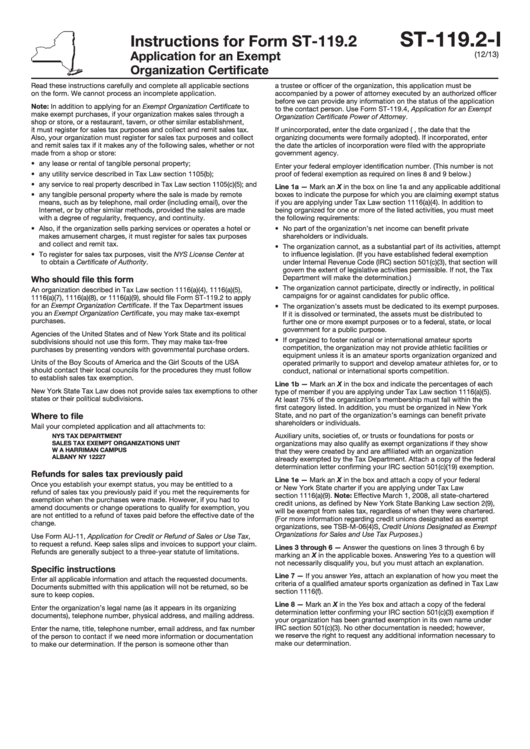

ST-119.2-I

Instructions for Form ST-119.2

Application for an Exempt

(12/13)

Organization Certificate

Read these instructions carefully and complete all applicable sections

a trustee or officer of the organization, this application must be

on the form. We cannot process an incomplete application.

accompanied by a power of attorney executed by an authorized officer

before we can provide any information on the status of the application

Note: In addition to applying for an Exempt Organization Certificate to

to the contact person. Use Form ST-119.4, Application for an Exempt

make exempt purchases, if your organization makes sales through a

Organization Certificate Power of Attorney.

shop or store, or a restaurant, tavern, or other similar establishment,

it must register for sales tax purposes and collect and remit sales tax.

If unincorporated, enter the date organized (i.e., the date that the

Also, your organization must register for sales tax purposes and collect

organizing documents were formally adopted). If incorporated, enter

and remit sales tax if it makes any of the following sales, whether or not

the date the articles of incorporation were filed with the appropriate

made from a shop or store:

government agency.

• any lease or rental of tangible personal property;

Enter your federal employer identification number. (This number is not

• any utility service described in Tax Law section 1105(b);

proof of federal exemption as required on lines 8 and 9 below.)

• any service to real property described in Tax Law section 1105(c)(5); and

Line 1a — Mark an X in the box on line 1a and any applicable additional

• any tangible personal property where the sale is made by remote

boxes to indicate the purpose for which you are claiming exempt status

means, such as by telephone, mail order (including email), over the

if you are applying under Tax Law section 1116(a)(4). In addition to

Internet, or by other similar methods, provided the sales are made

being organized for one or more of the listed activities, you must meet

with a degree of regularity, frequency, and continuity.

the following requirements:

• Also, if the organization sells parking services or operates a hotel or

• No part of the organization’s net income can benefit private

makes amusement charges, it must register for sales tax purposes

shareholders or individuals.

and collect and remit tax.

• The organization cannot, as a substantial part of its activities, attempt

• To register for sales tax purposes, visit the NYS License Center at

to influence legislation. (If you have established federal exemption

to obtain a Certificate of Authority.

under Internal Revenue Code (IRC) section 501(c)(3), that section will

govern the extent of legislative activities permissible. If not, the Tax

Department will make the determination.)

Who should file this form

• The organization cannot participate, directly or indirectly, in political

An organization described in Tax Law section 1116(a)(4), 1116(a)(5),

campaigns for or against candidates for public office.

1116(a)(7), 1116(a)(8), or 1116(a)(9), should file Form ST-119.2 to apply

for an Exempt Organization Certificate. If the Tax Department issues

• The organization’s assets must be dedicated to its exempt purposes.

you an Exempt Organization Certificate, you may make tax-exempt

If it is dissolved or terminated, the assets must be distributed to

purchases.

further one or more exempt purposes or to a federal, state, or local

government for a public purpose.

Agencies of the United States and of New York State and its political

• If organized to foster national or international amateur sports

subdivisions should not use this form. They may make tax-free

competition, the organization may not provide athletic facilities or

purchases by presenting vendors with governmental purchase orders.

equipment unless it is an amateur sports organization organized and

Units of the Boy Scouts of America and the Girl Scouts of the USA

operated primarily to support and develop amateur athletes for, or to

should contact their local councils for the procedures they must follow

conduct, national or international sports competition.

to establish sales tax exemption.

Line 1b — Mark an X in the box and indicate the percentages of each

New York State Tax Law does not provide sales tax exemptions to other

type of member if you are applying under Tax Law section 1116(a)(5).

states or their political subdivisions.

At least 75% of the organization’s membership must fall within the

first category listed. In addition, you must be organized in New York

Where to file

State, and no part of the organization’s earnings can benefit private

shareholders or individuals.

Mail your completed application and all attachments to:

Auxiliary units, societies of, or trusts or foundations for posts or

NYS TAX DEPARTMENT

SALES TAX EXEMPT ORGANIZATIONS UNIT

organizations may also qualify as exempt organizations if they show

W A HARRIMAN CAMPUS

that they were created by and are affiliated with an organization

ALBANY NY 12227

already exempted by the Tax Department. Attach a copy of the federal

determination letter confirming your IRC section 501(c)(19) exemption.

Refunds for sales tax previously paid

Line 1e — Mark an X in the box and attach a copy of your federal

Once you establish your exempt status, you may be entitled to a

or New York State charter if you are applying under Tax Law

refund of sales tax you previously paid if you met the requirements for

section 1116(a)(9). Note: Effective March 1, 2008, all state-chartered

exemption when the purchases were made. However, if you had to

credit unions, as defined by New York State Banking Law section 2(9),

amend documents or change operations to qualify for exemption, you

will be exempt from sales tax, regardless of when they were chartered.

are not entitled to a refund of taxes paid before the effective date of the

(For more information regarding credit unions designated as exempt

change.

organizations, see TSB-M-06(4)S, Credit Unions Designated as Exempt

Organizations for Sales and Use Tax Purposes.)

Use Form AU-11, Application for Credit or Refund of Sales or Use Tax,

to request a refund. Keep sales slips and invoices to support your claim.

Lines 3 through 6 — Answer the questions on lines 3 through 6 by

Refunds are generally subject to a three-year statute of limitations.

marking an X in the applicable boxes. Answering Yes to a question will

not necessarily disqualify you, but you must attach an explanation.

Specific instructions

Line 7 — If you answer Yes, attach an explanation of how you meet the

Enter all applicable information and attach the requested documents.

criteria of a qualified amateur sports organization as defined in Tax Law

Documents submitted with this application will not be returned, so be

section 1116(f).

sure to keep copies.

Line 8 — Mark an X in the Yes box and attach a copy of the federal

Enter the organization’s legal name (as it appears in its organizing

determination letter confirming your IRC section 501(c)(3) exemption if

documents), telephone number, physical address, and mailing address.

your organization has been granted exemption in its own name under

IRC section 501(c)(3). No other documentation is needed; however,

Enter the name, title, telephone number, email address, and fax number

we reserve the right to request any additional information necessary to

of the person to contact if we need more information or documentation

make our determination.

to make our determination. If the person is someone other than

1

1 2

2 3

3 4

4