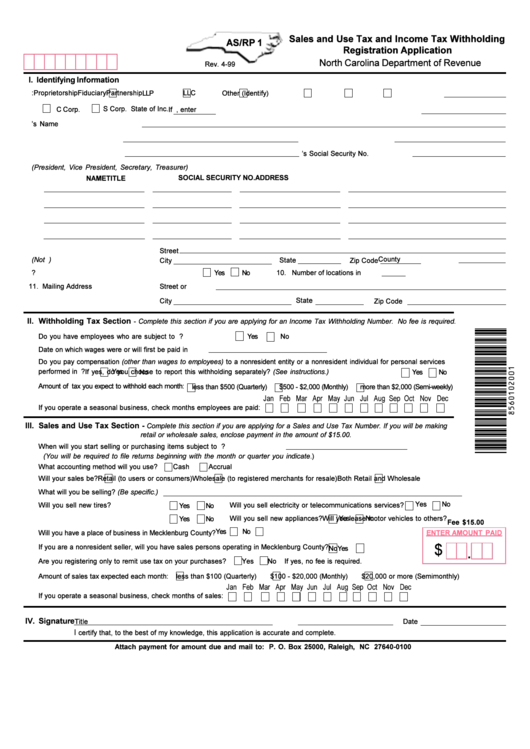

As/rp 1 - Sales And Use Tax And Income Tax Withholding Registration Application

ADVERTISEMENT

Sales and Use Tax and Income Tax Withholding

AS/RP 1

Registration Application

North Carolina Department of Revenue

Rev. 4-99

I. Identifying Information

1. Type of Ownership:

Proprietorship

Fiduciary

Partnership

LLC

LLP

Other (Identify)

S Corp. State of Inc.

C Corp.

If N.C. Corporation or LLC, enter N.C. Secretary of State ID No.

2. Legal Business/Owner’s Name

4. Daytime Business Phone

3. Trade Name/DBA Name

5. Federal Employer ID No.

6. Proprietor’s Social Security No.

7. List primary partners or corporate officers (President, Vice President, Secretary, Treasurer)

SOCIAL SECURITY NO.

ADDRESS

NAME

TITLE

8. Business Location in N.C.

Street

County

(Not P.O. Box Number)

City

State

Zip Code

9. Is the business located within city or town limits?

10. Number of locations in N.C.

Enclose list if more than one.

Yes

No

11. Mailing Address

Street or P.O. Box

State

City

Zip Code

II. Withholding Tax Section

- Complete this section if you are applying for an Income Tax Withholding Number. No fee is required.

Do you have employees who are subject to N.C. withholding?

Yes

No

Date on which wages were or will first be paid in N.C.

Do you pay compensation (other than wages to employees) to a nonresident entity or a nonresident individual for personal services

performed in N.C.?

Yes

No

If yes, do you choose to report this withholding separately? (See instructions.)

Yes

No

Amount of tax you expect to withhold each month:

less than $500 (Quarterly)

$500 - $2,000 (Monthly)

more than $2,000 (Semi-weekly)

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

If you operate a seasonal business, check months employees are paid:

III. Sales and Use Tax Section -

Complete this section if you are applying for a Sales and Use Tax Number. If you will be making

retail or wholesale sales, enclose payment in the amount of $15.00.

When will you start selling or purchasing items subject to N.C. sales or use tax?

(You will be required to file returns beginning with the month or quarter you indicate.)

What accounting method will you use?

Cash

Accrual

Will your sales be?

Retail (to users or consumers)

Wholesale (to registered merchants for resale)

Both Retail and Wholesale

What will you be selling? (Be specific.)

Yes

No

Will you sell electricity or telecommunications services?

Will you sell new tires?

Yes

No

Will you lease motor vehicles to others?

Will you sell new appliances?

Yes

No

Yes

No

Fee $15.00

Yes

No

ENTER AMOUNT PAID

Will you have a place of business in Mecklenburg County?

$

If you are a nonresident seller, will you have sales persons operating in Mecklenburg County?

Yes

No

.

Are you registering only to remit use tax on your purchases?

Yes

No

If yes, no fee is required.

Amount of sales tax expected each month:

less than $100 (Quarterly)

$100 - $20,000 (Monthly)

$20,000 or more (Semimonthly)

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

If you operate a seasonal business, check months of sales:

IV. Signature

Title

Date

I

certify that, to the best of my knowledge, this application is accurate and complete.

Attach payment for amount due and mail to: P. O. Box 25000, Raleigh, NC 27640-0100

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2