Discounted Cash Flows (Dcf) Cheat Sheet

ADVERTISEMENT

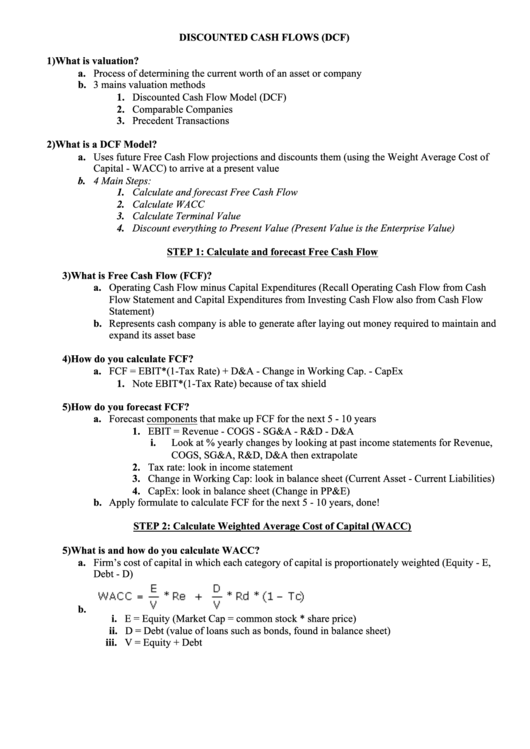

DISCOUNTED CASH FLOWS (DCF)

1) What is valuation?

a. Process of determining the current worth of an asset or company

b. 3 mains valuation methods

1. Discounted Cash Flow Model (DCF)

2. Comparable Companies

3. Precedent Transactions

2) What is a DCF Model?

a. Uses future Free Cash Flow projections and discounts them (using the Weight Average Cost of

Capital - WACC) to arrive at a present value

b. 4 Main Steps:

1. Calculate and forecast Free Cash Flow

2. Calculate WACC

3. Calculate Terminal Value

4. Discount everything to Present Value (Present Value is the Enterprise Value)

STEP 1: Calculate and forecast Free Cash Flow

3) What is Free Cash Flow (FCF)?

a. Operating Cash Flow minus Capital Expenditures (Recall Operating Cash Flow from Cash

Flow Statement and Capital Expenditures from Investing Cash Flow also from Cash Flow

Statement)

b. Represents cash company is able to generate after laying out money required to maintain and

expand its asset base

4) How do you calculate FCF?

a. FCF = EBIT*(1-Tax Rate) + D&A - Change in Working Cap. - CapEx

1. Note EBIT*(1-Tax Rate) because of tax shield

5) How do you forecast FCF?

a. Forecast components that make up FCF for the next 5 - 10 years

1. EBIT = Revenue - COGS - SG&A - R&D - D&A

i.

Look at % yearly changes by looking at past income statements for Revenue,

COGS, SG&A, R&D, D&A then extrapolate

2. Tax rate: look in income statement

3. Change in Working Cap: look in balance sheet (Current Asset - Current Liabilities)

4. CapEx: look in balance sheet (Change in PP&E)

b. Apply formulate to calculate FCF for the next 5 - 10 years, done!

STEP 2: Calculate Weighted Average Cost of Capital (WACC)

5) What is and how do you calculate WACC?

a. Firm’s cost of capital in which each category of capital is proportionately weighted (Equity - E,

Debt - D)

b.

i. E = Equity (Market Cap = common stock * share price)

ii. D = Debt (value of loans such as bonds, found in balance sheet)

iii. V = Equity + Debt

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Education

1

1 2

2 3

3