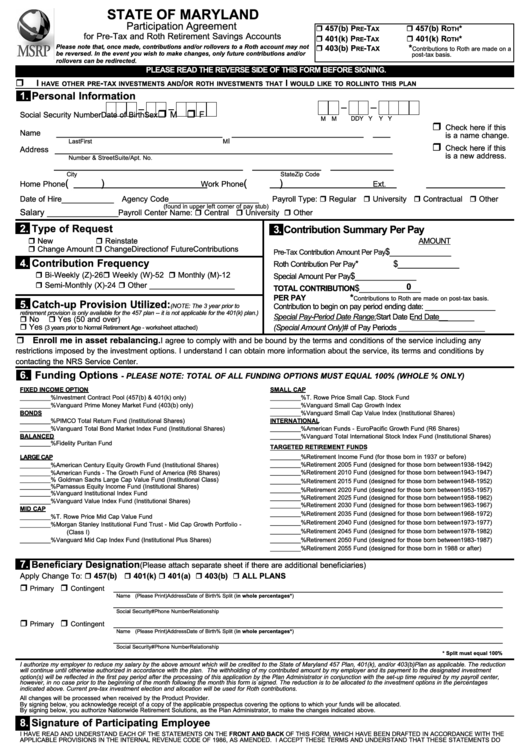

STATE OF MARYLAND

Participation Agreement

r 457(b) P

r 457(b) R

-T

*

RE

AX

OTH

for Pre-Tax and Roth Retirement Savings Accounts

r 401(k) P

r 401(k) R

-T

*

RE

AX

OTH

r 403(b) P

Please note that, once made, contributions and/or rollovers to a Roth account may not

*

-T

X

RE

A

Contributions to Roth are made on a

be reversed. In the event you wish to make changes, only future contributions and/or

post-tax basis.

rollovers can be redirected.

PLEASE READ THE REVERSE SIDE OF THIS FORM BEFORE SIGNING.

r

I

-

/

I

HAVE OTHER PRE

TAX INVESTMENTS AND

OR ROTH INVESTMENTS THAT

WOULD LIKE TO ROLL INTO THIS PLAN

1.

Personal Information

r

r

M

F

Social Security Number

Date of Birth

Sex

M M

D D

Y Y

Y Y

r

Check here if this

_____________________________ _______________________ ___

Name

is a name change.

I

Last

First

M

r

___________________________________________________________

Check here if this

Address

is a new address.

Number & Street

Suite/Apt. No.

_________________________________ ____________ ___________

City

State

Zip Code

(

)

(

)

Home Phone

Work Phone

Ext.

Payroll Type: r Regular r University r Contractual r Other

___________

___________________

Date of Hire

Agency Code

(found in upper left corner of pay stub)

Payroll Center Name: r Central r University r Other

Salary _______________

2.

Type of Request

3.

Contribution Summary Per Pay

r New

r Reinstate

AMOUNT

r Change Amount r Change Direction of Future Contributions

4.

$______________

Pre-Tax Contribution Amount Per Pay

4.

Contribution Frequency

*

$______________

Roth Contribution Per Pay

r Bi-Weekly (Z)-26

r Weekly (W)-52 r Monthly (M)-12

$______________

Special Amount Per Pay

r Semi-Monthly (X)-24 r Other ____________________

0

$______________

TOTAL CONTRIBUTION

*

PER PAY

Contributions to Roth are made on post-tax basis.

5.

Catch-up Provision Utilized:

________________

(NOTE: The 3 year prior to

Contribution to begin on pay period ending date:

retirement provision is only available for the 457 plan -- it is not applicable for the 401(k) plan.)

________

Special Pay-Period Date Range: Start Date

End Date

r No

r Yes (50 and over)

r Yes

(Special Amount Only) # of Pay Periods ______________________

(3 years prior to Normal Retirement Age - worksheet attached)

r Enroll me in asset rebalancing.

I agree to comply with and be bound by the terms and conditions of the service including any

restrictions imposed by the investment options. I understand I can obtain more information about the service, its terms and conditions by

contacting the NRS Service Center.

6.

Funding Options

- PLEASE NOTE: TOTAL OF ALL FUNDING OPTIONS MUST EQUAL 100% (WHOLE % ONLY)

FIXED INCOME OPTION

SMALL CAP

_________%

Investment Contract Pool (457(b) & 401(k) only)

_________%

T. Rowe Price Small Cap. Stock Fund

_________%

Vanguard Prime Money Market Fund (403(b) only)

_________%

Vanguard Small Cap Growth Index

BONDS

_________%

Vanguard Small Cap Value Index (Institutional Shares)

_________%

PIMCO Total Return Fund (Institutional Shares)

INTERNATIONAL

_________%

Vanguard Total Bond Market Index Fund (Institutional Shares)

_________%

American Funds - EuroPacific Growth Fund (R6 Shares)

BALANCED

_________%

Vanguard Total International Stock Index Fund (Institutional Shares)

_________%

Fidelity Puritan Fund

TARGETED RETIREMENT FUNDS

LARGE CAP

_________%

Retirement Income Fund (for those born in 1937 or before)

_________%

American Century Equity Growth Fund (Institutional Shares)

_________%

Retirement 2005 Fund (designed for those born between1938-1942)

_________%

Retirement 2010 Fund (designed for those born between1943-1947)

_________%

American Funds - The Growth Fund of America (R6 Shares)

_________%

Goldman Sachs Large Cap Value Fund (Institutional Class)

_________%

Retirement 2015 Fund (designed for those born between1948-1952)

_________%

Parnassus Equity Income Fund (Institutional Shares)

_________%

Retirement 2020 Fund (designed for those born between1953-1957)

_________%

Vanguard Institutional Index Fund

_________%

Retirement 2025 Fund (designed for those born between1958-1962)

_________%

Vanguard Value Index Fund (Institutional Shares)

_________%

Retirement 2030 Fund (designed for those born between1963-1967)

MID CAP

_________%

Retirement 2035 Fund (designed for those born between1968-1972)

_________%

T. Rowe Price Mid Cap Value Fund

_________%

Retirement 2040 Fund (designed for those born between1973-1977)

_________%

Morgan Stanley Institutional Fund Trust - Mid Cap Growth Portfolio -

_________%

Retirement 2045 Fund (designed for those born between1978-1982)

(Class I)

_________%

Vanguard Mid Cap Index Fund (Institutional Plus Shares)

_________%

Retirement 2050 Fund (designed for those born between1983-1987)

_________%

Retirement 2055 Fund (designed for those born in 1988 or after)

7.

Beneficiary Designation

(Please attach separate sheet if there are additional beneficiaries)

Apply Change To: r 457(b) r 401(k) r 401(a) r 403(b) r ALL PLANS

r

r

__________________________________________________________________________________

Primary

Contingent

Name (Please Print)

Address

Date of Birth

% Split (in whole percentages*)

__________________________________________________________________________________

Social Security#

Phone Number

Relationship

r

r

__________________________________________________________________________________

Primary

Contingent

Name (Please Print)

Address

Date of Birth

% Split (in whole percentages*)

__________________________________________________________________________________

Social Security#

Phone Number

Relationship

* Split must equal 100%

I authorize my employer to reduce my salary by the above amount which will be credited to the State of Maryland 457 Plan, 401(k), and/or 403(b)Plan as applicable. The reduction

will continue until otherwise authorized in accordance with the plan. The withholding of my contributed amount by my employer and its payment to the designated investment

option(s) will be reflected in the first pay period after the processing of this application by the Plan Administrator in conjunction with the set-up time required by my payroll center,

however, in no case prior to the beginning of the month following the month this form is signed. The reduction is to be allocated to the investment options in the percentages

indicated above. Current pre-tax investment election and allocation will be used for Roth contributions.

All changes will be processed when received by the Product Provider.

By signing below, you acknowledge receipt of a copy of the applicable prospectus covering the options to which your funds will be allocated.

By signing below, you authorize Nationwide Retirement Solutions, as the Plan Administrator, to make the changes indicated above.

8.

Signature of Participating Employee

I HAVE READ AND UNDERSTAND EACH OF THE STATEMENTS ON THE FRONT AND BACK OF THIS FORM, WHICH HAVE BEEN DRAFTED IN ACCORDANCE WITH THE

APPLICABLE PROVISIONS IN THE INTERNAL REVENUE CODE OF 1986, AS AMENDED. I ACCEPT THESE TERMS AND UNDERSTAND THAT THESE STATEMENTS DO

NOT COVER ALL THE DETAILS OF THE PLAN OR PRODUCTS.

__________________________________________________________

________________________

_______________________________________________________

PARTICIPATING EMPLOYEE’S SIGNATURE

DATE

PRINCIPAL

__________________________________________________________

________________________

_________________________

RETIREMENT SPECIALIST SIGNATURE

FSR NO.

SALES DIRECTOR NO.

MAIL TO:

Nationwide Retirement Solutions

11350 McCormick Road

Executive Plaza 1 - Suite 400

Hunt Valley, MD 21031

For assistance with completing this form, please call 443-886-9402 or toll-free at 1-800-966-6355. Fax number: 1-443-886-9403

DC-4531-0213

Copies 1, 2 – Processing Center; Copy 3 – Participant

1

1 2

2