Sample Canada Customs Invoice Form

ADVERTISEMENT

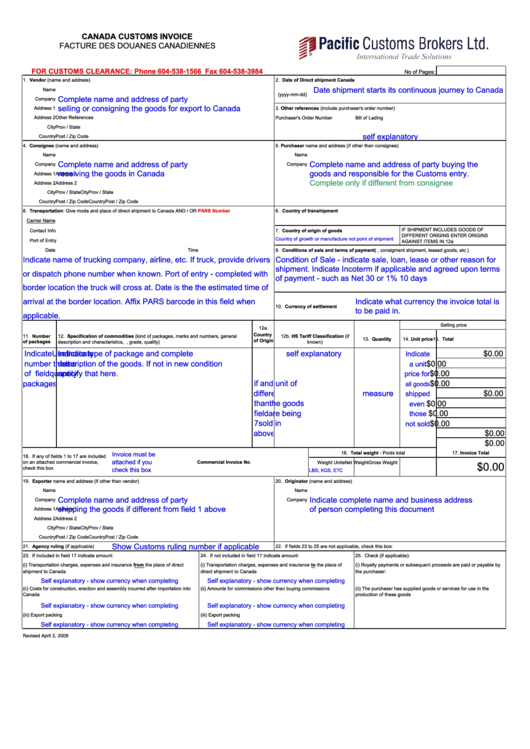

CANADA CUSTOMS INVOICE

FACTURE DES DOUANES CANADIENNES

FOR CUSTOMS CLEARANCE: Phone 604-538-1566 Fax 604-538-3984

No of Pages:

1. Vendor (name and address)

2. Date of Direct shipment Canada

Date shipment starts its continuous journey to Canada

Name

(yyyy-mm-dd)

Complete name and address of party

Company

selling or consigning the goods for export to Canada

Address 1

3. Other references (include purchaser's order number)

Address 2

Purchaser's Order Number

Bill of Lading

Other References

City

Prov / State

self explanatory

Country

Post / Zip Code

4. Consignee (name and address)

5. Purchaser name and address (if other than consignee)

Name

Name

Complete name and address of party

Complete name and address of party buying the

Company

Company

receiving the goods in Canada

goods and responsible for the Customs entry.

Address 1

Address 1

Complete only if different from consignee

Address 2

Address 2

City

Prov / State

City

Prov / State

Country

Post / Zip Code

Country

Post / Zip Code

8. Transportation: Give mode and place of direct shipment to Canada AND / OR

PARS Number

6. Country of transhipment

Carrier Name

IF SHIPMENT INCLUDES GOODS OF

Contact Info

7. Country of origin of goods

DIFFERENT ORIGINS ENTER ORIGINS

Country of growth or manufacture not point of shipment

Port of Entry

AGAINST ITEMS IN 12a

Date

Time

9. Conditions of sale and terms of payment (I.e. sale, consigment shipment, leased goods, etc.)

Indicate name of trucking company, airline, etc. If truck, provide drivers

Condition of Sale - indicate sale, loan, lease or other reason for

shipment. Indicate Incoterm if applicable and agreed upon terms

or dispatch phone number when known. Port of entry - completed with

of payment - such as Net 30 or 1% 10 days

border location the truck will cross at. Date is the the estimated time of

arrival at the border location. Affix PARS barcode in this field when

Indicate what currency the invoice total is

10. Currency of settlement

to be paid in.

applicable.

Selling price

12a.

Country

11. Number

12. Specification of commodities (kind of packages, marks and numbers, general

12b. HS Tariff Classification (if

13. Quantity

14. Unit price

15. Total

of Origin

of packages

description and characteristics, i.e., grade, quality)

known)

Indicate

Indicate type of package and complete

Use

self explanatory

Indicate

$0.00

Indicate

number

description of the goods. If not in new condition

this

the

$0.00

a unit

of

specify that here.

field

quantity

$0.00

price for

packages

if

and unit of

$0.00

all goods

different

measure

$0.00

shipped

than

the goods

$0.00

even

field

are being

$0.00

those

7

sold in

$0.00

not sold

above

$0.00

$0.00

16. Total weight - Poids total

17. Invoice Total

Invoice must be

18. If any of fields 1 to 17 are included

attached if you

on an attached commercial invoice,

Commercial Invoice No.

Weight Units

Net Weight

Gross Weight

$0.00

check this box

check this box

LBS, KGS, ETC

19. Exporter name and address (if other than vendor)

20. Originator (name and address)

Name

Name

Complete name and address of party

Indicate complete name and business address

Company

Company

shipping the goods if different from field 1 above

of person completing this document

Address 1

Address 1

Address 2

Address 2

City

Prov / State

City

Prov / State

Country

Post / Zip Code

Country

Post / Zip Code

Show Customs ruling number if applicable

21. Agency ruling (if applicable)

22. If fields 23 to 25 are not applicable, check this box:

23. If included in field 17 indicate amount:

24. If not included in field 17 indicate amount:

25. Check (if applicable):

(i) Transportation charges, expenses and insurance from the place of direct

(i) Transportation charges, expenses and insurance to the place of

(i) Royalty payments or subsequent proceeds are paid or payable by

shipment to Canada

direct shipment to Canada

the purchaser:

Self explanatory - show currency when completing

Self explanatory - show currency when completing

(ii) Costs for construction, erection and assembly incurred after importation into

(ii) Amounts for commissions other than buying commissions

(ii) The purchaser has supplied goods or services for use in the

Canada

production of these goods

Self explanatory - show currency when completing

Self explanatory - show currency when completing

(iii) Export packing

(iii) Export packing

Self explanatory - show currency when completing

Self explanatory - show currency when completing

Revised April 2, 2009

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1