxes

License Plates

Utilities/Garbage

Interest

Insurance

Repairs/Maintenance

Continue below if you take actual expense (must use actual expenses if you lease)

Hours Used Per Week

Gas, oil, lube, repairs, tires, batteries, insurance, supplies, wash, wax, etc.

Hours Worked Per Week

Lease Costs

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2